2019-8-3 00:08 |

A day after LedgerX announced the launch of its physically-settled Bitcoin Futures contracts; the US Commodity Futures Trading Commission (CFTC) has denied issuing any approvals. In a statement, CFTC said that “LedgerX has not yet been approved by the commission.”

Consequently, the derivatives exchange’s press representative, Ryan Gorman, has distanced himself from the firm citing “concerns about the events of the last 24 hours.” Already, officials from LedgerX have confirmed that the launch of the futures contracts has been stopped.

Earlier, LedgerX, a clearinghouse and a Bitcoin derivatives exchange based in the US, announced it was launching Bitcoin Futures contracts. These Futures were to be physically settled just like Bakkt’s.

Paul Chou, LedgerX’s CEO, said:

“Not only are they [futures] delivered physically in the sense that our customers can get Bitcoin after the futures expires, but also they can deposit Bitcoin to trade in the first place. Cash-settled is cash-in and cash-out, we’re Bitcoin-in Bitcoin-out.”

Institutions will WaitLedgerX Future’s product was open to both individual traders and institutional clients. However, those seeking to trade on the derivatives exchange were required to go through a KYC procedure. All the same, and according to the platform, retail and institutional traders would have had different accounts. For instance, retail traders would use the new Omni platform that has connections with LedgerX while those with millions in assets would use “LedgerX’s other products.”

By being physically-settled, customers who interact with the Futures contract would receive actual Bitcoins when the contracts expire. Although other Bitcoin Futures have found their way into the US market, LedgerX’s futures contracts were the only ones that physically-settles, competing with Bakkt who are seeking approvals from the CFTC.

Chou added:

“If you imagine somebody that deposits Bitcoin, they would not have to use the US banking system at all. That’s why physically-settled is very important. I think it’s one of the most unique use cases for Bitcoin, where you’re using cryptocurrencies as collateral. As a digital commodity, Bitcoin trades 24/7/365 and our customers expect that from us, so if you trade Sunday night, the banking system did not have to open.”

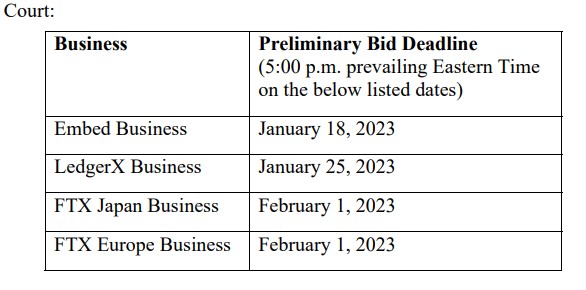

LedgerX’s vision to offer physically-settled Bitcoin futures contracts started in 2018. In November 2018, the derivatives exchange engaged the CFTC in search of the required licenses. Luckily, in June 2019, CFTC issued LedgerX with a designated contract markets (DCM) license.

Bakkt’s DelaysBakkt, on the other hand, has been postponing its launch. The Bakkt platform is developed by Intercontinental Exchange (ICE) which also operates the New York Stock Exchange.

Towards the end of 2018, the CEO of Bakkt, Kelly Loeffler, said:

“Given the volume of interest in Bakkt and work required to get all of the pieces in place, we will now be targeting January 24, 2019, for the launch [of Bitcoin futures contracts] to ensure that our participants are ready to trade on Day!”

Unfortunately, it was until July 22, 2019, when ICE reported that they have begun testing the futures contracts platform. “Testing is proceeding as planned with participants from around the world,” read a section of a tweet by Bakkt. As part of the testing phase, Bakkt users will go through anti-money laundering and know-your-customer reviews as defined by the CFTC.

Adam White, Bakkt COO, noted that launching physically-settled Bitcoin futures contracts will ignite institutional participation because “institutions launch safely into this market is the right stuff for the future”

According to reports, the delay in launching Bakkt emanated from regulatory concerns. For example, instead of Bakkt requesting the CFTC to approve its futures contracts, Bakkt asked for a self-certify approval. With this approach, Bakkt would certify its own Bitcoin futures contracts with the CFTC’s mandate limited to review.

origin »Bitcoin price in Telegram @btc_price_every_hour

Filecoin [Futures] (FIL) на Currencies.ru

|

|