2023-6-20 10:50 |

The concept of a global infrastructure for digital currencies, as proposed by the International Monetary Fund (IMF) Managing Director Kristalina Georgieva, could have significant implications for the adoption of cryptocurrencies. Georgieva’s remarks about interoperability and the avoidance of settlement blocks highlight the growing recognition of the need for coordination and compatibility among digital currencies issued by national central banks.

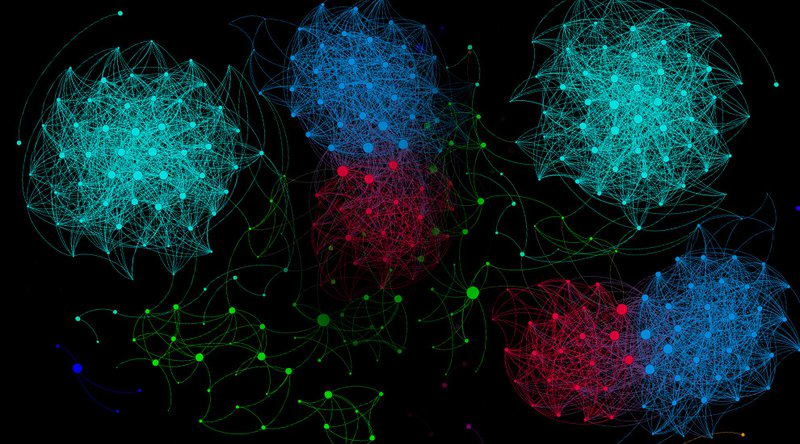

CBDCS Growing Interest From CountriesThe fact that 11 countries have already launched their central bank digital currencies (CBDCs) and all G7 economies are in the development stage underscores the increasing interest and momentum behind CBDCs. This growing trend indicates that governments and central banks are acknowledging the potential benefits of digital currencies in providing improved financial services to their citizens. As more countries explore CBDCs, with 114 countries currently engaged in the process, it demonstrates a widespread recognition of the value and transformative potential of digital currencies.

IMF’s InvolvementThe IMF’s involvement and focus on creating a shared infrastructure for CBDCs could further facilitate the adoption of cryptocurrencies. The IMF’s role as a global financial institution brings credibility and influence, allowing it to shape discussions and standards around CBDCs. By promoting interoperability and avoiding economic fragmentation, the IMF aims to establish a framework that encourages collaboration and compatibility among digital currencies. This approach could help address concerns about fragmentation and promote a more cohesive global financial system.

Impact On The Cryptocurrency IndustryThe development of a global infrastructure for digital currencies could also have implications for the broader cryptocurrency ecosystem. As CBDCs gain prominence and adoption, they may impact private cryptocurrencies, such as Bitcoin and Ethereum. CBDCs backed by governments and central banks could potentially offer greater stability and trust, which are often cited as drawbacks of private cryptocurrencies. This could lead to increased competition and possibly a shift in the balance of power within the cryptocurrency landscape.

However, it is important to consider the potential challenges and risks associated with CBDCs. Critics have raised concerns about privacy and surveillance, as the use of CBDCs could enable governments to monitor transactions more closely. Striking a balance between privacy and regulatory oversight will be crucial in ensuring the successful adoption of CBDCs.

Final ThoughtsFinally, the IMF’s focus on a global infrastructure for CBDCs, along with the increasing interest and exploration of digital currencies by countries worldwide, will likely have a significant impact on the adoption of cryptocurrencies. The coordination and interoperability facilitated by the proposed infrastructure could encourage greater acceptance of CBDCs and potentially reshape the broader cryptocurrency ecosystem. However, addressing privacy concerns and establishing robust regulatory frameworks will be essential to ensure the successful and responsible implementation of CBDCs.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Image Source: mohdazrin/123RF // Image Effects by Colorcinch

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Currency Reserve (GCR) на Currencies.ru

|

|