2020-9-11 03:03 |

While Bitcoin is touted as uncorrelated, the cryptocurrency has been following the inverse of one asset over the past few months: the U.S. dollar. Like gold, BTC’s price action is partially dictated by the value of fiat currencies.

Over the past few months, the negative correlation gold and Bitcoin have with the U.S. dollar has been exacerbated.

Unfortunately for BTC, then, there are analysts expecting the U.S. dollar to bounce in the coming weeks. This could put pressure on Bitcoin, forcing it back under $10,000.

Related Reading: Here’s Why This Crypto CEO Thinks BTC Soon Hits $15,000 The Dollar Could Soon Bounce: Here’s What That Means for BitcoinA leading cryptocurrency trader believes that the Dollar Index, which tracks the value of the U.S. dollar against a basket of foreign currencies, is in a textbook bull pattern.

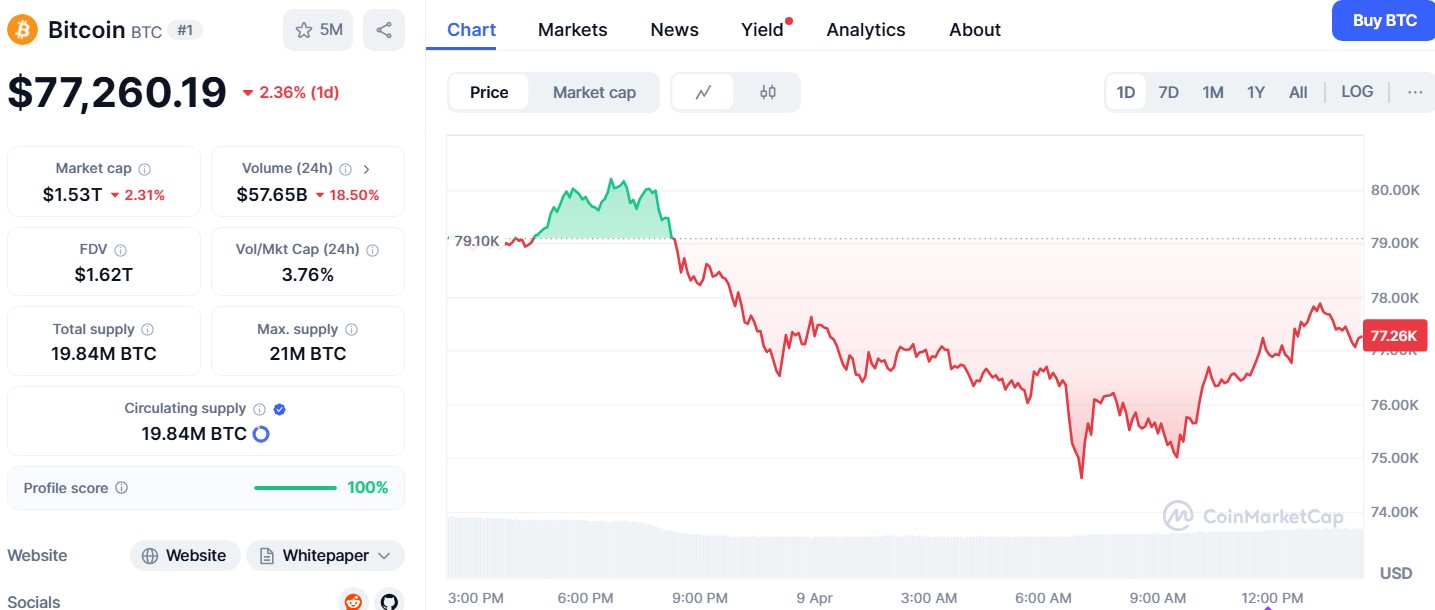

He shared the chart below, depicting that the asset is trading in a textbook descending broadening wedge:

“My thoughts on $DXY. Now I’m not a fan of descending broadening wedges and this isn’t the cleanest example out there- but I think it could play out. Probably one of the rare instances you will ever see me post a broadening wedge-ish like pattern. Chart from yesterday and today.”

Chart of the DXY over the past few months with a range analysis by crypto trader "Trader XO" (@TraderXOXO on Twitter). Chart from TradingView.comThe abovementioned analyst isn’t the only one that thinks the U.S. dollar may be bottoming to undergo a bullish reversal, thus harming the Bitcoin bull case.

One cryptocurrency and foreign cryptocurrency trader shared the chart below late in August. It suggests that the Dollar Index is bottoming, which could harm the trajectories of Bitcoin, Ethereum, gold, and silver:

“$DXY finally finding support? Keep an eye on this chart, if we regain that top level expect $BTC, $ETH, $Gold and $Silver to fall further.”

Chart of the DXY over the past few months with a range analysis by crypto trader "Mayne" (@Tradermayne on Twitter). Chart from TradingView.com Related Reading: Crypto Tidbits: MicroStrategy’s $250m Bitcoin Purchase, Ethereum DeFi Boom, BitMEX KYC More Stimulus?The one factor that could cause the U.S. dollar to ease its rally, fiscal stimulus, is on hold.

Bloomberg just reported that the odds of another stimulus bill from the U.S. government has dropped due to political trends:

“Odds of another round of fiscal stimulus for the U.S. economy dropped on Thursday as senators headed out of Washington for the weekend following a partisan split over a slimmed-down package proposed by Republicans.”

Related Reading: This European Crypto Exchange Was Just Hacked for $5 Million Photo by Charles Deluvio on Unsplash Price tags: xbtusd, btcusd, btcusdt, dxy Charts from TradingView.com The Dollar Is Poised to Gain Steam—and That's Bad for Bitcoin origin »Bitcoin price in Telegram @btc_price_every_hour

Dollar Online (DOLLAR) на Currencies.ru

|

|