2021-1-25 12:00 |

ZENTEREST was recently added to MANTRA DAO’s rapidly expanding suite of DeFi protocols

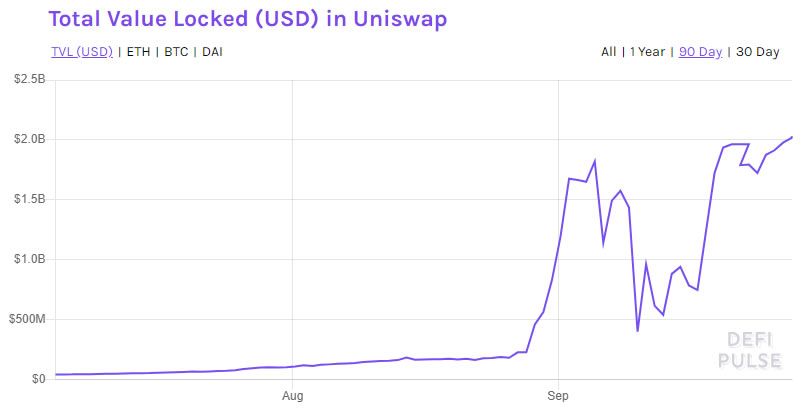

We have seen decentralized finance grow exponentially in recent months and the TVL (total value locked) in DeFi protocols now stands at a jaw-dropping $24 billion. Amongst the projects that have contributed to the sector’s explosive growth in recent months is MANTRA DAO, a community-governed and decentralized DeFi platform that offers its users a wide range of services including staking, lending, stablecoins, derivatives, governance, grants, and custody.

Rapid growthFollowing its successful token launch, MANTRA DAO continued to make noise in the space throughout December, announcing a flurry of partnerships with the likes of BAND, LUNA, and KAVA being added to the list. As well as joining forces with some of the most exciting projects in DeFi, MANTRA DAO also began announcing the rollout of various DeFi products on its platform including soft governance, which allows the MANTRA DAO community to vote and propose changes to various aspects of the ecosystem.

In December the project reached a particularly notable milestone, with over 100 million OM tokens being staked natively on the MANTRA DAO staking platform since it’s unveiling just 2 months previously. The community was rewarded for being an integral part of the project’s success with the opportunity to own one of 88 rare MANTRA DAO NFTs being sold on NFT platform Rarible. The event sold out in 30 minutes, and proceeds from sales went back to the community.

Lending, decentralizedOne of the most exciting features to be announced in recent weeks by MANTRA DAO was their decentralized lending protocol ZENTEREST, which is an overcollateralized, money market, lending protocol enabling users of the platform to supply, borrow and use their crypto assets as collateral.

The Beta version of ZENTEREST was launched at the end of December 2020 and is a fork of both Compound Finance and Cream.finance, two well designed and successful lending protocols that have become popular in the DeFi space. Although utilising the best of both protocols, ZENTEREST will have its own unique set of listed assets that can be used for borrowing, lending, or the two combined. Various assets including the MANTRA DAO native OM token, ETH, wBTC, LINK, COMP, USDC, DAI, SNX, UNI, SUSHI, AAVE, LINK, YFI, 1INCH, and other smaller upcoming projects such as POLS, DSD, BONDLY, RSR, ROYA, etc. are available to users.

This is the first of various lending products planned to become available on the MANTRA DAO platform, with the second taking shape as a proprietary multi-asset CDP/stablecoin. KARMA Protocol, a decentralized credit rating system will be the third, and these products are set for release in Q1 and Q2 of this year respectively.

Developed to leverage the “knowledge and wisdom of the crowd”, MANTRA DAO is currently in the Parity Substrate Builders Program and besides offering a diverse range of DeFi products and services to its community, MANTRA DAO is a validator for several projects including BAND, Terra, Matic, ATOM, and most recently e-Money, a platform offering currency-backed, collateralized stablecoins.

MANTRA DAO is so far successfully delivering on promises outlined on a lengthy roadmap; the launch of lending products is another win for the platform’s already thriving community. With the future of DeFi looking more promising than ever, MANTRA DAO is set to become one of the sector’s success stories on the road to trustless, inclusive, and globally accessible financial products.

Image by Pexels from PixabaySimilar to Notcoin - Blum - Airdrops In 2024

Defi (DEFI) на Currencies.ru

|

|