2023-11-16 21:00 |

On-chain data shows Tether (USDT) has recently seen developments in its on-chain metrics that may hold relevance for the Bitcoin price.

Tether Whale Transactions And Volume Are At High Values Right NowAs explained by the on-chain analytics firm Santiment, the number one stablecoin in the sector, USDT, has seen a large spike in activity recently. There are two metrics of interest here: trading volume and whale transaction count.

The former of these keeps track of the total amount of USDT that’s getting involved in trades on spot exchanges daily. The metric’s value basically tells us about how active the market participants are right now.

The other relevant indicator here, the whale transaction count, measures the number of transfers happening on the network that carry a value of at least $100,000.

Only the whale entities are capable of moving such large amounts in single transactions, so the metric can provide hints about the interest that these humongous investors hold in the cryptocurrency currently.

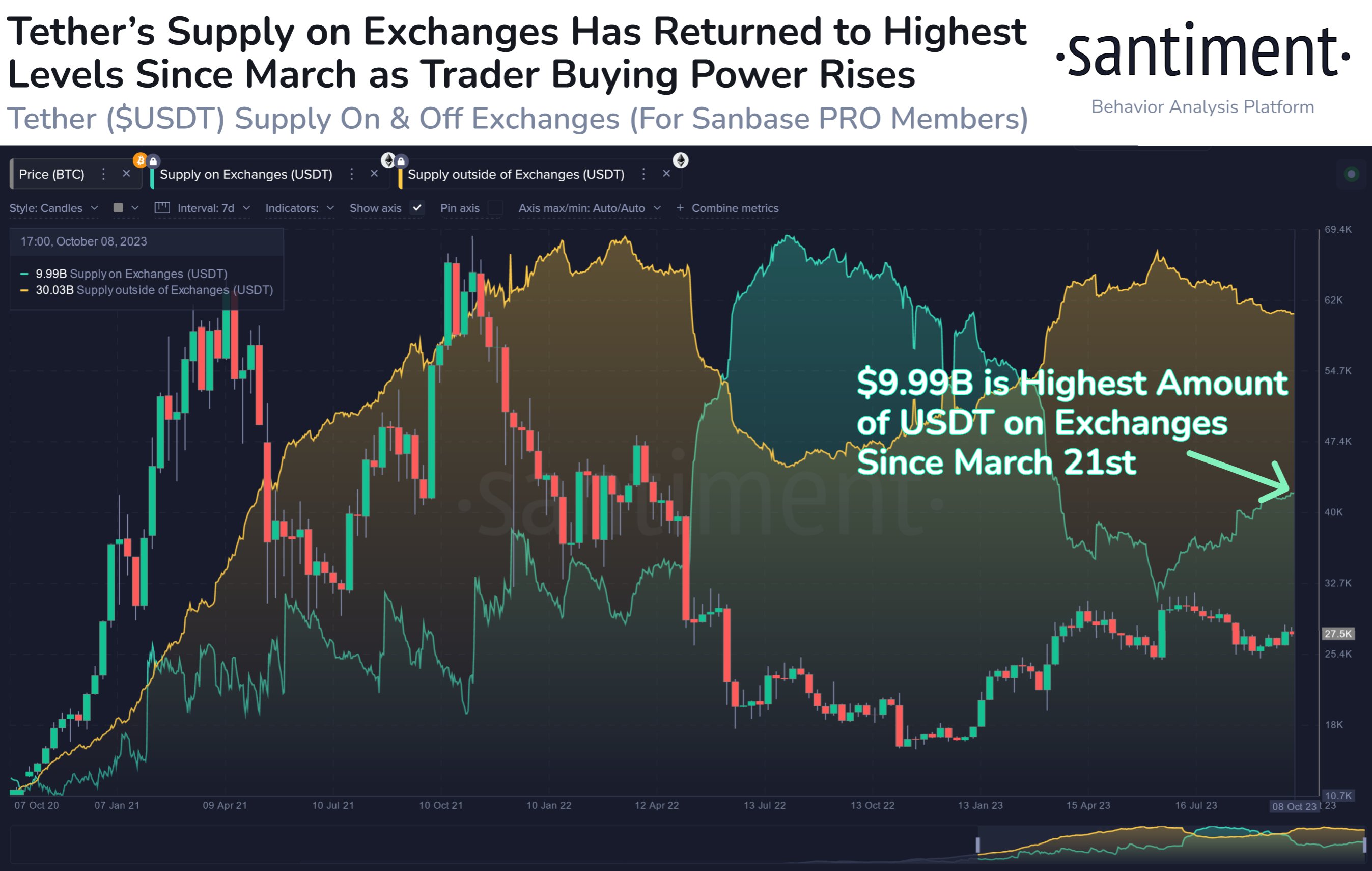

Now, here is a chart that shows the trend in the trading volume and whale transaction count for the stablecoin Tether over the last few months:

As displayed in the above graph, both the Tether whale transaction count and transaction volume metrics have seen a surge during the past month. At present, the stablecoin is seeing 40,000 weekly whale transactions and $50 billion in daily volume.

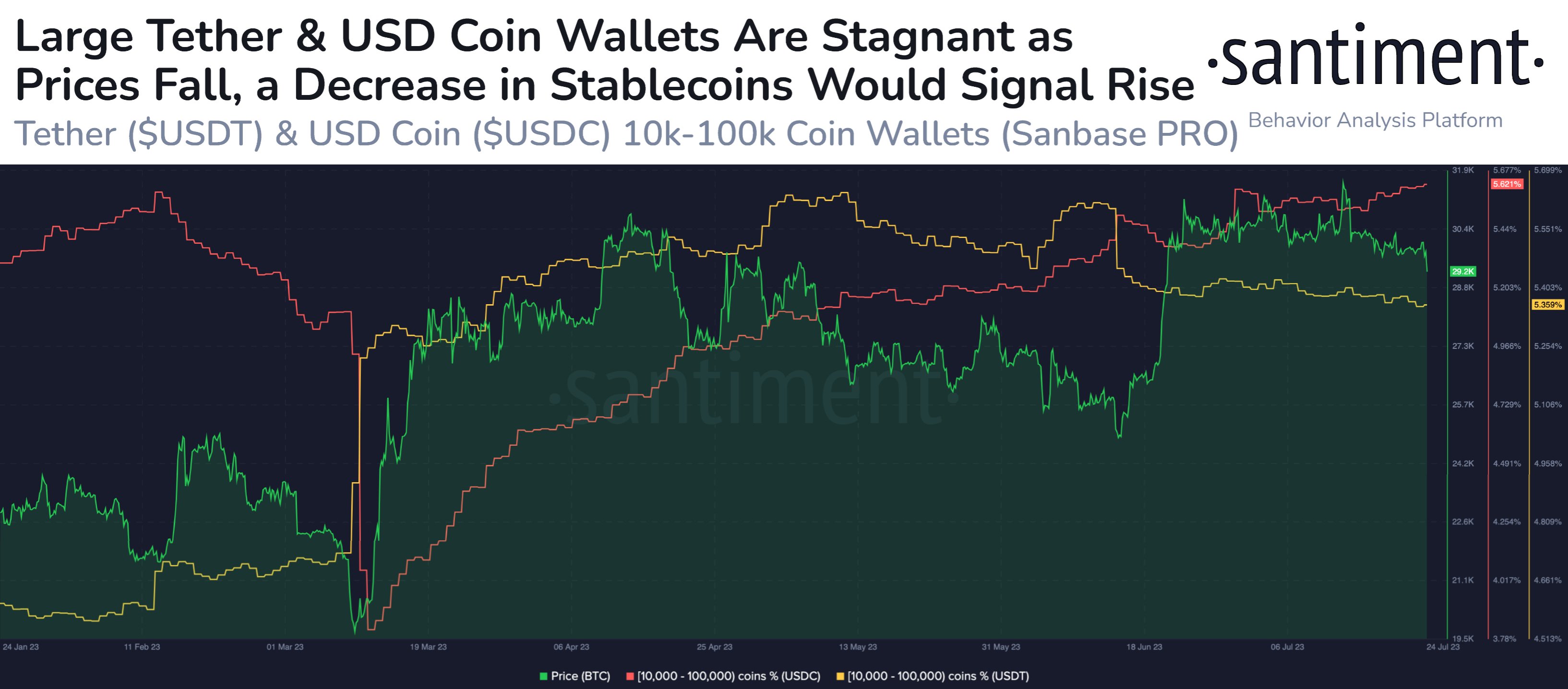

What relevance does this hold for the Bitcoin price? To understand this, the role of the stablecoin sector needs to be known first. Generally, investors make use of stables whenever they want to seek shelter away from the volatility associated with BTC and other cryptocurrencies.

Such holders usually only want to temporarily keep their capital stored in the stablecoin, however, as they eventually plan to return back toward the volatile market (if they didn’t, they would have probably moved to fiat instead).

Whenever the Tether transaction activity is high (especially from the whales), it’s a sign that the investors are transferring the asset around to potentially exchange it for assets like Bitcoin. That’s not the only direction it goes, obviously; the reverse transfers would also add to the activity.

However, considering that BTC has in fact seen sharp bullish momentum as the latest stablecoin activity has occurred, it would appear likely that at least some of the whales have been buying the asset with their USDT.

A similar pattern was also seen during the surge back in June, where both of these Tether metrics registered spikes. This time, the increase in the indicators is even higher; in fact, they are now at their highest levels since March.

Interestingly, when this pattern had formed in March, Bitcoin was gearing up for a 50% rally. Naturally, this doesn’t have to mean BTC would see a similar surge this time at all, but the historical precedence at least adds support to the idea that this USDT activity would prove to be at least somewhat bullish for the coin.

BTC PriceBitcoin has returned back above $37,000 after a 2.5% jump in the past 24 hours.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Tether (USDT) на Currencies.ru

|

|