2020-4-1 20:19 |

We are about to end March, a month that saw the price of bitcoin hitting $3,850 and ready to end the quarter with over 10% losses. With these losses, Bitcoin will make a red quarter hattrick while BTC price hovers around $6,400.

While the price of bitcoin ranges, Tether Treasury is printing the heck out of USDT. In March only, they printed about $1.14 billion worth of USDT, as per Whale Alert.

Till last week, Tether has been printing batches of 60 million USDT in an interval of a few days but from Tuesday onwards, they started printing $120 million worth of USDT for every other day.

All of these new USDT, Paolo Ardoino, CTO at Tether and its sister company, Bitfinex, a crypto exchange said has been “inventory replenish.”

In the past week, the market cap of USDT has also jumped over $6 billion. The popular USD pegged stablecoin also took over the third spot from XRP earlier this month.

Current USDt in circulation: $6.18billion

Outstanding loan to Bitfinex: $550million

Excess assets vs liabilities: $116million@Tether_to is therefore now >91% backed by USD and <9% by debt owed by @bitfinex

(Bitfinex raised $1billion when it issued the $LEO tokens)

— Alistair Milne (@alistairmilne) March 31, 2020

This third-largest cryptocurrency by market cap has been managing the second-highest daily trading volume after bitcoin and at times even surpassing that.

Demand for USDT on the RiseInterestingly, though this month USDT traded above the $1 USD mark which is a potential reason for this much USDT printing.

Source: MessariSam Bankman-Fried, the CEO of competitor exchange FTX said these inventory replenishes are because of the “huge buy-side demand for USDT.”

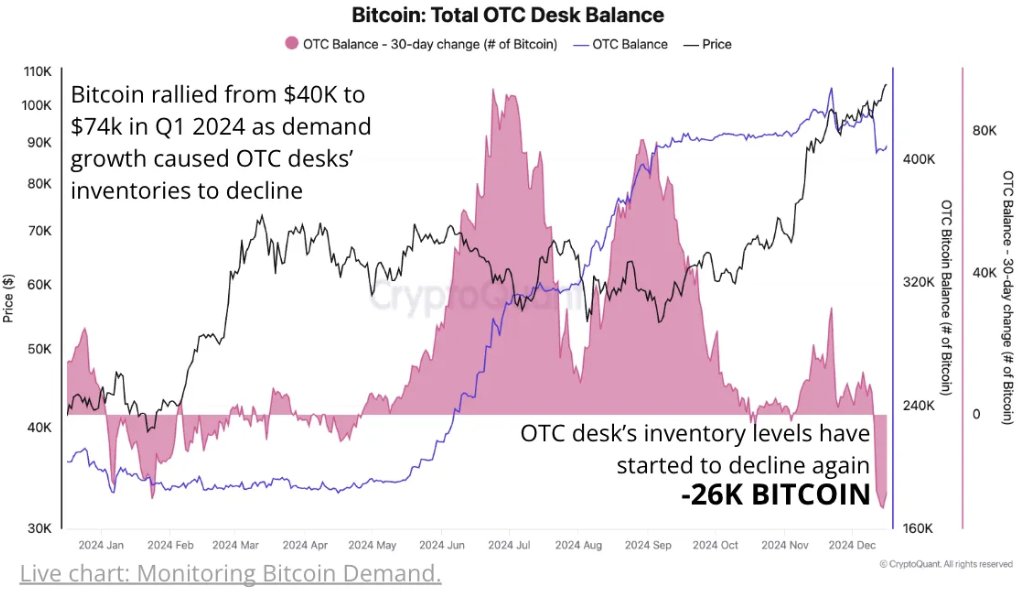

This demand for USD is coming from over-the-counter (OTC) flow, primarily from Asia, and people selling BTC converted into USDT to hedge positions and to reduce risk. Another thing worth noting is margin USDT which drives some of this demand and requires the funds to be kept in USDT.

And all of this is related to changes in futures premiums, crypto sentiment, miner balance sheets, borrow/lend rates, and desire to move capital, he said. “USDT is over $1 rn either they sell it for $1 and OTC buyer sells it for the arb, or they use USDT to buy btc,” said hedge fund manager Tradeboi Carti.

This demand for USDT then drives up the price and in turn supply, so regular USDT minted by Tether Treasury.

According to Bitfinex Bitcoin whale Joe007, there could be a “troubling” possibility as well in the way that,

“some USDT-only exchanges may be running fractional-reserve shops. Now that people are selling crypto for USDT and try to withdraw, exchanges don't really have that USDT, and need to buy it asap to maintain liquidity.”

Waiting for the perfect moment to buyAs we reported, while the price of cryptocurrencies fell this month, stablecoins have been seeing an increase in demand and market cap. Just like investors are fleeing for the safety of cash in the macro environment, crypto investors took to park their funds in fiat-backed stablecoins.

In the week following the crash in the crypto space, stablecoins’ balances on exchange doubled and the combined balance of USDT and USDC on exchanges surpassed $1 billion. 85% of these stablecoins are held by Binance while 8.3% is with Bitfinex.

“It is a measure of how much money is sitting on the sidelines or placed in limit orders at exchanges, waiting for the perfect moment to buy,” said Ankit Chiplunkar, a research lead at crypto analysis firm Token Analyst.

origin »Bitcoin (BTC) на Currencies.ru

|

|