2019-2-27 13:22 |

CoinSpeaker

Tech Glitch at CME Group Halts Trades at All Markets Including Crypto

The problem started at 7:39 p.m. Eastern time and trading across all markets on CME’s electronic platform was halted about 28 minutes later.

The exchange had previously said via Twitter that all CME Globex markets have been halted due to technical issues.

Surge in bitcoin price leads to record $BTC futures volume on February 19 with over 18K contracts traded. https://t.co/X3zW4D861Y pic.twitter.com/Qldb1jaVgw

— CMEGroup (@CMEGroup) February 21, 2019

Bursa Malaysia, which operates on CME Globex, announced that trading had resumed at 0330 GMT as the technical issues had been resolved, adding that its afternoon session was expected to operate normally.

This outage affected many markets including metals, grains, crude oil and natural gas. According to data from Bloomberg, no trades were executed in U.S. stock-index futures since early Wednesday in Asia.

Bitcoin Holding Steady Price After the GlitchBut it’s not just crude oil that was hit by this glitch. Last week Bitcoin took a hike of 10 percent and passed $4k mark. However, after the glitch, it fell back to $3,872 at the time of writing, holding now the price steady for a while.

Bear in mind that in tandem with the surge in Bitcoin price, last week the volume of Bitcoin Future on CME also took a significant hike.

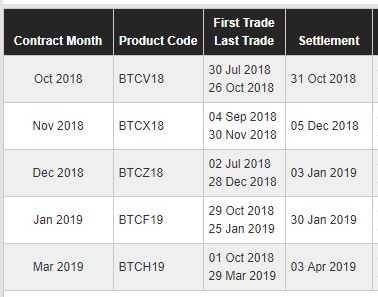

Since the launch of futures contracts on December 17th, 2018, CME Group has had more than 21,000 accounts trading the Bitcoin futures contracts. This investment vehicle provides the investors with an opportunity to bet on the future price of Bitcoin and go long or short on it.

CME Group first launched BTC futures in 2017 and according to the internal letter, the futures contract is taking off without a hitch. The internal e-mail read:

“Yesterday (Feb 19th) set a new record with 18,338 contracts traded, this is equivalent to 91,690 bitcoin or $360MN… Q1 2019 is off to a strong start, ADV has improved to 4,630 contracts (23,150 equivalent bitcoin), up ~13% from Q4 2018 while [open interest] rose to 4,076 contracts, an improvement of 21.5% over Q4 2018.”

In addition to the above, the CME Group has about 2,100 accounts and about 30 unique firms that have traded the contract. The e-mail stated:

“Institutional interest has gradually risen and the number of LOIHs (Large Open Interest Holders) has been holding steady around 43 holders since November. A LOIH is an entity that holds at least 25 BTC contracts.”

Further, researches for January 2019 shows a significant increase in the number of Bitcoin Futures contracts traded on CME when compared to its counterparts. The daily volumes increased by 20%, from $66.5M to $79.9M in January.

Everybody Waiting For the Bakkt LaunchWith the anticipation around the launch of Bakkt building up, it is expected that the prices of cryptocurrencies would shoot up. 2019 started with a rally, contrary to the general bearish trend that overtook the cryptocurrency market in 2018. In fact, the rally pushed the price of BTC to touch major resistance at $4000.

Stock market futures stateside were largely tepid following the resumption of trading. Dow Jones Industrial Average futures slipped 15 points as of 11:19 p.m. ET Tuesday, implying an opening decline of 28.98 points for the index at Wednesday’s open. S&P 500 and Nasdaq 100 futures also pointed to slight declines for the open.

Shares on Wall Street slipped during Tuesday’s trading session amid disappointing earnings, mixed U.S. economic data as well as a testimony from Fed Chair Jerome Powell.

Powell delivered his testimony to a U.S. Senate committee on Tuesday, noting that the U.S. economic outlook was “generally favorable” but warned of headwinds from overseas. China and Europe were particular areas of concern, he said, adding that the Fed was watching how Brexit negotiations and trade talks play out.

Luckily for traders, markets that were open saw muted price moves. The MSCI Asia Pacific Index of stocks added 0.2 percent, while Brent crude was up 0.7 percent.

Millions of contracts tracking the S&P 500, Dow Jones Industrial Average and Nasdaq 100 trade every weekday virtually around the clock on the CME. For eight hours each night after extended trading ends on exchange-traded funds, they are effectively the only way to express a view on the biggest U.S. equity indexes. Developments in Asian and American politics have made for volatile trading in recent years.

Tech Glitch at CME Group Halts Trades at All Markets Including Crypto

origin »Bitcoin price in Telegram @btc_price_every_hour

Trident Group (TRDT) на Currencies.ru

|

|