2021-2-10 22:21 |

SushiSwap is now rewarding Axie Infinity users who provide liquidity to the WETH-AXS pair on the trading platform.

Axie LPs Can Now Earn SUSHIAxie Infinity is a non-fungible token (NFT) game where users trade collectibles styled after the amphibian axolotl. In addition to NFTs, the platform also has a governance token, AXS.

Liquidity providers (LP) who support the WETH-AXS pair on SushiSwap can now earn SUSHI as reward. Since the reward scheme went live, the liquidity of the WETH-AXS pair has risen significantly. Prior to this, the trading pair had less than $5,000 in liquidity. Now, it has nearly $1 million in liquidity.

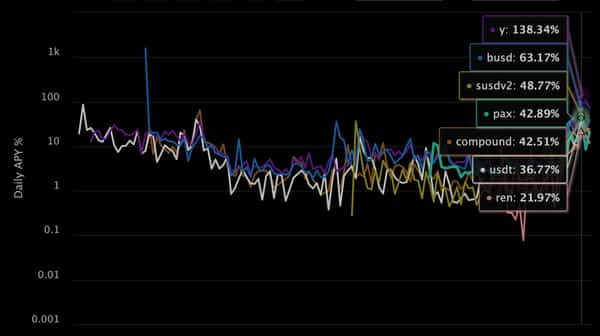

WETH-AXS liquidity, via SushiSwapApart from earning 0.25% trading fees, LPs will also earn SushiSwap’s native governance token SUSHI at a rate of 140% APY.

Axie Infinity has attracted the attention of behemoths like Ubisoft and Binance. Recently, the team has managed to sell nine plots of land for this game for a staggering sum of 888.25 ETH ($1.5 million).

Meanwhile, SushiSwap has witnessed a 1,000% increase in liquidity and a 3,000% increase in market value over three months. It has also launched a vault with an APY of over 300%.

Discolsure: At the time of writing, this author held Ethereum (ETH).

Similar to Notcoin - Blum - Airdrops In 2024

Ribbit Rewards (RBR) на Currencies.ru

|

|