2023-8-17 19:30 |

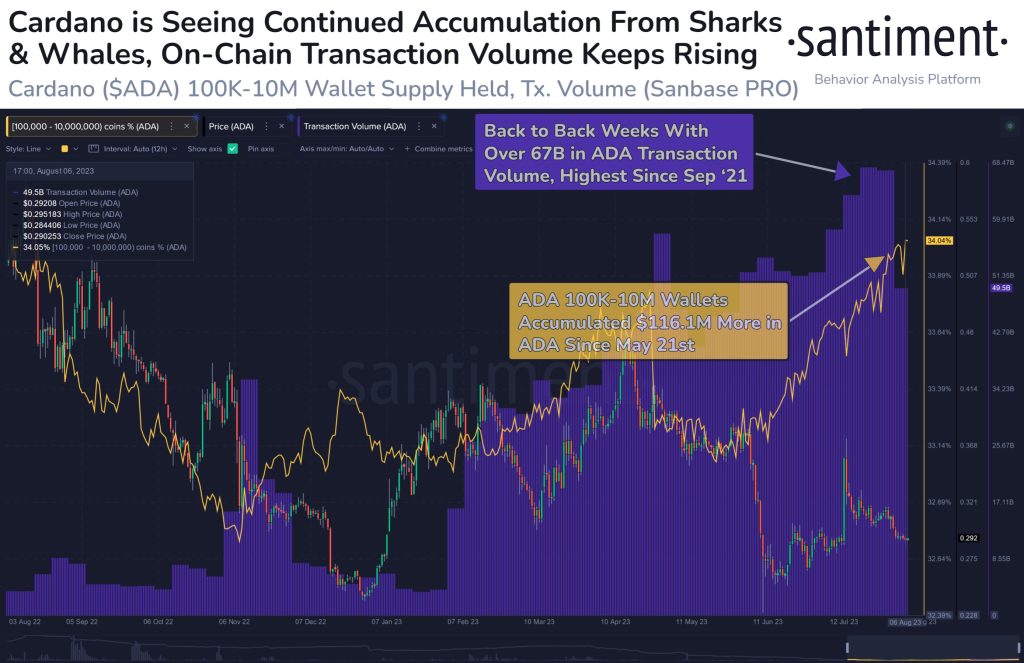

The crypto market has experienced an unusual lack of volatility throughout most of the summer. Seeing such stability in what has historically been a very tumultuous market has prompted many market participants to halt their activity.

This lack of activity has translated to a lower sell-off risk, especially among short-term holders.

Short-term holders, typically those who hold their Bitcoin for less than 155 days, play a pivotal role in the crypto market. Short-term price fluctuations drive their trading behavior, often leading to price volatility and pronounced liquidity shifts. Short-term holders can amplify price swings during market uncertainty by quickly moving in and out of positions.

Their propensity to react quickly to market events makes them a crucial cohort to monitor to understand potential market shifts and sentiment.

The short-term holder (STH) sell-side risk ratio is a technical indicator that shows the potential for sell-side market pressure. It’s derived by dividing the aggregate of all profits and losses realized on-chain by the realized cap. This essentially compares the total USD-denominated value that investors transact daily against the overall STH realized cap.

When the risk ratio is high, it suggests many investors are selling their holdings, potentially to take profits. Prolonged periods of an elevated STH sell-side risk ratio can indicate oversupply and market sentiment that leans towards overvaluation.

In contrast, drops in the sell-side risk ratio show a decrease in the value realization by short-term holders. Periods of low sell-side risk ratio correlate with periods of low volatility and are often seen during consolidations that precede large market movements.

Currently, the ratio for short-term Bitcoin holders is at 0.05%, a level not seen in nearly 13 years.

Graph showing the sell-side risk ratio for short-term holders in 2023 (Source: Glassnode)To provide historical context, the only time the ratio has been lower was on Oct. 3, 2010, when it dropped to 0.025%. At the time, Bitcoin’s price hovered around $0.06.

Graph showing the sell-side risk ratio for short-term holders from 2010 to 2023 (Source: Glassnode)Historical trends suggest that periods of extremely low sell-side risk ratios, particularly among short-term holders, often come before large price swings in the market. This pattern indicates that the market might be on the cusp of a substantial shift, either bullish or bearish.

The post STH sell-side risk ratio drops to record low: What does it mean for Bitcoin? appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|