2020-5-29 10:12 |

Over the last few years, we have seen record gains in the stock market. Price increases have defied what many investors thought was possible. But the current COVID-19 pandemic has impacted countries around the world, and global economies are expected to experience major recessions – up to 15%. This uncertainty leaves many worried about the future of their investments.

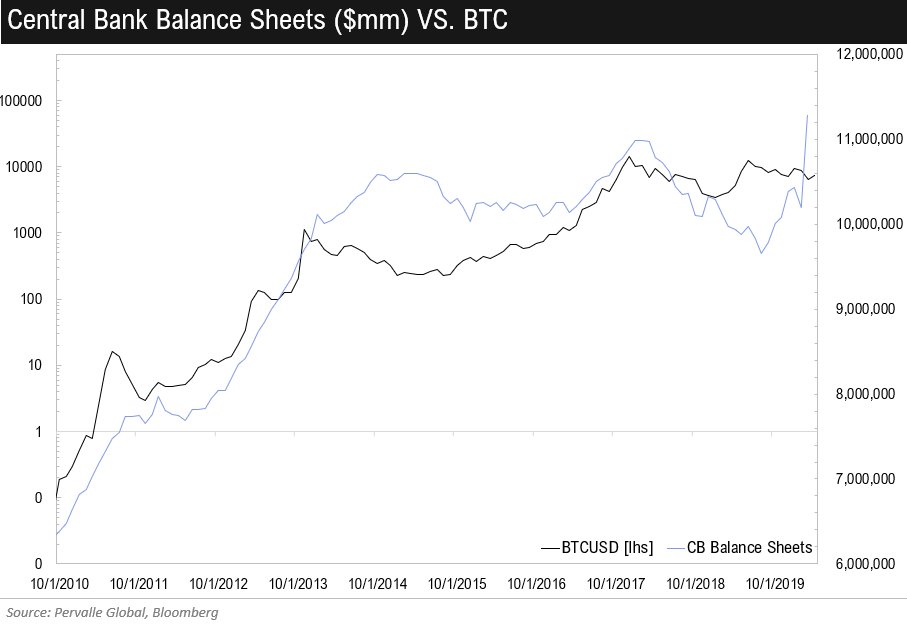

And, while the world is reeling from COVID-19 lockdowns, the market is still impacted by the decade-old ‘Financial Crisis’; interest rates around the globe still have not returned to their previous levels. Interest rates are the prime vector central banks use to influence monetary policy and maintain a healthy and functioning economy. So, to offset the economic downturn, many countries reduced their interest rates to historic lows. In some countries, they even hit zero (or below!).

Why does all of this matter?The current performance of the stock market and interest rates have a major impact on investments and savings. When determining where to allocate your savings, the primary goal is to optimise for the best possible return with the lowest risk profile. For many people, times of financial change are the impetus to rethink their savings and make strategic decisions about where to invest their capital.

In this post, we take a look at a new way to utilise crypto assets and put your savings to work – staking. It is increasingly popular with members of Gen Z, who want full ownership and control over their money, especially because it’s as simple as holding crypto assets in your wallet.

An Introduction to StakingStaking, in simple terms, is holding a cryptocurrency in your wallet for a fixed amount of time and earning interest on that asset. The level of interest paid depends on which crypto asset you hold and for how long. It’s very similar to earning interest from a bank account – the longer you hold, the more you earn.

Proof of Stake (PoS) blockchains make staking possible, and use this system to reach consensus. All you need to know at this point, though, is that if you stake crypto assets, you contribute to the security of the network, and are rewarded for that. This is where the interest or staking yield comes from.

Staking, while a completely new passive way to earn interest on crypto savings, may seem familiar as it closely mimics the type of passive earning that savings accounts that banks enable. The staker receives regular payouts of interest in the crypto tokens of the network they are staking.

Right now, there are many major projects that either already use Proof of Stake consensus or are actually migrating to this consensus model. At Ledger, we currently support both Tezos and Tron staking natively with Ledger Live and our hardware devices. But this is just the beginning, and we will add more assets throughout 2020 and beyond.

Staking is seen as an exciting prospect for the future of the blockchain space and is gaining even more attention with Ethereum (the second biggest project behind Bitcoin) set to launch it’s Ethereum 2.0 staking network later this year. The potential popularity can be seen through this report. It is thought that up to 66% of the Ethereum community may plan to stake at least some of their Ethereum upon the launch of Ethereum 2.0.

Due to its ease of use and stable rewards, it is very popular for crypto-asset holders who want to hold onto a certain asset long term, but still, passively benefit and support a certain cryptocurrency. It is also becoming increasingly popular for members of Gen Z, who see their bank savings achieving zero interest in traditional bank accounts.

Stats on StakingAccording to this report from May 2020, the current total value locked in staking sits around $8.46 billion. However, this is expected to increase dramatically upon the launch of Ethereum 2.0.

These remarkable numbers show just how popular staking has become. Tezos (XTZ) has the highest value of tokens staked, and many of the top PoS projects have 50-80% of their total tokens staked to support the network.

Right now, at the time of writing, Tezos currently has 80.02% of its total tokens staked. Ledger is currently the second-largest backer in the Tezos network, with over 49 million Tezos tokens (XTZ) staked by our users, second only to Coinbase. We are incredibly proud of this statistic, and it shows the trust that our community puts into our products and services. We hope that as we make tokens available for staking, we will see these numbers increase across numerous Proof of Stake blockchains.

Why we believe Gen Z will turn to stakingGlobally, we are experiencing a time of historically low-interest rates. In some countries, they are even paying people to take out mortgage loans for houses. This might be great if you want to buy a house, but what happens if you want to store or save your money?

It means that not only will interest rates not yield decent returns, but at some point you could realistically have to pay your bank to hold your money for you. This pressure is compounded by the fact that all of this is stacked on a system with near all-time low trust in banks.

Unsurprisingly this is unappealing for most people, and those people are now looking for alternatives. With their increased knowledge and awareness of cryptocurrencies, we may see many members of Gen Z choosing to stake crypto instead of saving in banks.

Companies like Robinhood, who make it easier for people to trade stocks with zero fees, have seen explosive growth in the last few years. The majority of their 10 million user base is categorized as Gen Z, and what this shows is the increased interest in this generation wanting to manage their own money. We could likely see a similar trend towards staking as people look for other ways to escape low-interest bank accounts and take back control of their money.

Is it too good to be true?Now that staking is so easy and the rewards are advertised as being so high, it honestly sounds too good to be true. However, there are a couple of things you need to consider before putting your life savings into staking crypto.

Underlying price volatility — depending on the token you choose to stake, there can be a price movement in the crypto itself. For example, you may choose to stake a token valued at $1.00, paying a 10% yearly yield. This is a great level of return compared to a normal bank account. But, the price of the token can also move from $1.00, impacting the overall yield. One year later it could have moved dramatically, both up or down. You should be aware of this and the potential risk if the price also goes down.Don’t just pick the highest percentage yield — a common mistake is picking the project with the highest percentage yield. This may seem like the most attractive option, but it doesn’t always mean the project is the highest quality and could give you more risk on the token price movement.Understand any penalties — many staking networks require you to meet certain criteria to obtain the staking reward. If you are staking through a company like Ledger, we try to control that for you. But there are always risks of the reward not being paid out for node downtime or network outages.Know the time limits. Different networks have different payout schedules and timeframes that you must commit to the network to receive rewards. Do your research and know how long your commitment is. Staking with LedgerIf all of this sounds like something you are interested in and want to know more about, that is something that we at Ledger are committed to. We believe that we provide the most secure way to grow your assets through staking.

We also give you full control over your assets. When staking on a network you often have some governance rights that allow you to vote for or against decisions that are proposed for that network. When staking with Ledger, through our Ledger Live product, you maintain full governance rights and the freedom to make your own decisions. This is unlike most crypto exchanges, who can vote on your behalf.

Our goal at Ledger is to continue to provide more assets for you to stake (we currently have Tezos and Tron), make sure you have the most secure way to do that and give you help and full freedom to take part in your favourite blockchain networks. We expect increased interest in staking over the next few years from Gen Z and beyond.

origin »LALA World (LALA) на Currencies.ru

|

|