2023-6-20 19:00 |

On-chain data shows the supply of stablecoins has been going up recently, a sign that could potentially be bullish for Bitcoin.

Stablecoins Have Registered An Increase In Their Supply RecentlyAs pointed out by an analyst in a CryptoQuant post, every increase in stablecoins’ supply since late 2022 has been accompanied by a rise in the price of Bitcoin. The metric of interest here is naturally the combined circulating supply of all stablecoins.

When the value of this indicator rises, it means that capital is entering into the stables currently as more of their tokens are being minted. On the other hand, a decline implies investors are either redeeming these fiat-tied tokens for currencies like the dollar or shifting them into other cryptocurrencies like Bitcoin.

Generally, investors use stables whenever they want to avoid the volatility associated with most of the coins in the sector. Thus, whenever the supply of these tokens is going up, it can also be a sign that investors are possibly retreating from the volatile markets.

When such investors eventually feel like the prices are right to jump back into the other assets, they simply exchange their stablecoins for their desired coins. Naturally, this can provide bullish pressure on the price of the cryptocurrency that they are shifting into.

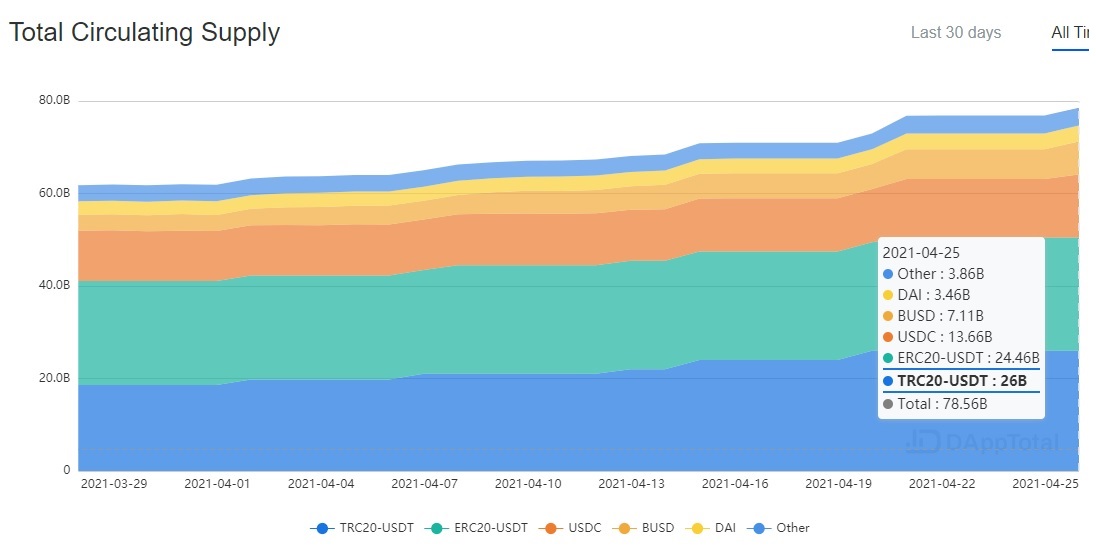

Now, here is a chart that shows the trend in the combined circulating supply of the stablecoins over the past year and a half:

As displayed in the above graph, the combined circulating supply of the stablecoins had started moving on an overall downtrend back when Bitcoin hit the bull market top. This decrease in the supply of these tokens implied the exit of capital from the market, as BTC and other coins also went down in value alongside this downtrend.

In late 2022, however, the indicator finally showed a brief deviation from the downward trajectory as its value registered a sharp increase. Interestingly, not too long after this spike appeared, the price of Bitcoin started observing its rally.

This increase in the supply of the stablecoins could have been a sign that a capital injection into the market took place, and as these freshly piled up stables were converted to the other coins, the market obtained its fuel for the rally.

In March of this year, when the rally had paused and the Bitcoin price had been going down, the metric had once again spiked, implying that investors may have possibly been withdrawing their BTC into the stables.

After the bottom below $20,000, however, the supply of the stablecoins once more dropped, suggesting that holders were potentially exchanging back into Bitcoin. Naturally, the price of the asset observed a bullish boost from this, as the rally kicked back on.

From the chart, it’s visible that the indicator has been rising again recently. Given that all such rises in the metric have been bullish for BTC during recent months, it’s possible that this fresh influx of capital can provide fuel for the asset this time as well.

BTC PriceAt the time of writing, Bitcoin is trading around $26,400, up 2% in the last week.

Similar to Notcoin - Blum - Airdrops In 2024

Supply Shock (M1) на Currencies.ru

|

|