2018-10-19 10:02 |

Distrust Propelling Crypto Rise, May Hit Trillion Market Cap

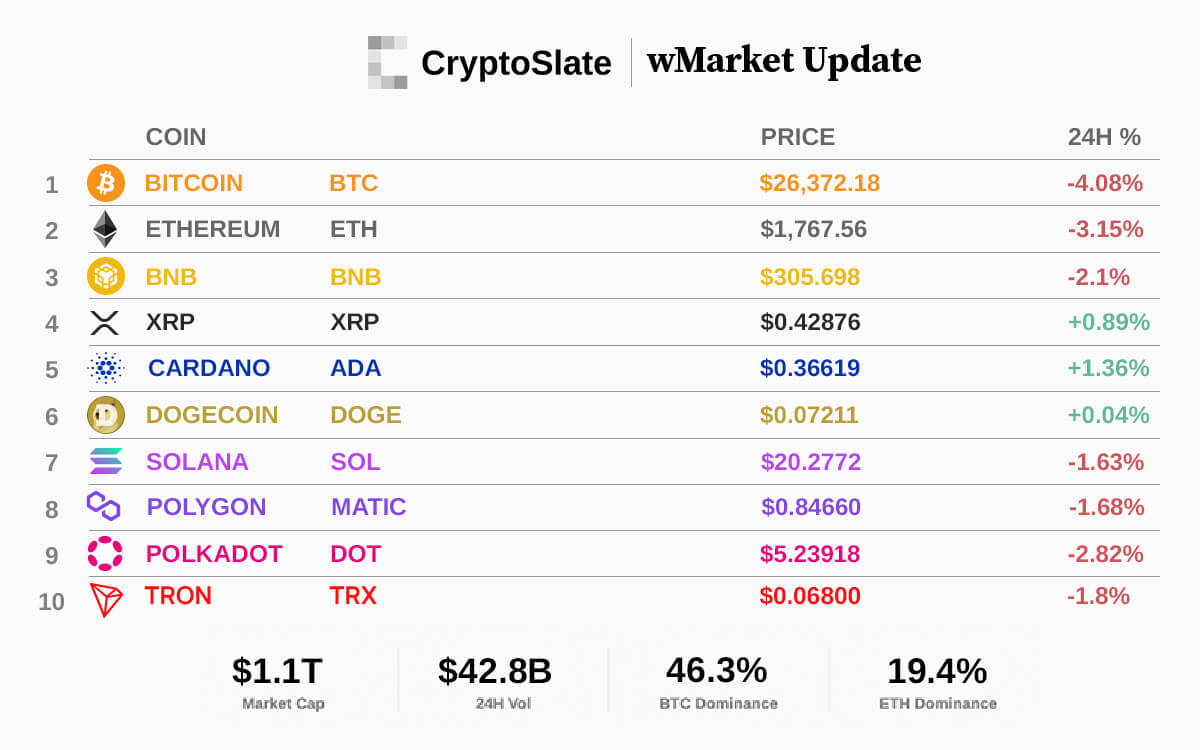

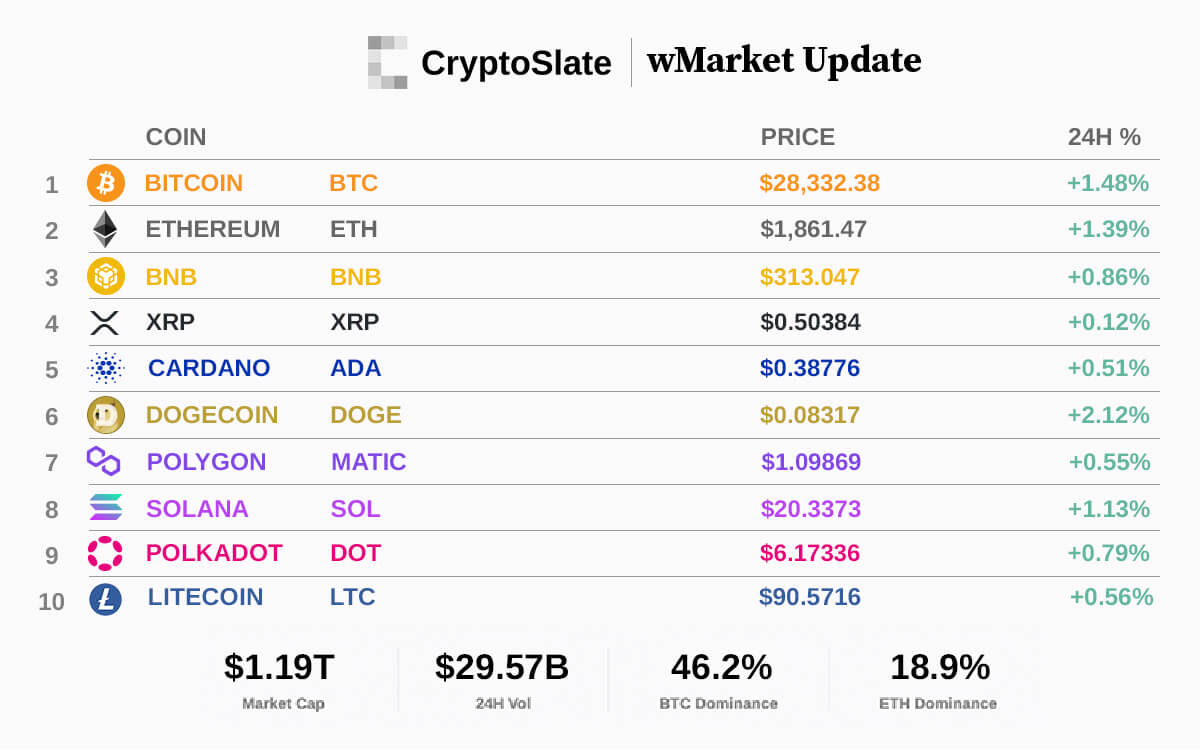

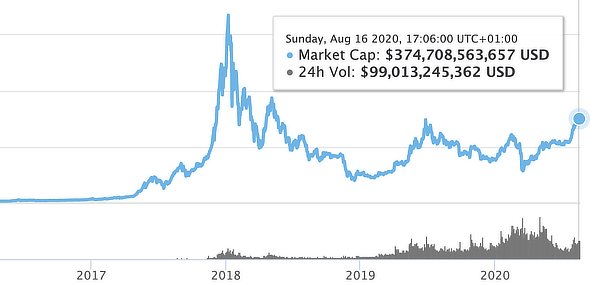

The crypto industry is hugely a ‘go big or go home’ industry as it is no stranger to high market cap rise; even as the distrust for large financial institutions among millennials continue to propel its resurgence.

Coming from an all time high market cap of $800 billion, the crypto industry is set to hit the trillion mark, says Crypto Trader, Coinbase alum and crypto investment firm 1Confirmation founder Nick Tomaino. He said:

“I see investing and speculating as adoption. I think it is possible that crypto gets from $200 billion to several trillion on just that [speculation]. From my perspective, what I’m seeing globally in terms of viewing this new investable asset class I think that’s possible.”

He made the comments during an interview with Ran Neuner on CNBC’s Crypto Trader. According to Tomaino, an important macro trend that could lead to an influx of investors and capital into cryptocurrencies or consensus currencies is the decline in trust towards governments and large institutions like banks.

Various studies conducted by Facebook Research and major technology conglomerates have shown a clear trend of millennials shifting from legacy systems to innovative and trustless alternatives such as fintech applications.

In the long-term, he explained that a cultural and gradual shift from trusting large institutions to peer-to-peer systems could direct consumers to decentralized financial networks.

“My view is that the most important macro trend of our lifetime is people increasingly distrusting governments and large institutions. I see it more as kind of a gradual movement into crypto, I think it’s kind of a gradual and cultural shift from people trusting large institutions and governments to using the blockchain.”

Currently, the cryptocurrency market is growing exponentially in terms of infrastructure, adoption, and institutionalization.

The structure of blockchain networks are seeing progress in scalability, stability, and security, fueled by active open-source developer communities and ecosystems.

Tomaino stated that the infrastructure and middleware used in the cryptocurrency sector are rapidly improving, allowing the market to stabilize and appeal to accredited traders and institutional investors.

“At the same time, what I’m seeing in terms of real adoption is mostly infrastructure and middleware being built to fuel real applications. That’s things like scalability solutions, stablecoins, decentralized exchanges.”

Institutions that include hedge funds, pensions, and family funds will likely not trigger a similar trend of fear of missing out (FOMO) individual investors demonstrated in late 2017.

Similar to Notcoin - Blum - Airdrops In 2024

Rise (RISE) на Currencies.ru

|

|