2024-2-21 18:00 |

Data shows Solana and Chainlink are among the top cryptocurrencies that have observed growth in Open Interest to relatively high levels.

Solana & Chainlink Have Their Open Interest At Notable Values CurrentlyAccording to data from the on-chain analytics firm Santiment, there has been a dramatic increase in interest in the derivative market for cryptocurrencies recently.

The indicator of relevance here is the “Open Interest,” which keeps track of the total amount of derivative contracts for any given asset that is currently open on all centralized exchanges.

When the value of this metric goes up, it means that the investors are increasing positions on the derivative side of the market. Such a trend may be a predictor for higher volatility, as the total leverage in the sector tends to go up when new futures positions pop up.

On the other hand, a decrease in the indicator implies the holders are closing up their positions or are getting forcefully liquidated by their platform, thus leading to the leverage potentially coming down. As such, this kind of trend can result in the asset’s price becoming more stable.

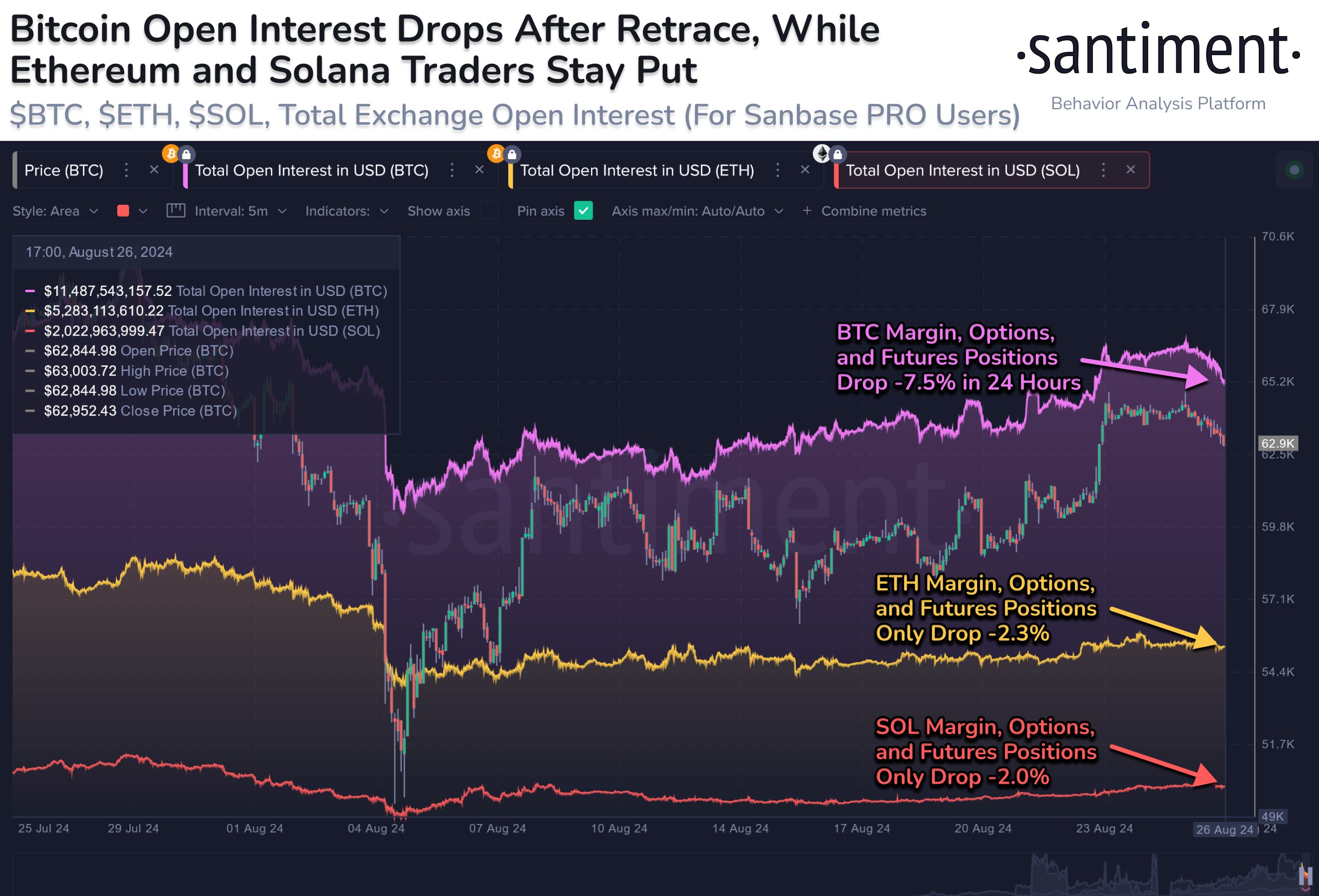

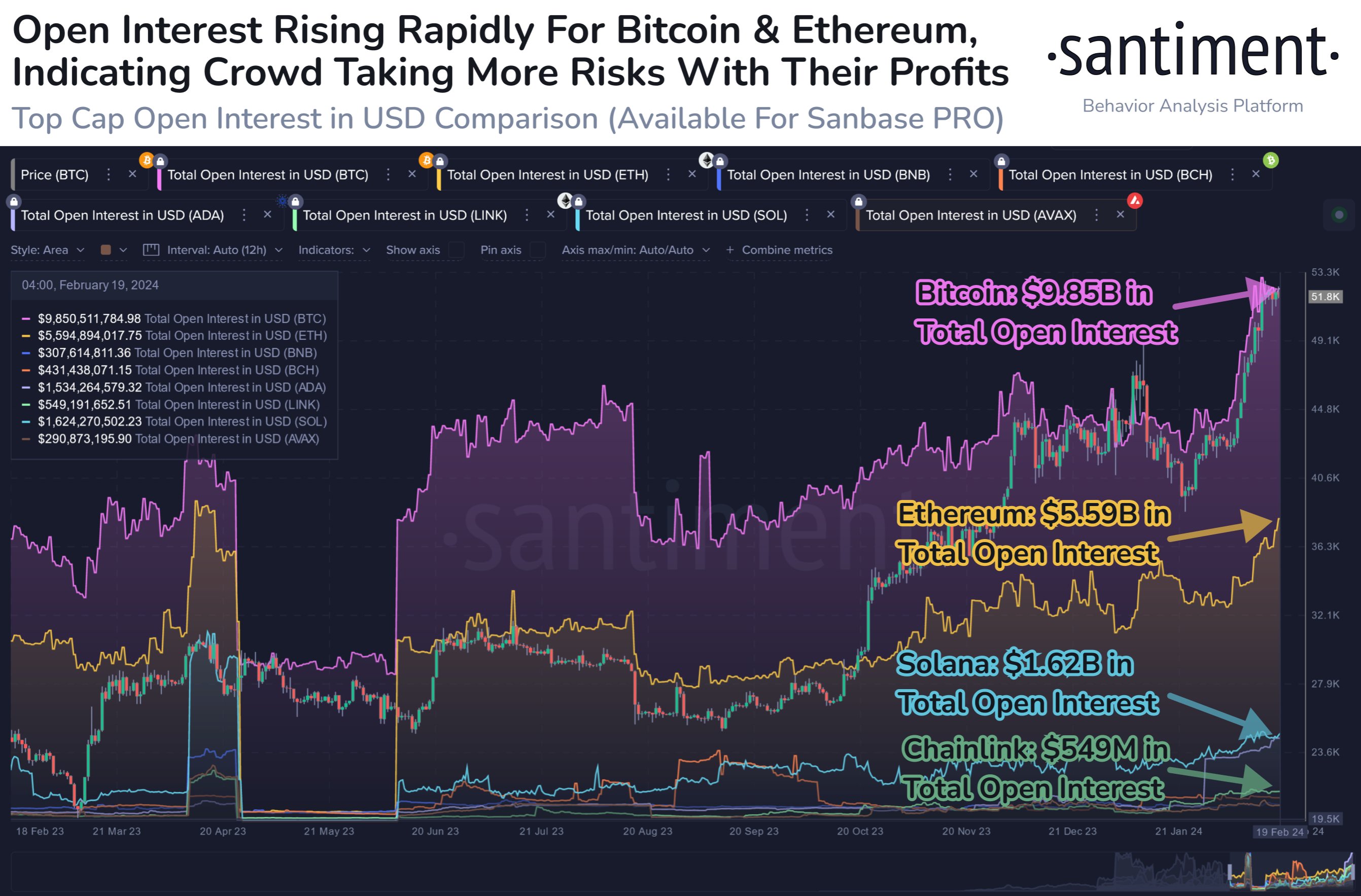

Now, here is a chart that shows the trend in the Open Interest for various top assets in the cryptocurrency sector over the past year:

As displayed in the above graph, the Open Interest has exploded for Bitcoin and Ethereum recently as the latest surge in prices has occurred. Generally, such sharp price action attracts a large amount of speculators to the assets, so the indicator’s upward trajectory isn’t surprising.

The scale of the increase, though, may be a bit concerning. From the chart, it’s visible that the BTC Open Interest is currently around $9.85 billion, while for ETH, it’s about $5.59 billion.

Among the altcoins, Solana and Chainlink have particularly stood out, as the indicator has touched $1.62 billion and $549 million for them, respectively. These are much smaller values than Bitcoin and Ethereum, of course, but their market caps are also much smaller than these two titans.

“With Bitcoin, in particular, crossing over $10B in open interest for the first time since July, 2022, this does signal crowd euphoria is alive and well,” notes the analytics firm. “Sometimes rising too quickly can be indicative of some caution flags.”

The reason that a high Open Interest has historically been a cause for concern is that mass liquidation events become more probable to occur in such market conditions, due to an abundance of leverage.

Such events, where liquidations can cascade together, are usually chaotic and result in some sharp price action. As Solana, Chainlink, and other top assets have a potentially overheated Open Interest right now, they may be ones to watch in the coming days, as any further increases might serve as a warning.

SOL PriceAt the time of writing, Solana is trading around the $110 level, down over 3% in the last seven days.

origin »Bitcoin Interest (BCI) на Currencies.ru

|

|