2021-5-12 16:00 |

The next generation of decentralized finance protocols and services will need to offer better security and protection to users. Insurance packages are currently a novelty in the industry, but that may not be the case for much longer. Shield Finance has a bold vision to combine the best of DeFi and insurance into an accessible and versatile offering.

The Current State of DeFiAnyone who has looked closely at how the DeFi industry works will know there are big rewards but equally significant risks to contend with. There is never a guarantee to make money in any industry, yet decentralized finance can provide more lucrative rewards to incentivize users. Whether one wants to provide liquidity or engage in yield farming, every opportunity has its own potential benefits and drawbacks. It is up to users to carefully evaluate the options at their disposal and how they wish to approach them.

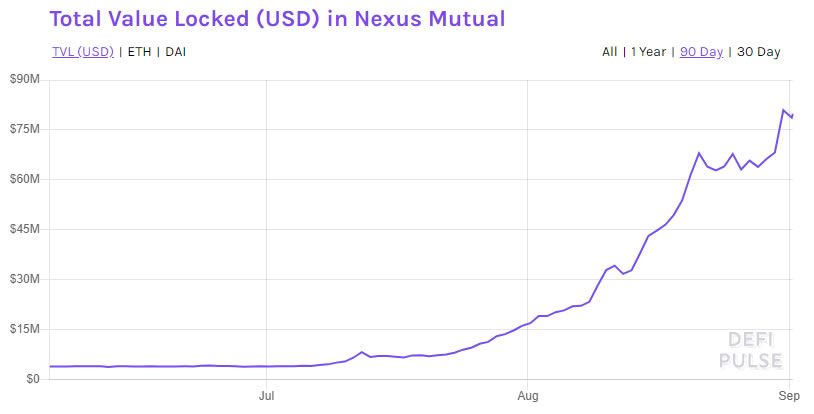

In its current state, decentralized finance does little to protect users and investors. Ranging from rug pulls to hacks and market crashes to other security issues, many things can go wrong in this nascent industry. That is to be expected when dealing with the first generation of DeFi projects, yet it also heightens the appeal of insurance-oriented solutions. Several projects provide such insurance, yet it can be challenging to find the right solutions that fit one’s personal needs.

Shield Finance aims to change this narrative by serving as a DeFi insurance aggregator. A thoughtful approach, as its aggregation engine, can offer custom insurance packages tailored to one’s needs. More importantly, all of this can be accessed through the native ecosystem, removing the need for switching between websites, platforms, and protocols.

By working together with various exchanges and DeFi protocols, wallets, and yield farming providers, Shield Finance will provide more security, peace of mind, and convenience to users. It is essential to keep building a solid foundation for decentralized finance to thrive. The project’s multi-chain approach – spanning Polkadot, Ethereum, Solana, and Binance Smart Chain – will prove crucial to unlocking the full potential of insurance in DeFi.

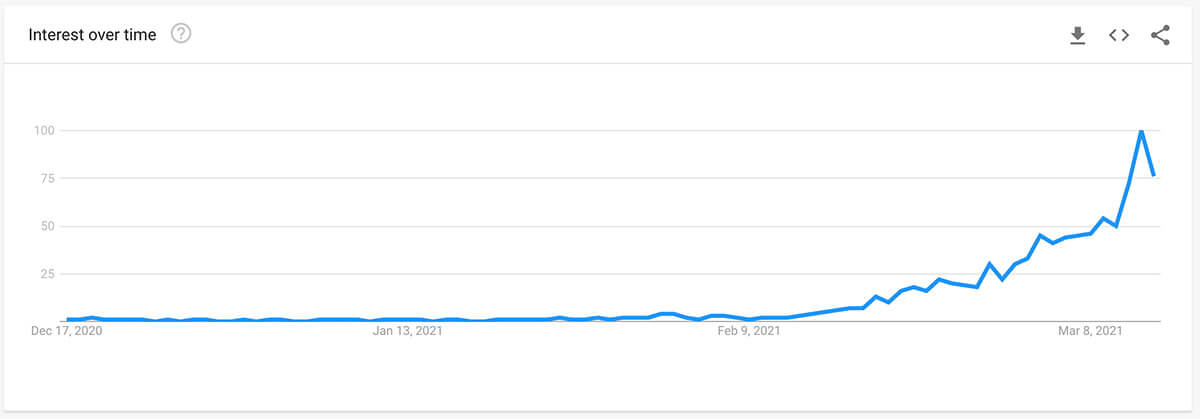

Shield Finance Funding And IDOThe vision outlined by Shield Finance has attracted ample attention from private investors. After setting the initial goal to $780,000, that amount was raised relatively quickly with the help of prominent investors. Entities supporting this venture include Zokyo, NGC Ventures, GD10. Ventures, Titan Ventures, and others. This successful private funding round marks a significant milestone for the team, as it confirms their vision for insurance in decentralized finance has merit.

Shield Finance CEO Denis Gorbachev adds:

“Insurance plays an important role in DeFi as a way to de-risk your investments. With a number of insurance players in the market, a multi-chain insurance aggregator will naturally attract users as a go-to place to buy insurance. This fundraise will be instrumental in driving the growth and development of Shield Finance.”

Shield Finance aims to organize an Initial DEX Offering – IDO – on PAID Network’s platform on May 19, 2021. With the help of PAID Network’s Ignition Launchpad, users will be able to access the native token and invest in it. As the PAID Network has built up a strong community and its launchpad is gaining popularity, it is a good fit for this upcoming IDO. Token sales remain an integral part of the cryptocurrency industry.

Acquiring the native $SHLD token will give users a chance to exert governance over the protocol. Additionally, users can earn staking rewards at a 30% stable APY, providing an extra incentive to hold on to tokens for longer periods. Additionally, Shield Finance’s buy & burn program will use 50% of the fees generated by suers to buy tokens on the open market and burn them to reduce the circulating supply.

Closing ThoughtsIt is interesting to see how DeFi solutions will grow and evolve over time. Focusing on multi-chain support and introducing insurance packages can prove to be two essential upgrades the industry needs today.

In its current form, decentralized finance does not provide an optimal user experience and has no option to let investors de-risk their positions. Shield Finance aims to change that narrative for the better.

origin »

Wish Finance (WSH) на Currencies.ru

|

|