2024-4-4 01:04 |

The SEC has opened comments on Grayscale, Fidelity, and Bitwise‘s applications to launch spot Ethereum exchange-traded funds (ETFs).

The notices apply to proposed rule changes through which two exchanges — Cboe BZX and NYSE Arca — aim to list and trade shares of the three funds.

Comments are open for 21 days following publication in the federal register.

This phase is a routine procedure in the approval process for ETFs, mirroring the approach taken with spot Bitcoin ETF applications, which previously encouraged feedback from US citizens and organizations.

Market correlationEach notice discusses matters that are expected to influence the SEC when it comes time to approve or reject the proposed spot Ethereum ETFs.

Most importantly, the notices discuss correlations between ETH futures and ETH spot markets and whether the spot ETH market is of a significant size related to the futures ETH market. The correlation is relevant because the SEC has previously approved futures ETH ETFs.

NYSE Arca and Grayscale cited an analysis by Coinbase that demonstrates the correlation and shows that fraud and manipulation are unlikely in the spot ETH market. The two companies also said that the Investment Company Act of 1940 does not offer relevant protections that should lead to the denial of certain spot crypto ETFs, contrary to the SEC’s claims.

Cboe and Fidelity asserted that their proposal and analysis prove that the spot ETH market is of relevant size. NYSE Arca and Bitwise cited their analysis to that end.

The notices also seek comment on other issues such as custodianship of funds, creation and redemption models, and sponsor’s fees. Requests for comments are routine and do not indicate whether a fund is likely to gain approval.

Ethereum ETFsThe call for comments arrives after a history of postponed decisions by the SEC regarding spot Ethereum ETFs. The involvement of high-profile fund managers such as Grayscale, Fidelity, and Bitwise emphasizes the significance and growing interest in cryptocurrency-based financial products among traditional investment firms.

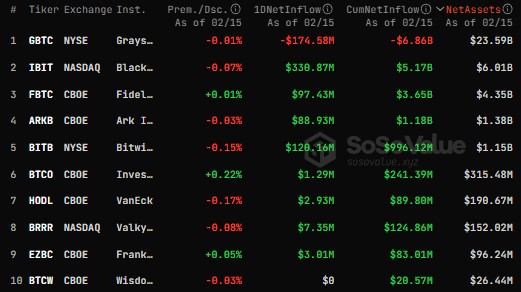

This initiative by the three fund managers aims to establish a spot ETH ETF, enabling investors to purchase shares that reflect the price of Ethereum. Following the SEC’s approval of 11 Bitcoin ETFs in January, which have since seen substantial inflows and popularity, there is a strong push to secure similar regulatory green lights for Ethereum-based products.

Notably, Coinbase held discussions with the SEC last week concerning Grayscale’s Ethereum ETF proposition. Grayscale aims to transform its existing Ethereum Trust into a spot ETH ETF, a move that Coinbase publicly supported in a recent presentation to the regulator.

The push for Ethereum ETFs comes amid varying market sentiments. While the SEC’s approval of spot Bitcoin ETFs marked a significant milestone, analysts remain divided on the prospects for Ethereum ETFs.

Some speculate that the SEC might delay its approval to create a temporal separation between Bitcoin and Ethereum products. Despite this, entities like Standard Chartered have expressed optimism, anticipating SEC approval by May.

The post SEC opens request for comments on 3 spot Ethereum ETFs appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

World Trade Funds (XWT) на Currencies.ru

|

|