2023-1-24 09:53 |

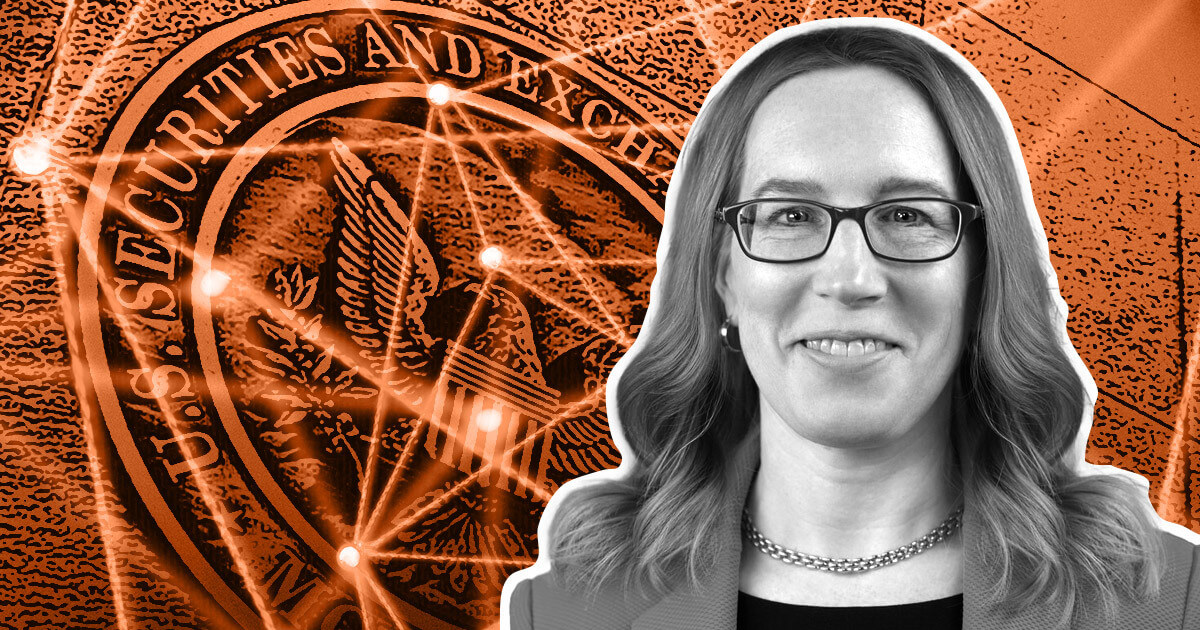

SEC Commissioner Hester Peirce recommended against disregarding crypto in a speech at the Duke Conference. She believes that the industry must also self-regulate to a degree.

United States Securities and Exchange Commission (SEC) Commissioner Hester Peirce has again made some positive headlines in the crypto world. Peirce, affectionately known as “Crypto Mom,” made a speech at a digital assets conference at Duke University.

Peirce said that last year’s incidents offer some important lessons going forward. She clarified that the position was her own and did not represent the SEC and its other members.

Among the major points she made was the fact that “Crypto’s value proposition depends primarily on the builders of this technology, not on regulators like me, who lack technical expertise and stand on the periphery looking in.” As such, she believes that those in the industry should not wait for regulators to fix issues. She states that privately designed and voluntarily implemented solutions can work better to achieve this goal.

She also stresses that the point of crypto is not to earn a profit through trading but to solve trust issues through the technology. In other words, she suggests focusing on worthwhile use cases.

Towards the end of her speech, she says that “rather than swiping left on crypto, we should remember that new technologies sometimes take a long time to find their footing.” She recommends allowing experimentation with the technology instead and not allowing strict regulation to get in the way.

Hester Peirce Doesn’t Think Howey Test Can Be Applied EasilyPeirce has made several remarks on crypto regulation over the years. She was clear about her position on crypto bailouts, saying she would not support it, especially if the company was over-leveraged. However, she said that the crypto market had matured somewhat back in 2021.

Peirce also disagrees with the current approach to regulation, saying that the agency’s currency approach is not in good faith. She also sees issues in applying the Howey Test to crypto assets, pointing out that the nuances of a crypto test don’t lend themselves easily to the test.

The Howey Test Visual by Securitize Gary Gensler Sees Checks as NecessaryPeirce’s takes on crypto contrast somewhat significantly against the positions of SEC Chair Gary Gensler. He is adamant about the need for checks and has vowed to crack down on non-compliant crypto firms.

Gensler said that the FTX collapse was a part of a pattern in the industry, namely that these companies borrow customers’ funds to invest without proper disclosure. He also believes that crypto exchanges are highly centralized.

The post SEC Commissioner Hester Peirce: Don’t ‘Swipe Left’ on Crypto appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) íà Currencies.ru

|

|