2023-6-19 13:56 |

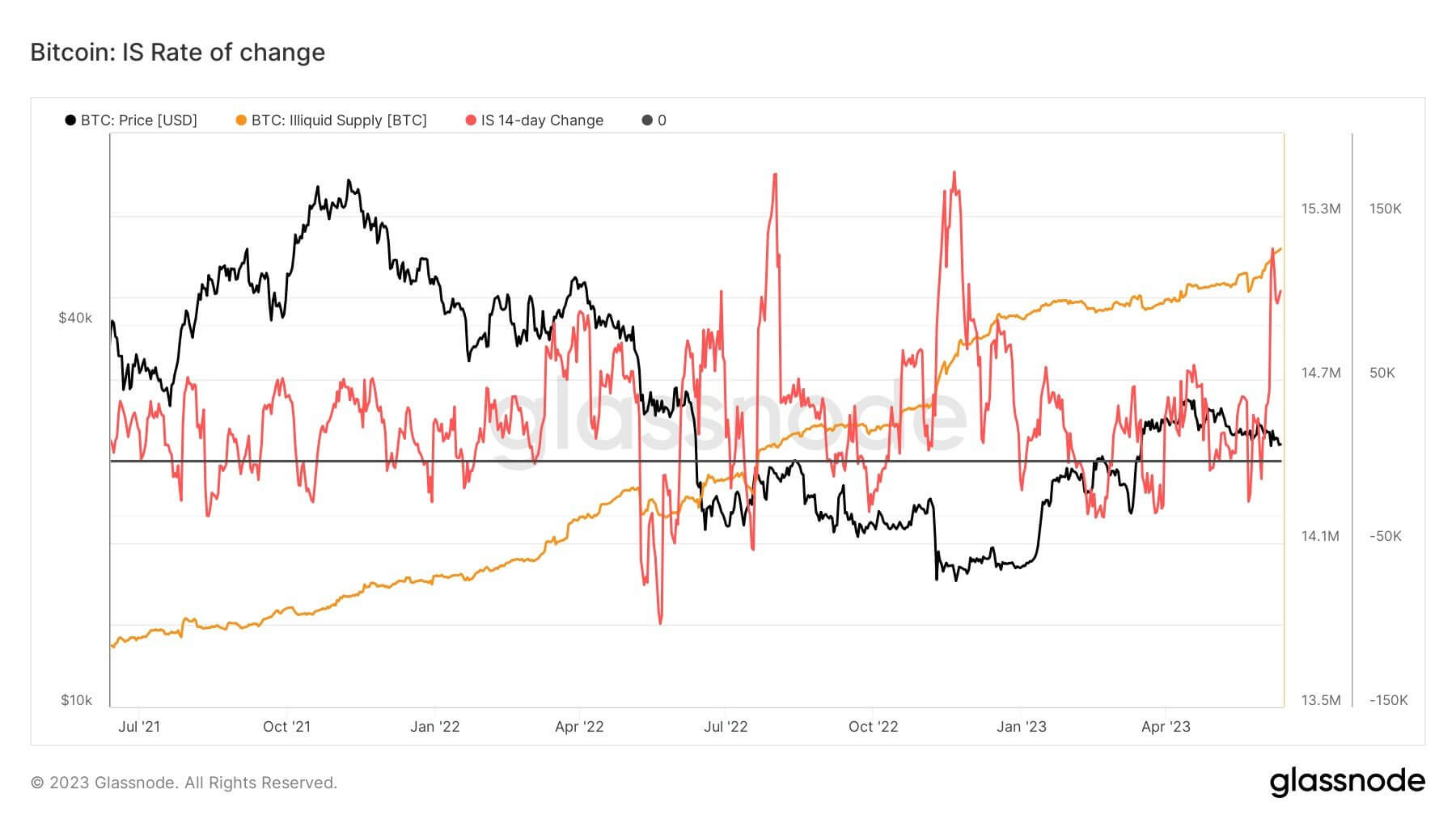

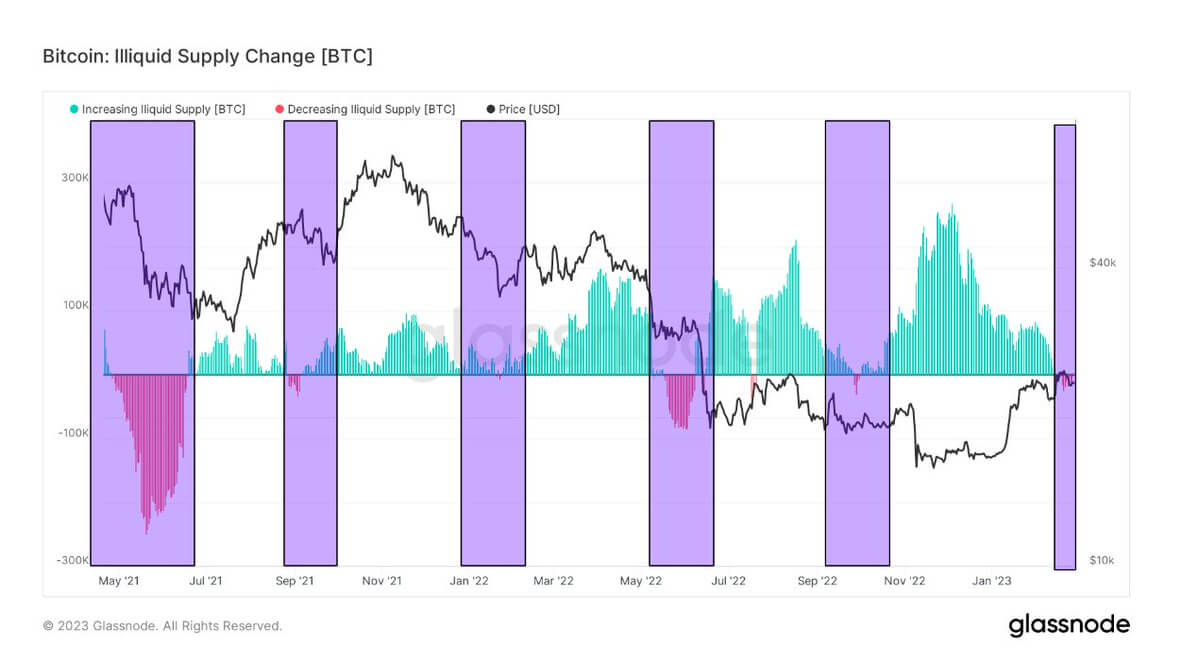

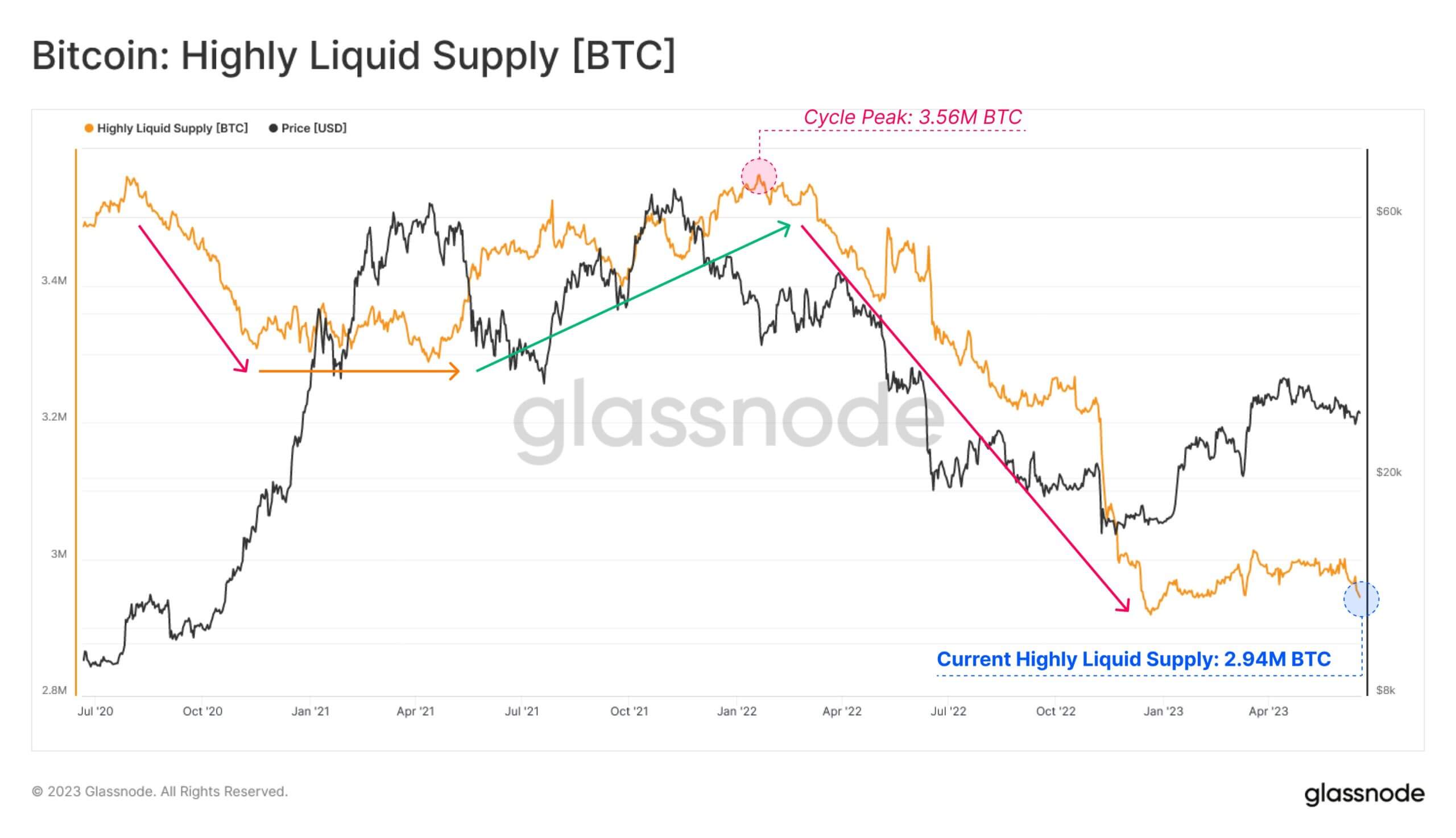

Quick Take ‘Illiquid supply’ refers to the amount of Bitcoin held by entities and is not readily available for trading or selling. Glassnode analysis identified the highly liquid supply in a noticeable downward trend. “Currently residing near a cycle low of 2.94M BTC, a -620K BTC decrease since Jan 2022”. Glassnode further said, “This suggests a significant contraction in the actively tradeable supply, resulting in both a decline in liquidity, as well as a constrained supply side.” To take the opposite side of this, more and more Bitcoin is becoming illiquid. 150k coins became illiquid in the past 30 days, similar to those seen after Luna’s collapse, marking a new year-to-date high. From a trend perspective, Bitcoin is becoming much less speculative and liquid. Highly Liquid Supply: (Source: Glassnode) Illiquid Supply Change: (Source: Glassnode)

The post Roughly 150K Bitcoin became illiquid in past 30 days appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Supply Shock (M1) на Currencies.ru

|

|