2020-10-9 15:19 |

Decentralized finance (DeFi) tokens, including Chainlink (LINK), Yearn.finance (YFI), and Aave (LEND) strongly recovered after a prolonged slump.

At its monthly low, YFI declined by nearly 64% in the past 11 days. Similarly, DeFi giants like Chainlink declined by 45% at the monthly low since mid-September.

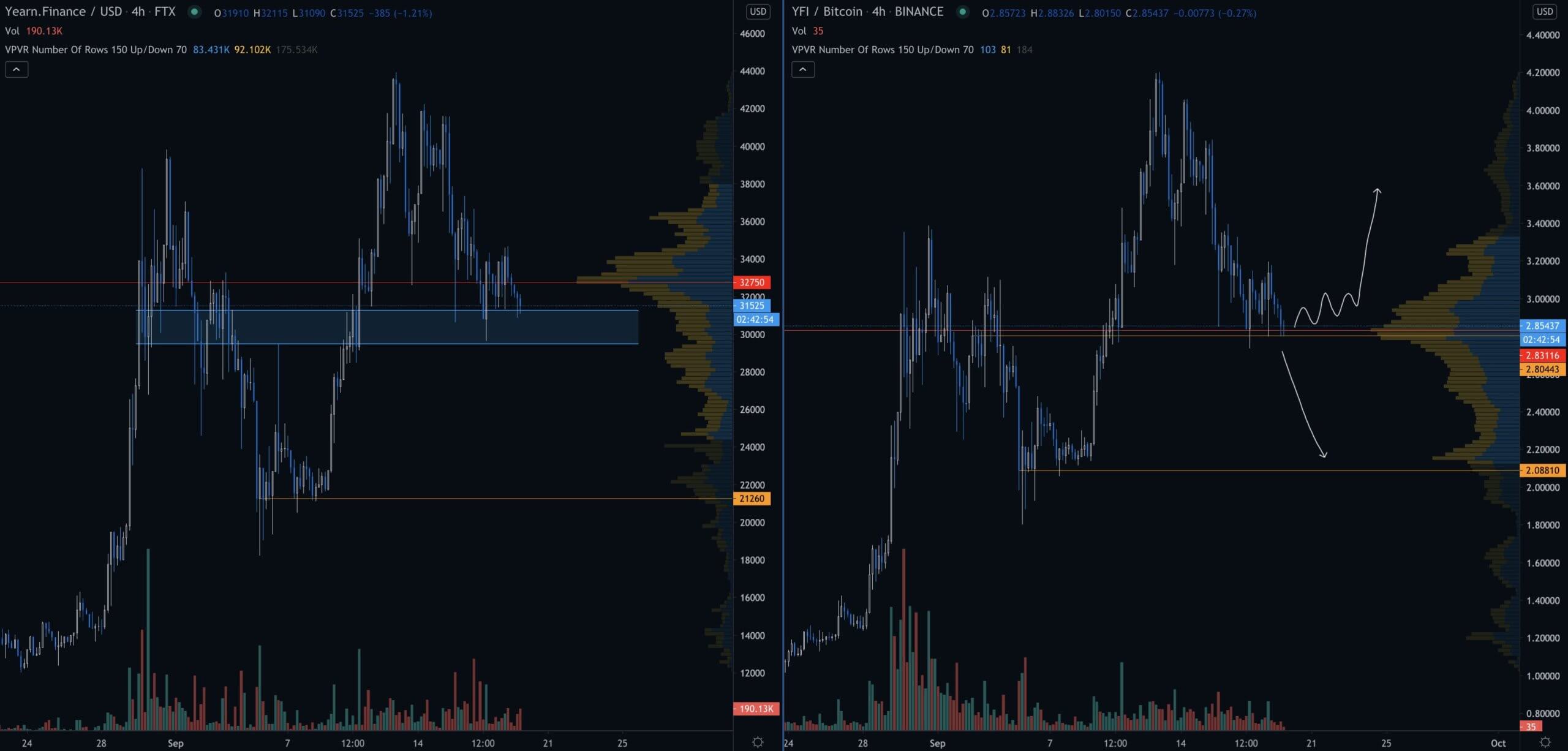

The 1-hour chart of Yearn.finance (YFI). Source: YFIUSD on TradingView.comBut following Bitcoin’s lead, Chainlink, YFI, and LEND are leading the DeFi market to a strong recovery.

Three major catalysts appear to be buoying the DeFi market in the last 72 hours. The factors are BTC’s rebound, the oversold DeFi market, and strengthening DeFi fundamentals.

Chainlink and YFI Oversold But Fundamentals Remain StrongWithin the past two weeks, Chainlink and YFI dropped by 40% to 64% against the U.S. dollar. But compared to their steep decline in value, their fundamentals have not declined substantially.

According to stats.finance, a website showing the total value locked in Yearn.finance, the protocol’s TVL is $902 million.

The total value locked across Yearn.finance (YFI) products. Source: Stats.FinanceThe data shows that nearly $1 billion worth of capital has been deployed to Yearn.finance’s products, particularly its vaults.

The capital deployed across Yearn.finance’s products has not significantly dropped, but the price of YFI declined by 64%.

Most of the weakness of YFI likely came from whales or high-net-worth individual investors shorting the cryptocurrency due to overall market uncertainty.

Many DeFi tokens rely on the strength of Ethereum during both bear and bull cycles. Hence, when the ETH price declined, it rattled the DeFi market.

Since then, YFI and other DeFi-related tokens, like Chainlink have rebounded sharply from their monthly lows.

Chainlink, in particular, has portrayed a favorable technical structure in the past two days. The daily candle of Chainlink opened on October 9 above the 20-day moving average. In technical analysis, traders often rely on the 20-day MA as crucial short-term support or resistance level.

Considering that Chainlink remains down by 23.5% since September 13, some traders believe it is oversold.

The 1-hour price chart of Chainlink. Source: LINKUSD on TradingView.com Bitcoin and Ethereum Rebounding, Providing DeFi Market a LifelineDespite the oversold nature of the DeFi market, Bitcoin and Ethereum’s struggle to rebound in early October caused DeFi tokens to further slump.

But subsequent to Bitcoin’s rally above $11,000, the sentiment around DeFi-related cryptocurrencies has become significantly optimistic.

Kevin Svenson, a chartist at the Kraken-acquired Cryptowat.ch, emphasized Chainlink has a “potential bullish setup.” He said:

“Even though I’ve been more neutral recently, things (so far) seem more bullish then I expected. S&P Futures breaking out right now #Bitcoin getting above resistance $ETH breakout soon? $LINK potential bullish setup. If Global Market keep moving up it will get bullish again.”

The chartist noted that the only lacking element is the continuous upsurge of the global market and equities.

Similar to Notcoin - Blum - Airdrops In 2024

yearn.finance (YFI) на Currencies.ru

|

|