2023-1-31 23:06 |

Data analyzed by CryptoSlate suggests the strong correlation between Bitcoin and gold could mark the start of a price run-up, depending on whether the Fed’s hiking schedule is done by March.

The Federal Open Market Committee (FOMC) meeting is set to conclude on Feb. 1, with the market overwhelmingly expecting a 25 basis point hike, which will take the federal funds rate to 4.5% – 4.75%.

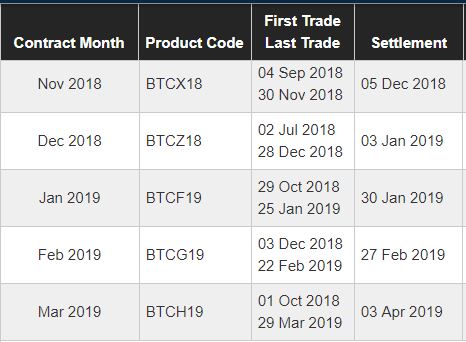

Source: cmegroup.comThe subsequent FOMC meeting is scheduled to conclude on March 22, with analysts majority betting on another 25 bps hike. From there, it is expected the Fed will hold rates marking the top of the hiking schedule.

Bitcoin and FOMC meetingsExamining the Bitcoin price percentage change for each 2022 FOMC meeting the day before the event, during, and after, 13 of the 24 instances resulted in a drawdown for the leading cryptocurrency.

When the Fed first began raising rates, a negative Bitcoin performance could be explained by sell pressure resulting from fearful markets. However, over the year, as the market accepted the inevitability of higher interest rates, a less negative reaction is expected.

Source: CryptoSlate.com Source: CryptoSlate.comOf greater significance than daily price movements is the long-term movement in relation to the Fed’s rate schedule.

Strong BTC-gold correlationPlotting the performance of the S&P and gold, since 1998, against the federal funds rate, it was noted the top of the Fed’s hiking schedule coincided with a bottoming in the gold price, as denoted by the black arrows on the chart.

In these cases, the price of gold went on to move significantly higher. For example, in late 2005 as it went from $400/oz to $1,920/oz over a six and half year period.

Similarly, pauses in the interest rate schedule coincided with the S&P bottoming, shown by the red arrows below, leading to sustained moves higher for tech stocks.

Source: TradingView.comSince February 2022, the price of Bitcoin and gold has shown an 83% correlation – the highest rate in over a year.

If gold reacts as it did in past instances of the Fed hiking schedule topping out, and Bitcoin mimics gold, BTC could be in for a significant jump in price.

Source: TradingView.comHowever, there is no certainty that March will mark the top of the Fed’s rate schedule. In addition, other macroeconomic and geopolitical factors are in play, as is the developing situation at Genesis following its bankruptcy filing.

The post Research: Bitcoin price expected to jump on hopes FOMC rate schedule tops out appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|