2019-2-19 05:41 |

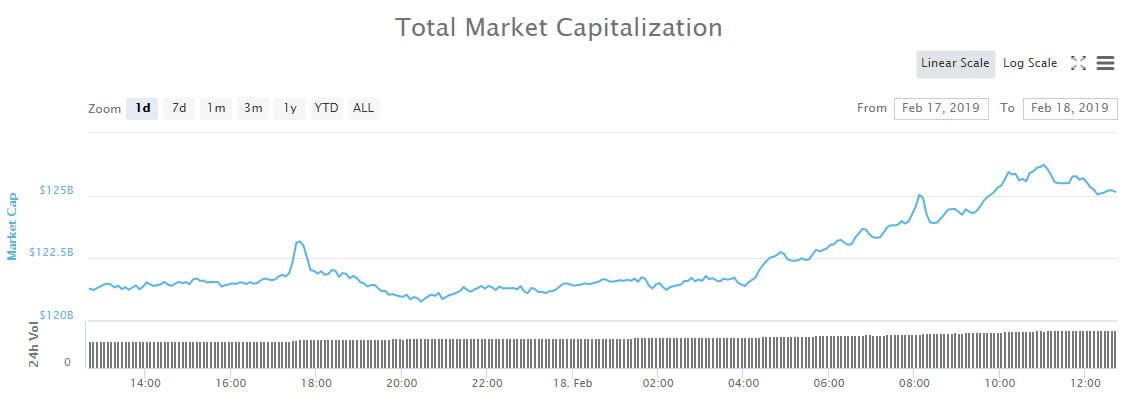

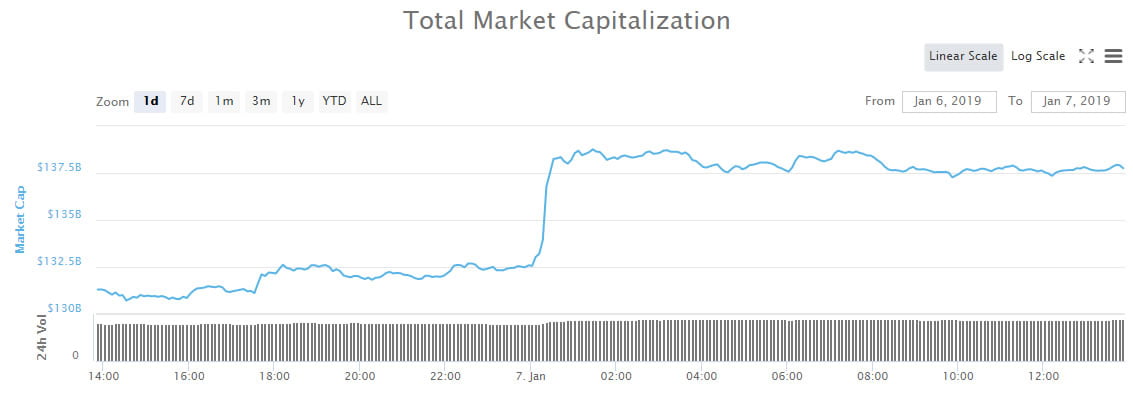

It looks like this week is off to a good start with the cryptocurrency market after a $5 billion rally. Bitcoin and many altcoins are reporting gains on their value, but the one with the biggest growth appears to be Ethereum, which had increased by 12% by this morning.

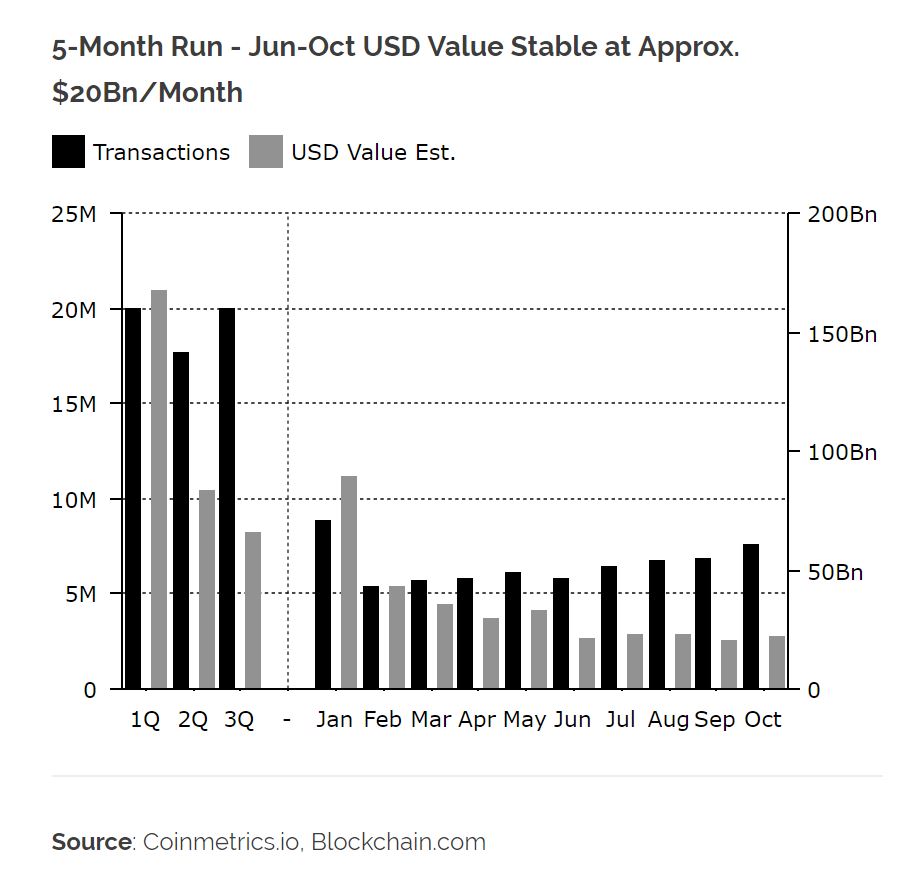

As of this morning, and still now, Ethereum seems to have the best performance of anyone in the top 25 tokens. Right now, XRP is not getting the same positive experience, which has spaced out the gap between the two tokens to over $2 billion in market capitalization. Even the daily trade volume has nearly doubled, going from $2.8 billion to $4.7 billion. Compared with Ethereum’s lowest low in 2019 so far ($103), this new value is 34% higher.

Right now, the momentum behind Ethereum is probably the Constantinople hard fork that is rapidly approaching, bringing multiple network improvements along with it. Right now, the estimated date that the hard fork will happen is March 1st, assuming this pace keeps up. The hard fork will not be implemented until block 7,280,000 is validated. On that day, Constantinople will introduce multiple Ethereum Improvement Proposals (EIPs), and there will be the removal of one EIP that has a bug in it.

There has been plenty of people to say that the hard fork is more bearish for ETH than bullish, since the delay of the difficulty bomb will reduce the overall supply. However, the adjustment of the block reward gives miners a little extra time until Casper brings the Proof of Stake protocol.

Thomas Chippas, the head of ErisX, had filed a letter with the US Commodity Futures Trading Commission (CFTC) recently, showing the importance of Ethereum futures for the overall health of the market. ErisX is closely tied to some major companies in the fintech industry, like Nasdaq, ConsenSys, and TD Ameritrade.

The letter stated, “ErisX believes that the introduction of a regulated futures contract on Ether would have a positive impact on the growth and maturation of the market for Ether, as well as the Ethereum Network more broadly.”

Chippas also stated that CFTC has historically approved products from Bitcoin, and Ethereum has some of the same infrastructure as Bitcoin. The letter further discusses the many benefits of Ethereum, and the way that an Ethereum-based investment product would “promote responsible innovation and development in the derivatives market.”

Presently, Ethereum is trading at $146.89, reporting 14.4% in gains in the last 24 hours. Considering the 12% increase reflected this morning, it is clear that the upward trend is still going. To see where the token is at by the end of the day, investors can check CoinMarketCap.com.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|