2019-8-15 23:50 |

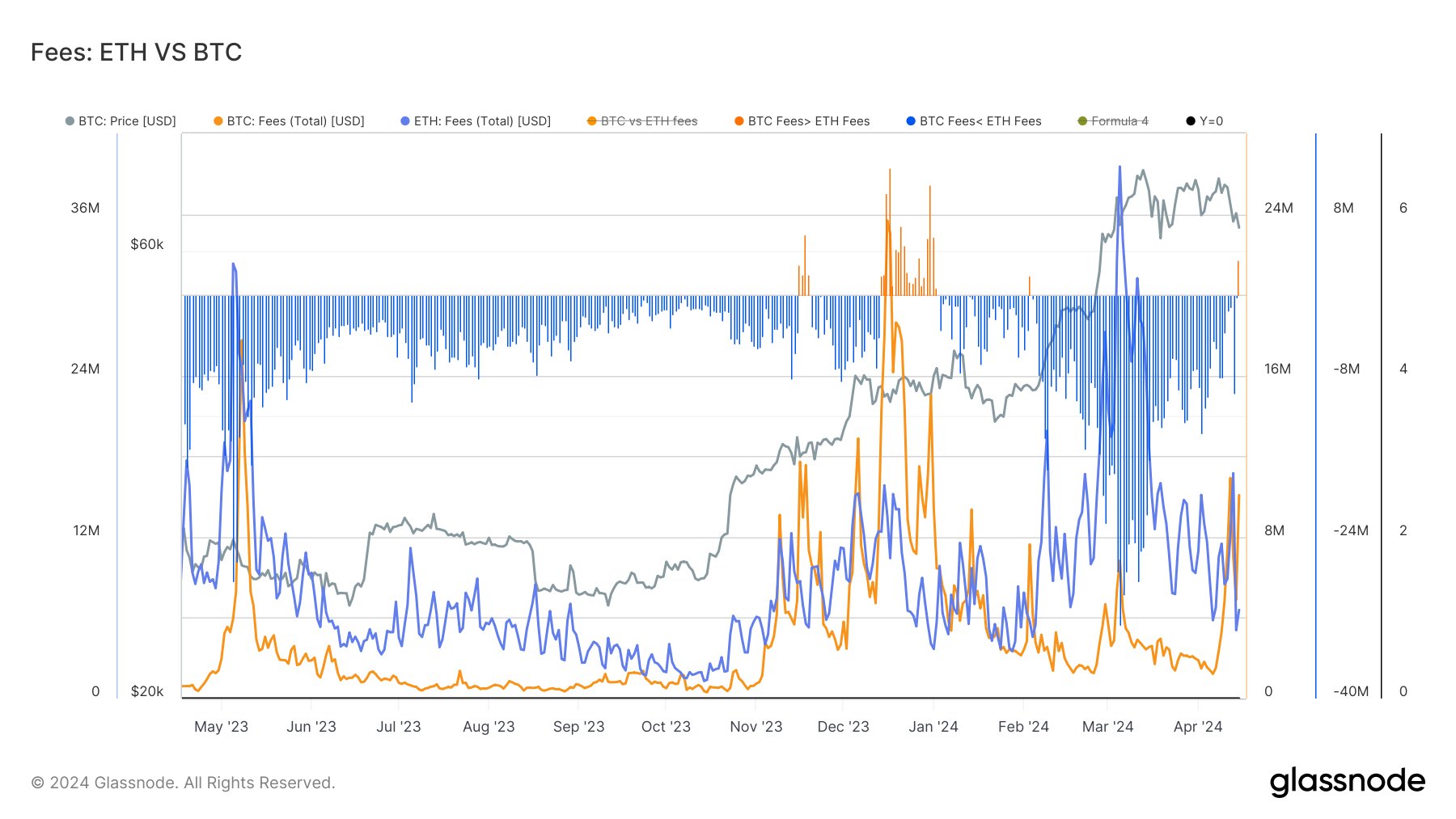

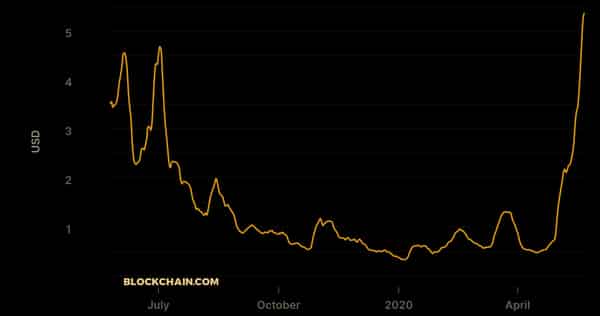

Bitcoin’s fees are on the rise. Between May and August, the average transaction cost has wavered between $2 and $6.

Most people don’t spend Bitcoin often enough to notice, but if you’re sending money home every week, those satoshis add up – especially since the average transaction cost less than $0.50 for most of early 2019.

Bitcoin transaction fees, via BitinfoCharts

Bitcoin’s average fees reached this year’s peak ($6.55) at the end of June. That was the highest level since June 2018, when transaction fees briefly brushed up against $6.85. Luckily, the days of $30 fees appear to be far behind, but Bitcoin transactions are still quite pricey.

Fortunately, there have been some cool-down periods to take the edge off. On Sunday, August 4th, the average Bitcoin transaction cost just $0.71. Furthermore, Bitcoin’s transaction fees have been relatively low on most other Sundays as well (these low points are marked in red below):

Bitcoin fees on Sundays, via BitinfoCharts

Transaction Volumes and Mempool Size

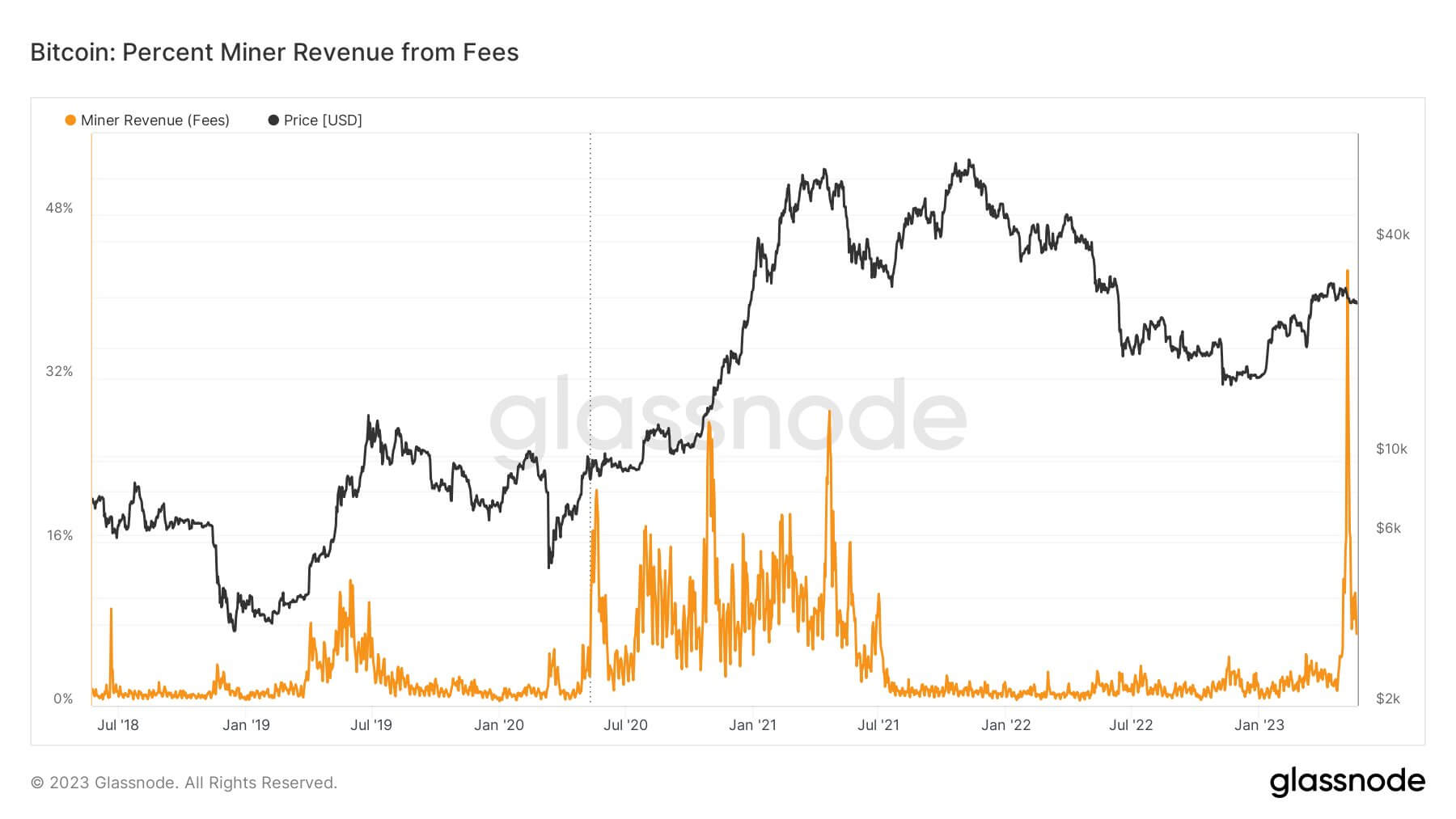

Those fees are largely due to rising transaction volumes. As traffic increases on the blockchain, users have to pay higher fees to prioritize their transactions. As shown below, Bitcoin’s daily transaction count has increased gradually but steadily over the past few months:

Bitcoin transactions per day, via Bitinfocharts

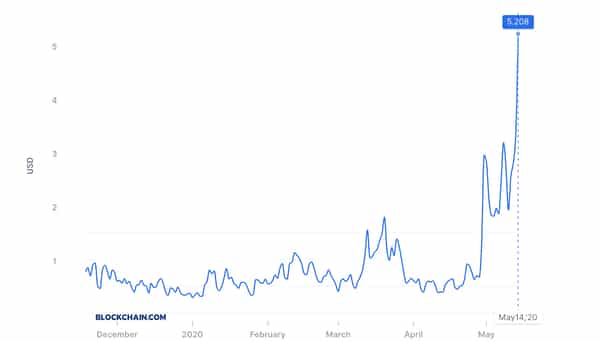

But this is just a long-term view. Some times of the day have lower transaction volumes than others. Bitcoin’s mempool usually contains a high number of pending transactions just before 12:00 UTC, as marked on the chart below. Avoiding transactions at that time may allow you to pay lower fees – although this is largely conjecture.

Bitcoin’s mempool size, via Blockchain.com Market Prices vs. Transaction Fees

Bitcoin’s transaction fees have been affected by market prices as well. For example, Bitcoin fees tripled between April and July. But the BTC price tripled during that time as well. So while the dollar value of transaction fees has increased, their satoshi prices appears to be largely unaffected.

Bitcoin prices vs. transaction fees (USD), via Bitinfocharts

This doesn’t mean that fees are lower when you measure them in U.S. dollars. It just means that, if you’ve been holding onto your Bitcoin for a few months, you might be spending roughly the same amount of BTC to send a transaction. But this too can change: in July, fees got lower even as prices stayed high.

How To Pay Lower FeesEven when Bitcoin’s fees are high, you usually have the option of paying less. Many Bitcoin wallets allow you to adjust your fee if you don’t mind waiting longer for your transaction to be confirmed.

You wouldn’t be the only one. According to BitcoinFees, there are still more than 26,000 transactions per day with a fee of only one or two satoshis per byte – although these transactions typically take over four hours to confirm. You can find ideal transaction fees on sites like BTC.com.

But exchanges and services often set their own fees, and they don’t allow individual users to choose how much they want to pay. Some marketplaces are adopting low-fee solutions like the Lightning Network and the Liquid Network. Their savings may trickle down to the rest of us – eventually.

But fussing about fees could be much ado about nothing: based on the month of July, Bitcoin’s transaction fees seem to be getting lower once again. If that’s still too expensive, you can always choose a cheaper coin: Ethereum, Bitcoin Cash, Litecoin and Monero all have much lower transaction fees.

The post Pinching Pennies? Send Bitcoin On Sunday Afternoons For Lower Fees appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|