2020-7-30 19:42 |

The recent precious metals rally reveals some startling revelations around physical safe-haven demand. Due to the effects of the COVID-19 pandemic, the U.S. Mint will be producing fewer gold and silver coins.

This is causing a substantial difference between the price of physical and paper commodities. Some suppliers are offering physical silver at a staggering 50% premium over the spot price. Have the markets priced this artificial shortage in yet? Or are we at the beginning of something bigger?

#Silver paper price $25 per oz

physical price $37 per oz (50% more)#Gold paper price $1,953 per oz

physical price $2,112 per oz (8% more) pic.twitter.com/O3GybiTihQ

— Gold, Silver, Geopolitics & Bitcoin (@Super_Crypto) July 28, 2020

The Coin ShortageAs BeInCrypto reported previously, the U.S. Mint will be operating at a lower capacity due to the COVID-19 virus. Due to strict health and safety measures, production will be impacted for the next 12 to 18 months.

According to a recent statement sent to Business Insider, the Mint explained:

“COVID-19 has resulted in the disruption of the supply channels of circulating coinage – the pennies, nickels, dimes, and quarters that the American people and businesses use in their day-to-day transactions.”

It added:

“We believe that this environment is going to continue to lead to some degree of reduced capacity as West Point struggles to balance employee safety against market demand.”

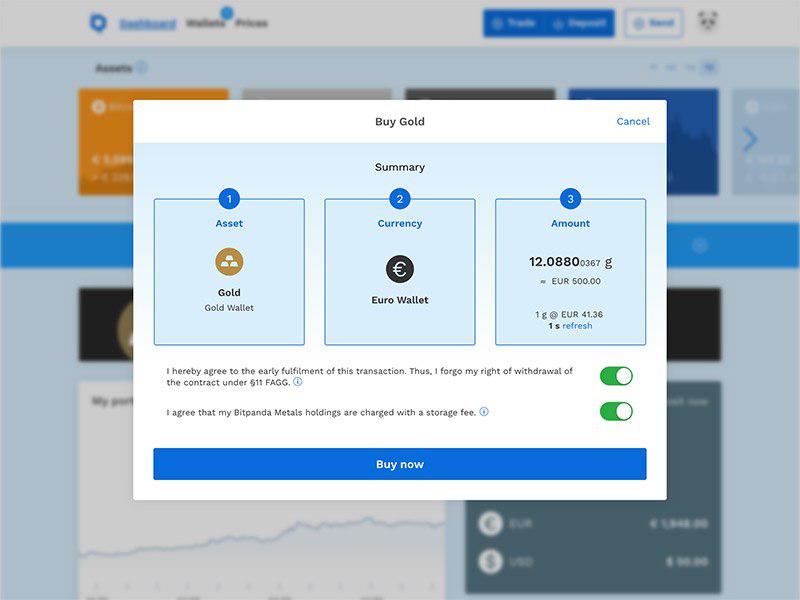

Fewer Nickels and Shiny CoinsThe Mint declared that it lacks the manpower to produce silver and gold coins at the same time. To at least guarantee some supply, the Mint is asking dealers to provide demand forecasts for between 10 and 90 day periods.

Physical silver coins trading above $37 an ounce. | Source: Apmex.The markets are already pricing in the foreseeable shortage of physical coins, and some dealers are selling Silver American Eagles above $37 an ounce.

For comparison, the spot price of silver, which is commonly accepted as the official price of the metal, is trading just above $24. That’s a 54% premium for the surging commodity.

How silver trades on “paper” – XAG/USD. | Source: Tradingview.Naturally, physical coins and bars will have some sort of premium associated with them.

After all, minters and dealers need to make a profit. Also, limited edition coins are sold at premium prices because many numismatic collectors value their rarity. However, at current levels, clearly, something else is going on.

Lessons From Silver and Other Precious MetalsThis is the first request from the Mint since its inception in 1792. The controversial measure will enable improved choice around what coins to mint, as some are more labor-intensive than others.

For instance, if the Mint decides to make one-tenth of an ounce of gold, it will have to cut the production of American Eagle Silver coins. This puts dealers and insiders in a very advantageous position. Having the supply artificially altered could cause sudden pumps and dumps in both silver and gold.

Precious metals hoarding could also occur, as dealers play with the calendar to get the most out of their sales. The consequences are already visible.

Notice the high number of silver products not in stock. | Source: BullionByPost.An old saying that works in both the precious metals and cryptocurrency world goes like this: ‘if you don’t hold it, you don’t own it.’

There’s a big difference between owning silver CFDs on a banking app and buying real-deal silver coins and bars. The current bull market in precious metals and the virus-induced reduction in supply are creating significant demand.

Sooner or later, the market will arbitrage the price differences. And when that happens, those holding the real stuff will likely be in a better position than those who own IOU’s.

The post Physical Silver Trades at a 54% Premium Over Paper Counterparts appeared first on BeInCrypto.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Silver (XAG) на Currencies.ru

|

|