2022-4-22 13:00 |

Blockchain technology started as a small, niche corner of the tech and finance world but has evolved into a massive phenomenon that drastically changed the way people think about assets, business, and more.

With more than 68,000,000 active blockchain wallets as of February 2021, it is clear that this innovative technology and the associated digital assets will only grow in size. To illustrate this further, worldwide spending on blockchain solutions is predicted to reach $11.7 billion in 2022.

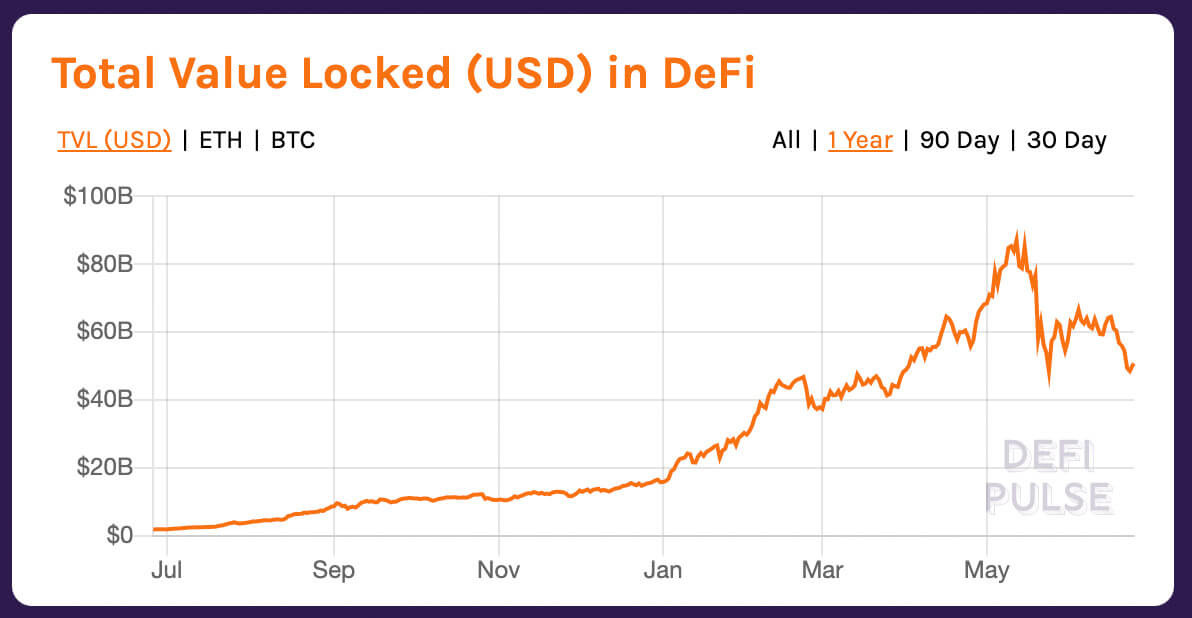

However, despite blockchain’s massive growth, many are still hesitant to adopt it. The digital asset and blockchain spaces need to incorporate tools found in traditional finance to make it to mass adoption’s coveted peak.

One of the most common tools found in finance is loans. Luckily, many digital asset projects have begun building infrastructures to ensure that the space can use these tools while benefiting from the decentralization at the core of blockchain technology.

PAXO Finance is a project taking decentralized loans to the next step. The protocol allows users to buy digital assets from multiple pools. The platform opens up borrowing and lending in the metaverse finance (MetaFi) space, allowing borrowers to take loans up to five times their equity. These loans also allow lenders to earn interest.

Investors require higher capital to earn substantial gains; however, more often than not, investors do not have the funds or have already invested at total capacity. With the ability to take loans up to five times their capital to invest, lenders’ ability to earn substantial returns increases significantly. This system opens up the door for anyone to profit from investing.

PAXO Finance’s Permissionless Investment Loan ProtocolPAXO Finance’s protocol allows users to purchase digital assets such as NFTs, game accessories, or metaverse land with around 80% borrowed capital.

Through the protocol, users can borrow and invest various digital assets, which are then locked in the protocol. From there, users can utilize their assets for staking, yield-farming and more.

One of PAXO’s more significant benefits is its interest rates, providing some of the most competitive pricing in the industry. With the cost-effective interest rates, lenders can earn sizable, long-term returns while also giving the borrower a predictable loan.

The risk management of the protocol tries a wall garden approach rather than the on-chain credit score route other digital asset loan platforms take. The testnet version has already been launched, tested, and appreciated by the PAXO community.

With the incorporation of blockchain, under-collateralized lending activities expand the reach of all lenders regardless of their size and background, allowing them to enter new markets and giving lenders the best potential capital efficiencies to exchange.

The platform’s features allow users to:

Make Long-Term Systematic Investments During a Dip – If an investor wants to buy one Ethereum during a dip, they can provide 20% capital and take an 80% loan to accumulate the coin. Also, they can start a payment plan and pay back the loan in three, six, or twelve months or create a custom time frame. Loans for Staking – Users can take out a loan and buy digital assets, which they can then use for staking and farming within the protocol. Buy in Metaverse – Users can buy land or game NFTs in the metaverse through the protocol. For example, if there is land for sale in a metaverse and the user doesn’t have enough capital, they can borrow it from PAXO and invest. PAXO Finance’s Current and Future EndeavoursThe protocol has already raised $1 million of funding from numerous sources. Funding came from multiple angel investors, Zebpay members Avinash Shekhar and Raj Kansara, Lemon Grass Fund, and Mithil Thakore from TeraSurge. Another investor, Rajat Gahlot, is from QuillHash Technologies, which also audited the project for security, codebase quality, and accuracy. The protocol is also currently being audited by another independent agency.

The next step for PAXO is to activate another 80 million wallets in the DeFi 2.0 ecosystem. Retail investors can access funds to participate in digital assets with little collateral through the platform. PAXO will also partner with other DeFi protocols for staking and farming with invested assets to expand its reach.

origin »Bitcoin price in Telegram @btc_price_every_hour

Wish Finance (WSH) на Currencies.ru

|

|