2023-8-20 21:28 |

Long-term holders are regarded as some of the most stable hands in the cryptocurrency market. These crypto holders are less likely to sell their holdings and more likely to continue accumulating. In the Bitcoin market, long-term holders appear to have the upper hand now.

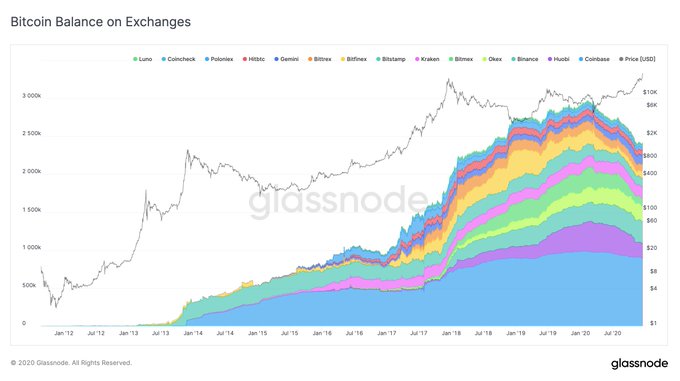

According to data from Glassnode, a leading on-chain analytics platform, most of the existing BTC tokens on the Bitcoin network have been scooped by long-term holders.

Glassnode’s data revealed that in 2023, long-term holders accumulated more Bitcoin than in previous years. At present, 75% of all available Bitcoins are now under the possession of long-term holders. The number of Bitcoins is estimated to sit at a staggering 15 million.

It is worth noting that the accumulation has been building up since 2010. While the data depicts an occasional fluctuation in these holdings, these long-term holders never sold a significant portion of their assets over the last 14 years.

These metrics reflect positively on Bitcoin, strengthening the narrative that adoption amongst key figures has not slowed, despite the constant chaos recorded in the cryptocurrency market.

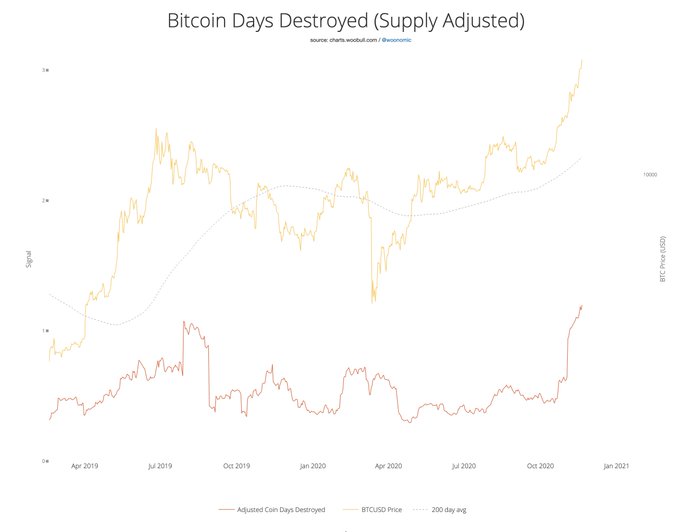

It also adds to another bullish trend that suggests that the more long-term holders accumulate, the fewer traders hold. With the former being less likely to sell and the latter looking to attain short-term profits, volatility is expected to reduce significantly as more long-term holders take over.

It appears that volatility in the market is already reducing at a notable speed. Glassnode’s most recent on-chain newsletter disclosed that volatility is already at an all-time low and that Bitcoin seems to be in a “bear hangover”, admitting the upsurge in long-term holdings.

“Volatility in the digital asset space remains historically low, with investors reaching an all-time low in willingness to spend coins on-chain. The conditions of the Bitcoin market continue to resemble the bear market hangover seen in prior cycles, with an outsized wealth held by long-term high conviction holders.” The newsletter reads.

However, low volatility also comes with its downsides, Glassnode asserts. As volatility reduces, apathy and exhaustion surges amongst market participants. In the long run, a relatively weak influx of demand might follow.

Additionally, Bitcoin’s Realized Cap is slowly moving upwards, suggesting that a sideways market might remain ahead. At the time of this report, Bitcoin is trading for $26,132 as hourly losses continue to surge.

Similar to Notcoin - Blum - Airdrops In 2024

Market.space (MASP) на Currencies.ru

|

|