2023-11-9 18:10 |

ORDI token was one of the top-performers on Wednesday as investors cheered the jump in Ordinals NFT sales. The token surged to a high of $14.65, the highest level since May this year. At its peak, Ordinals token was up by over 403% from the lowest level in September.

ORDI, the native token for Ordinals, is the best-performing token this week. This surge has pushed its total market cap to over $270 million. Its daily trading volume in the past 24 hours rose to over $569 million.

There are three reasons why ORDI is surging. First, in a statement, Binance said that it will list the token. This is a major event since Binance is the biggest crypto exchange in the world. Data by CoinMarketCap shows that most of ORDI’s volume came from Binance followed by OKX and Bitget.

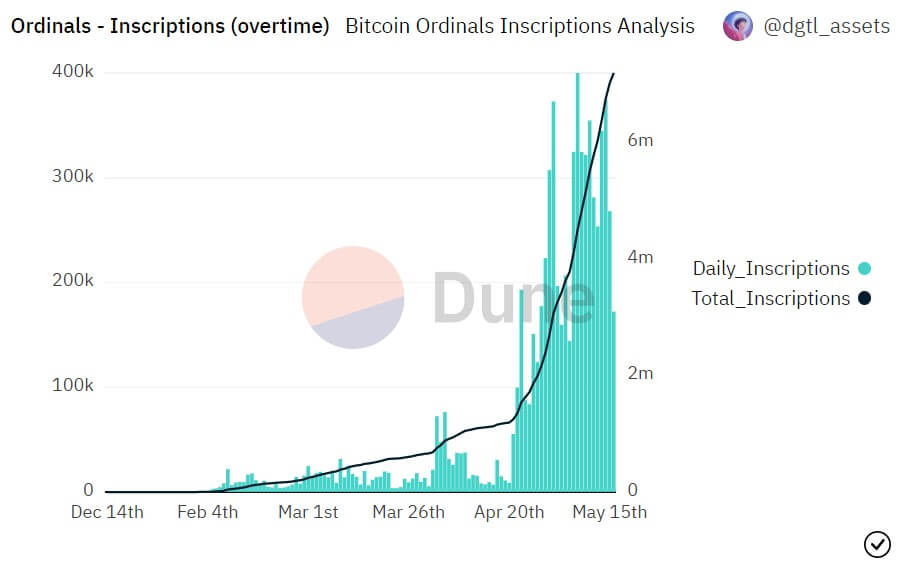

The other reason why ORDI token jumped is that the total volume of Ordinals NFTs jumped sharply. Data by CryptoSlam shows that Bitcoin’s NFTs jumped by over 19.9% in the past 24 hours to over $17.7 million. This increase was higher than that of Ethereum, which handled NFTs worth over $17 million.

Ethereum NFTs have been losing traction in the past few months, which has pushed their floor prices to a record low. As a result, companies in the space, including OpenSea have announced substantial layoffs.

Meanwhile, ORDI’s open interest inn the futures market jumped. According to CoinGlass, this open interest rose to an all-time high of over $79 million. Most of these assets were in Binance followed by OKX and Bitget.

Open interest is an important figure in the crypto industry that shows the volume of unfilled orders in the futures market. A higher open interest is a sign that demand is in an uptrend.

Another important metric was liquidations. Shorts liquidations jumped to a record high on Tuesday as the token started plunging.

The post ORDI price surges as futures open, Bitcoin Ordinals volume spikes appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Waves Community Token (WCT) на Currencies.ru

|

|