2024-3-20 19:21 |

Bitcoin halving, arguably one of the most significant events in the cryptocurrency world, is just a month away.

It occurs approximately every four years—or after every 210,000 blocks—are added to the blockchain.

What is Bitcoin halving?The Bitcoin halving is a fundamental mechanism designed to reduce the rewards for mining new blocks by half, thereby gradually decreasing the number of new bitcoins entering circulation. This process is crucial for maintaining Bitcoin’s value over time by enforcing scarcity, akin to precious metals like gold.

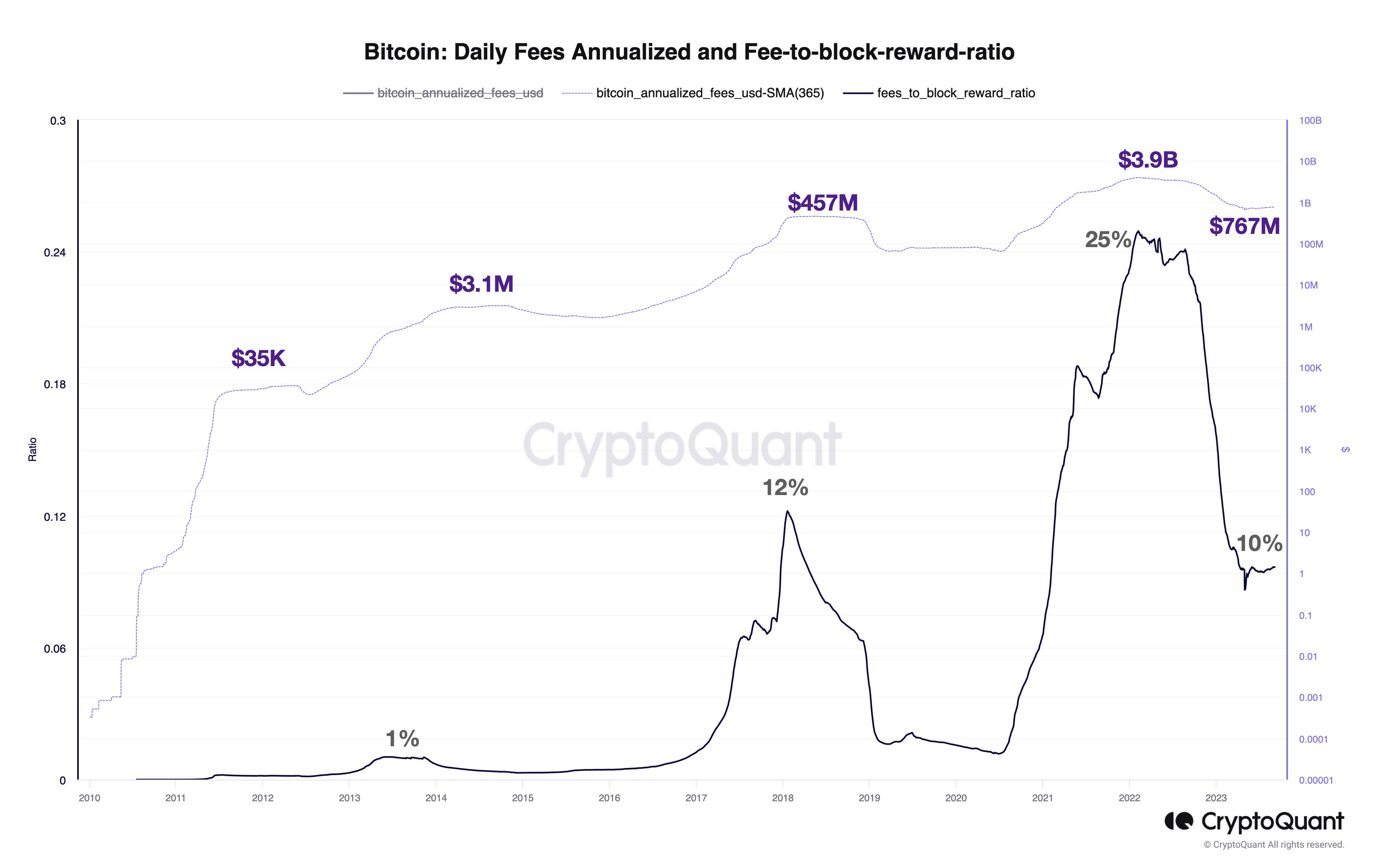

Historical context and projectionsSince Bitcoin’s inception, there have been several halving events, with the first occurring in November 2012 and the most recent ones in July 2016 and May 2020.

The next halving is expected in mid-April 2024, which will reduce mining rewards to 3.125 BTC per block.

This event is not just a technical adjustment but has profound implications for Bitcoin’s supply and, by extension, its price and the broader cryptocurrency ecosystem, including decentralized finance (DeFi).

The impact on DeFiDeFi, which aims to democratize finance by using blockchain to create open and trustless financial systems, is significantly influenced by Bitcoin’s market dynamics.

Given Bitcoin’s role as the linchpin of the crypto market, a halving event can lead to increased scarcity and potentially higher prices, benefiting the DeFi sector by attracting more investment and fostering growth.

Price fluctuations and decentralizationHistorically, halving events have been followed by periods of price appreciation for Bitcoin, influencing the entire crypto market.

This pattern underscores Bitcoin’s scarcity-driven value proposition and serves as a test of the resilience of decentralized financial systems against market fluctuations.

Abhishek Singh, co-founder and chief metaverse officer of AcknoLedger, says,

Predicting Bitcoin’s price trajectory with certainty is challenging, given the inherent unpredictability of cryptocurrency markets. However, based on historical trends, we can expect heightened market activity and the potential for both price appreciation and volatility surrounding the 2024 halving. Investors should remain vigilant and consider the long-term fundamentals of Bitcoin when navigating market fluctuations post-halving.

Mainstream attention and innovationEach halving cycle brings Bitcoin into the limelight, drawing attention from investors, regulators, and innovators.

This increased focus can spur the development of new DeFi solutions and adaptations to regulatory changes, further integrating cryptocurrency into mainstream financial systems.

The upcoming 2024 halving is particularly noteworthy, as Bitcoin reached an all-time high in its run-up, breaking the traditional post-halving price rally pattern.

This has led to speculation about new market dynamics and the extreme shortage of Bitcoin.

Anuj Chaudhary, Crypto Analyst & Blockchain Consultant, says,

BlackRock and other Bitcoin Exchange Traded Funds (ETFs) are buying heavily for their clients. Meanwhile, Bitcoin miners have not even been matching the current demand. Meanwhile, approximately 96% of Bitcoins have already been mined. Consequently, spot ETFs set to spur Bitcoin shortage. We call it “supply shock”. Bitcoin Industry diamond hand and MicroStrategy owner, Michael Saylor, has recently pointed out there is insufficient supply in the market and he will be buying forever. MicroStrategy has also raised $800M to buy more Bitcoin. Hence, Bitcoin has surged to a brand new all-time high of $72,000.

While the Bitcoin halving is not a panacea for market success, it remains a pivotal event in the cryptocurrency timeline, influencing supply, price, and the strategic direction of the DeFi sector.

As we approach the 2024 halving, the crypto community watches closely, anticipating the next chapter in Bitcoin’s history.

The post One month to go for Bitcoin halving: A deep dive into what to expect? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Miner One token (MIO) на Currencies.ru

|

|