2020-12-30 15:18 |

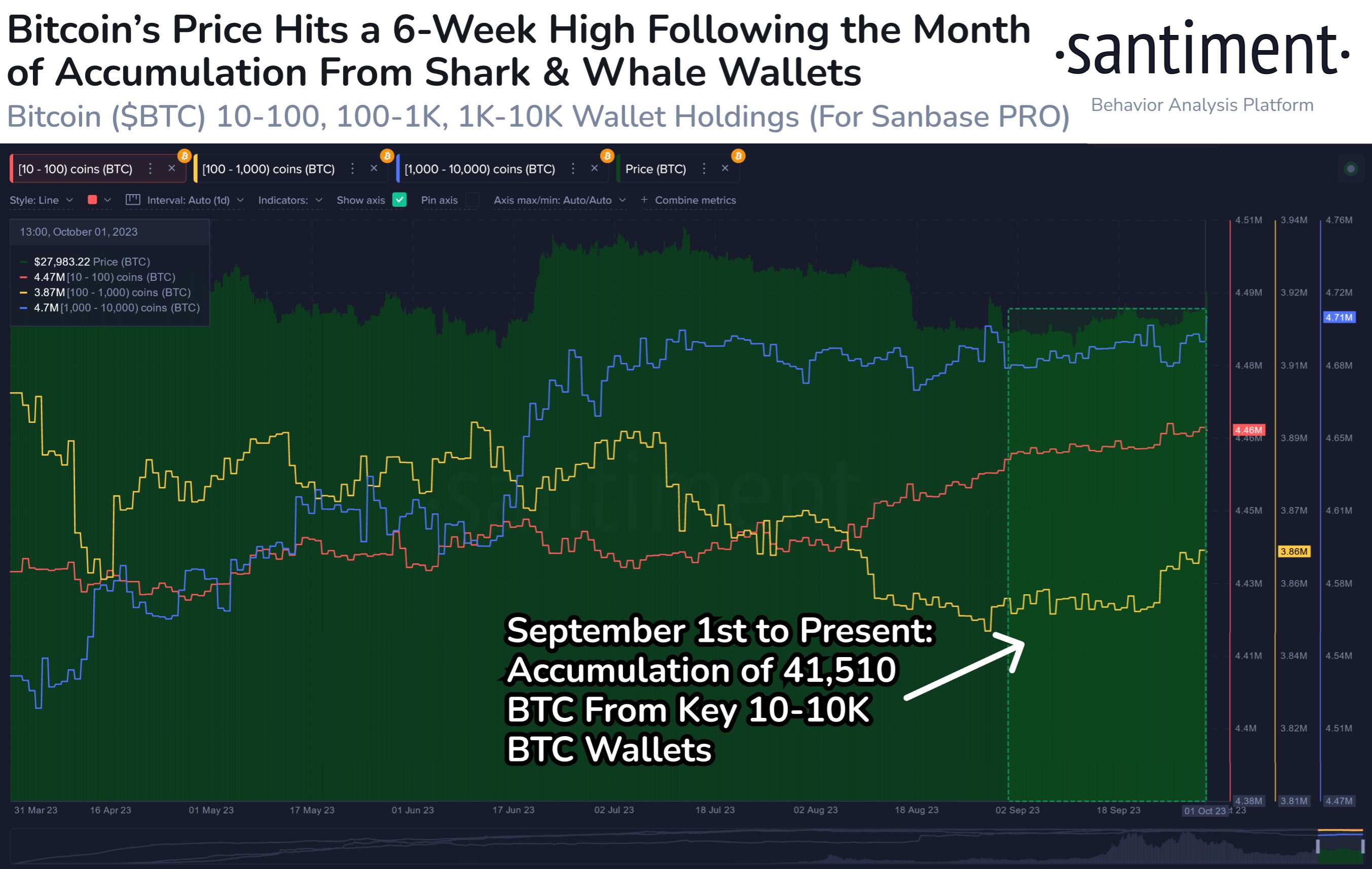

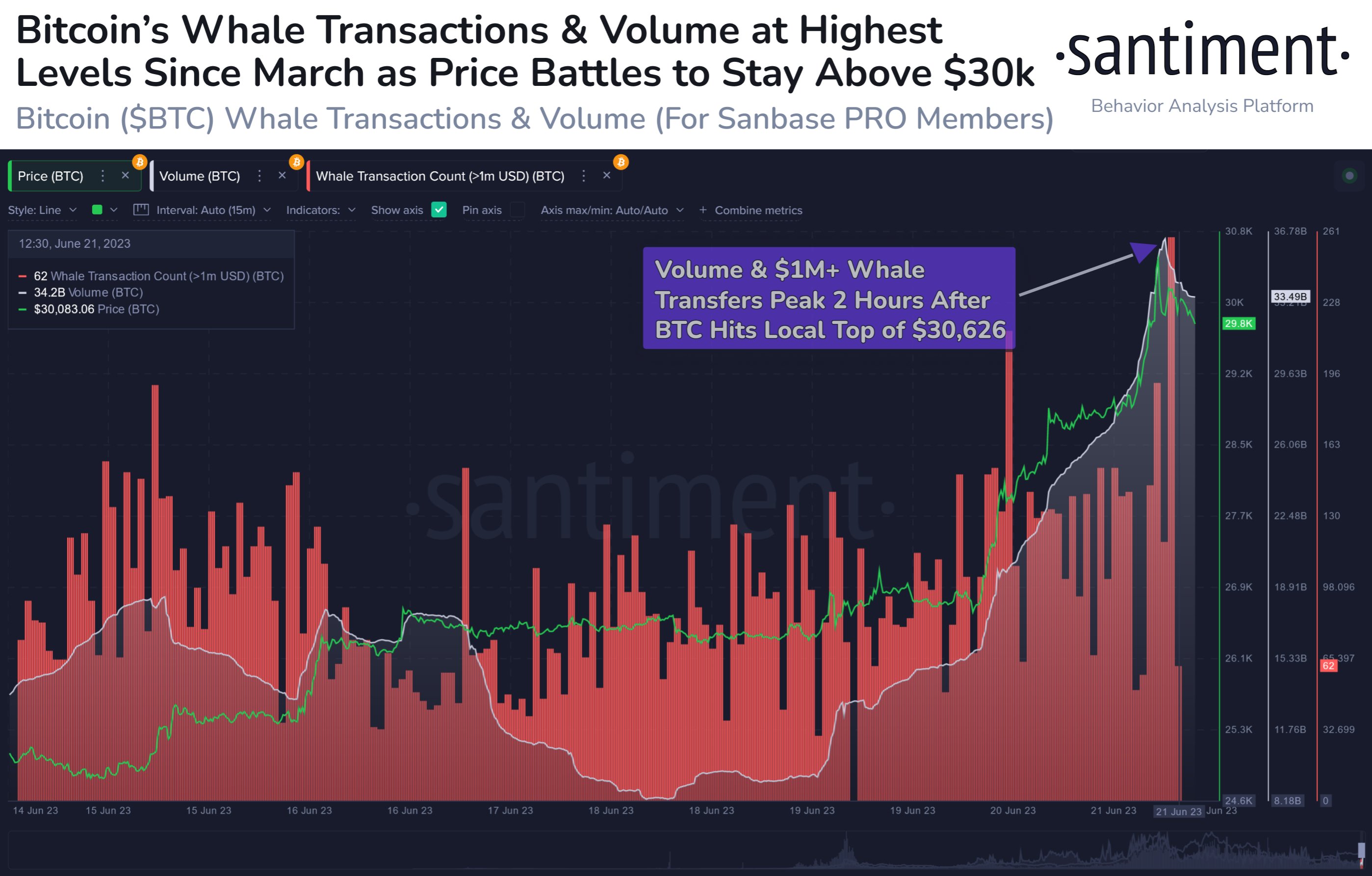

The data showed that high-net worth investors have purchased more and more bitcoin in the last four days

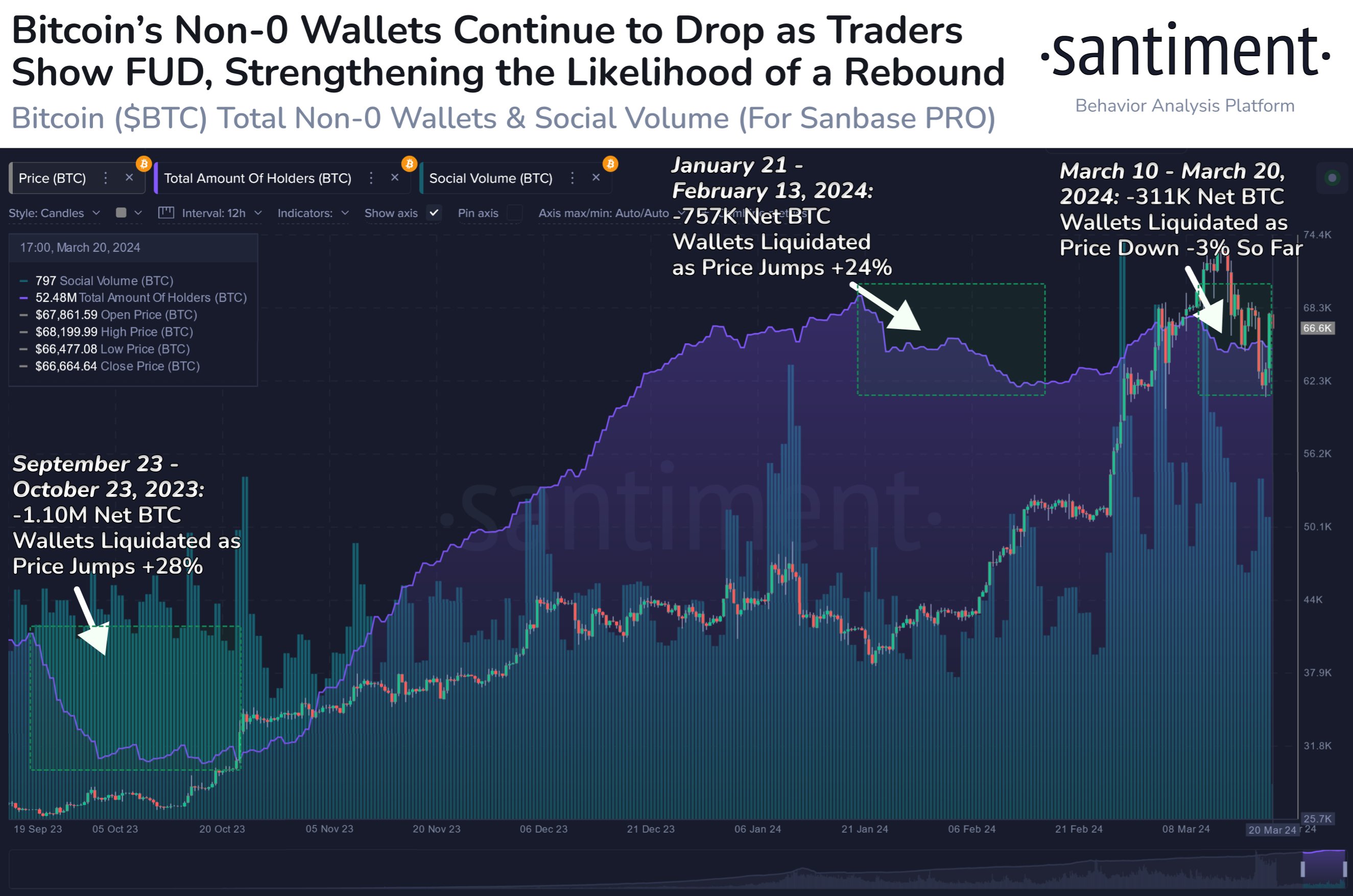

Trading activity on the Bitcoin blockchain has been volatile since Christmas and whales could be the reason. Whales have had a hand in eating up the supply of Bitcoin by buying the crypto asset aggressively according to on-chain data.

In the last few months, the crypto sector has seen a surge in the number of high-profile names mostly from the finance industry making an entry into the Bitcoin market. This uptick, as it appears, is not about to wane anytime soon. The data outlines an outpouring of wealthy investors into the market. However, there is an important point to note. It is difficult to tell apart individual investors from institutional investors through on-chain data.

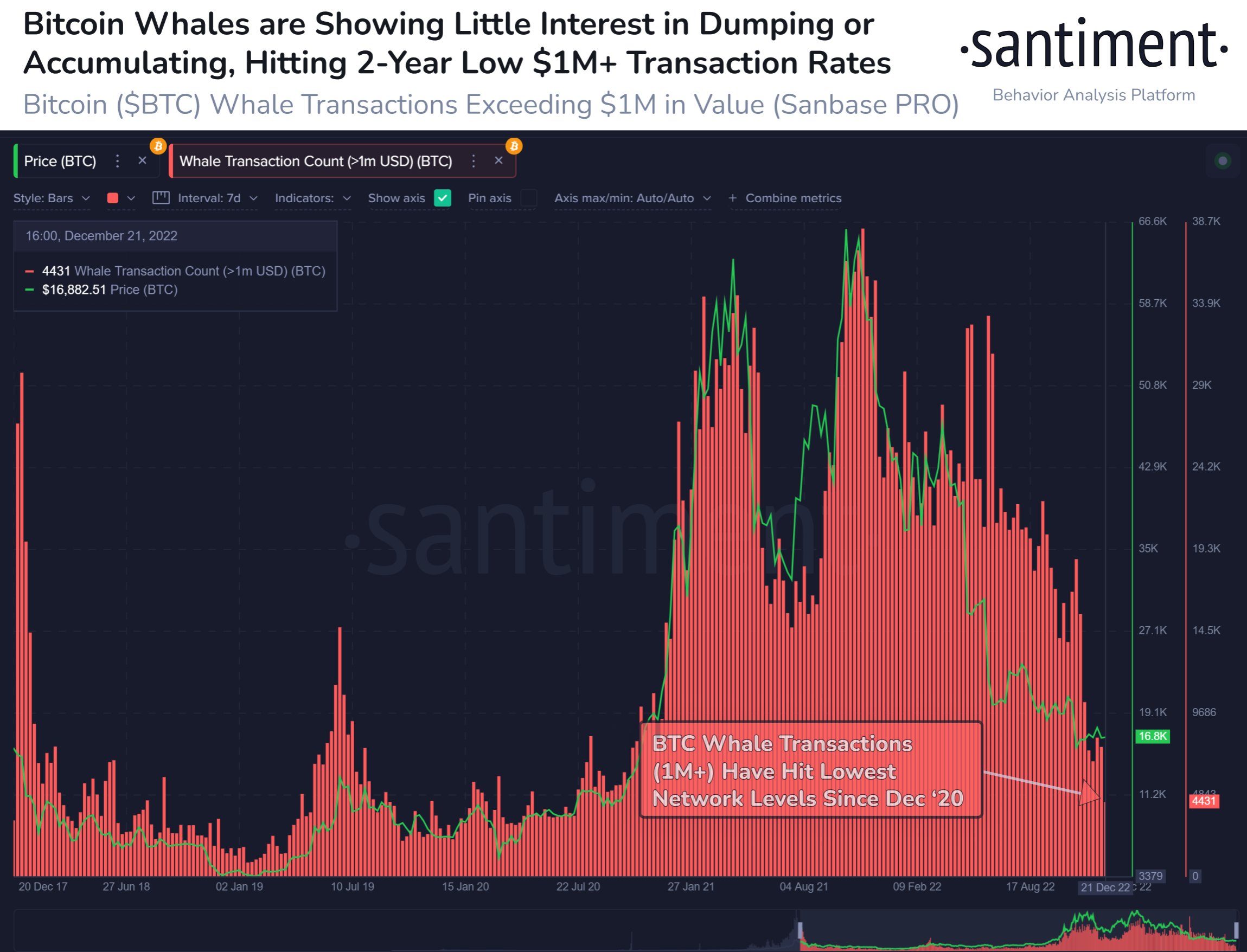

Addresses with over 1,000 BTC (translating to $26.5 million at the current price of $26,500) are widely regarded as whales. Santiment analysts believe that over $645 million worth of bitcoin has been moved to large addresses.

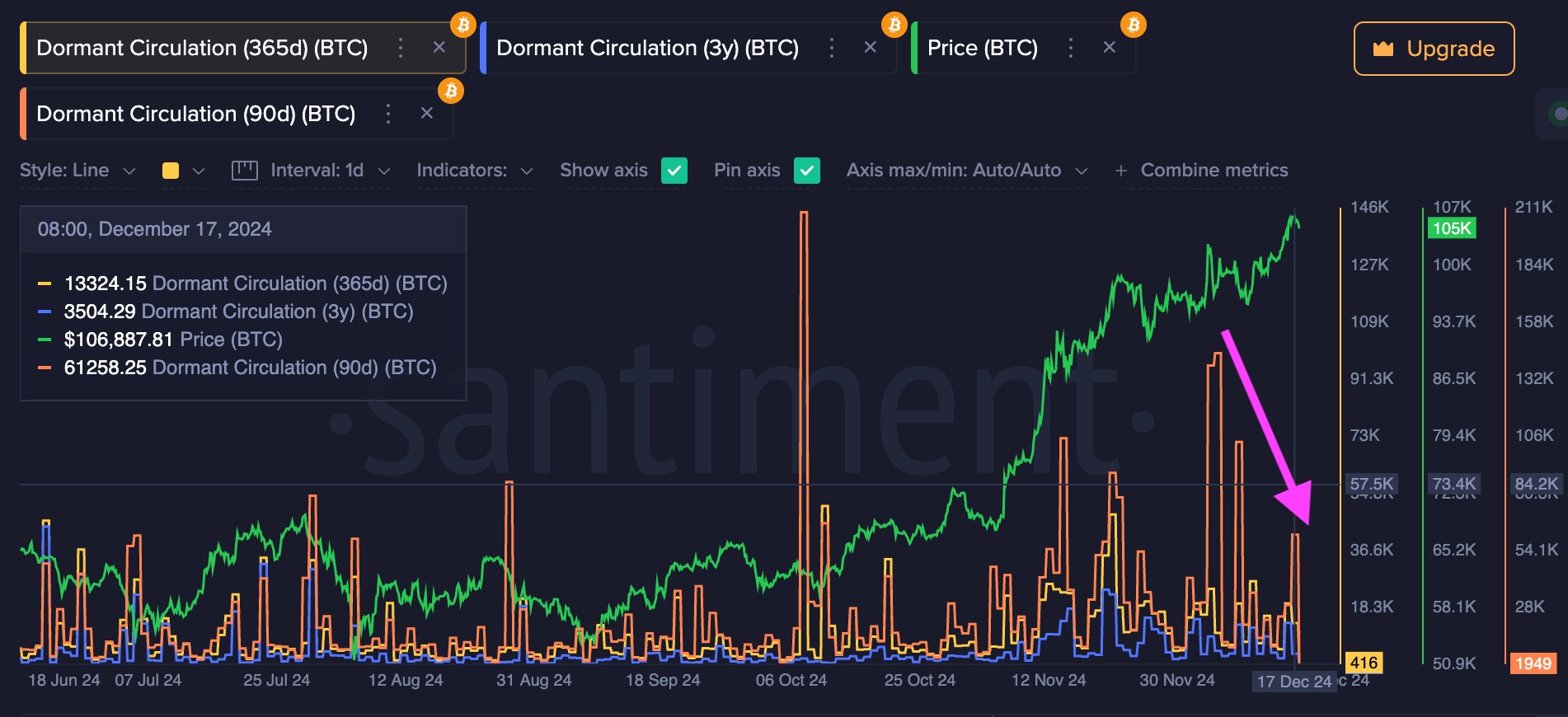

The on-chain data provider Santiment posted on Twitter, “Over the last 48 hours since Christmas, #Bitcoin addresses with 1,000 or more $BTC now own 0.13% more of the supply that smaller addresses did previously. This is about 24,158 tokens, which translates to $647.7M at the time of this writing.”

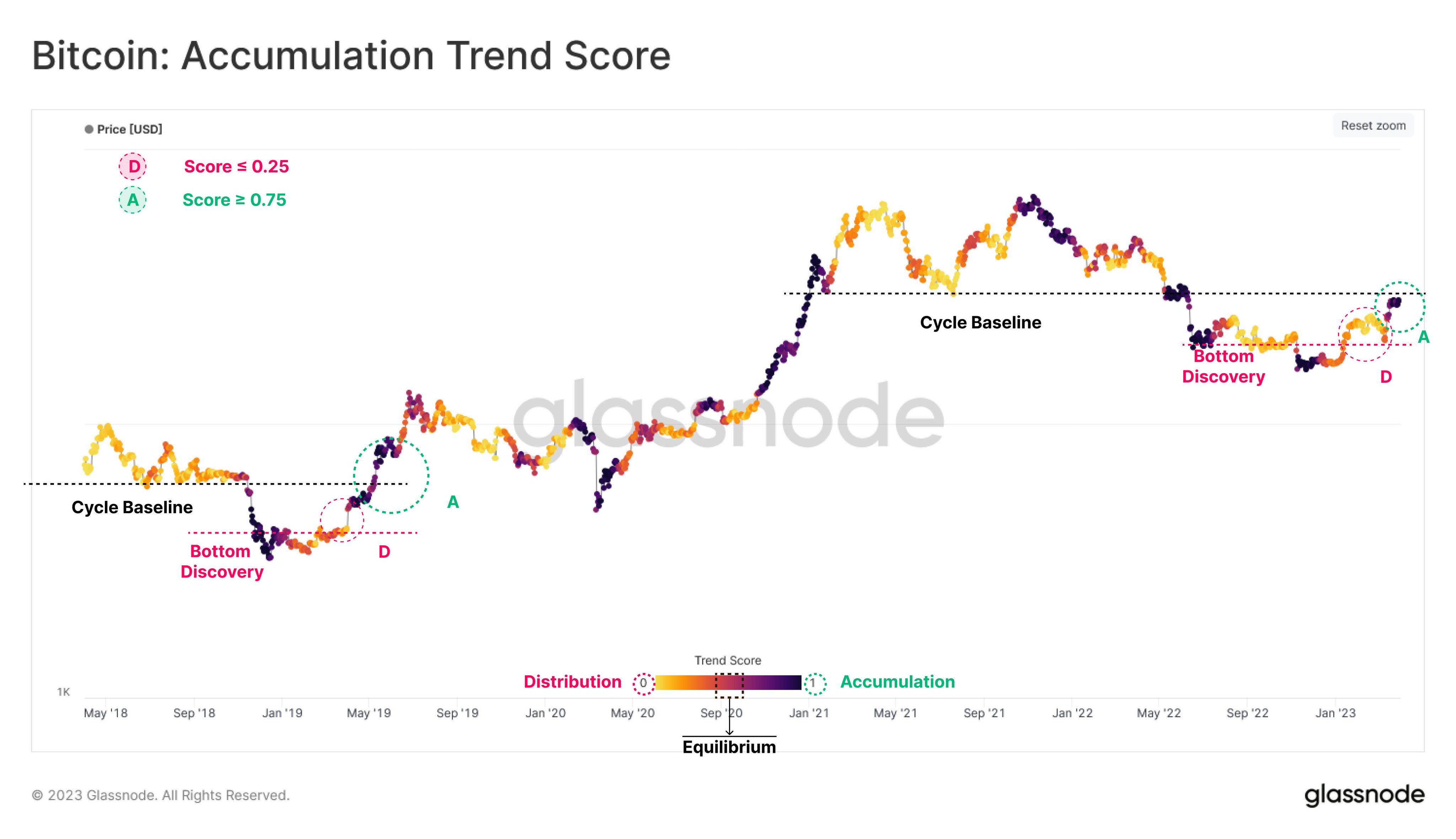

Interestingly, many high-net worth investors are holding onto their assets despite Bitcoin’s current rally. Only a small number of whales have sold their assets according to on-chain data points.

CryptoQuant’s chief executive Young Ju explains, “BTC whales seem exhausted to sell. Fewer whales are depositing to exchanges. I think this bull-run will continue as institutional investors keep buying and Exchange Whale Ratio keeps below 85%.”

Analysts attribute this to two major reasons. One, whales likely believe that the digital asset will go beyond $30,000 and even aim to0 reach $36,000 hence the accumulation. Two, the whales don’t foresee a major correction happening any time soon.

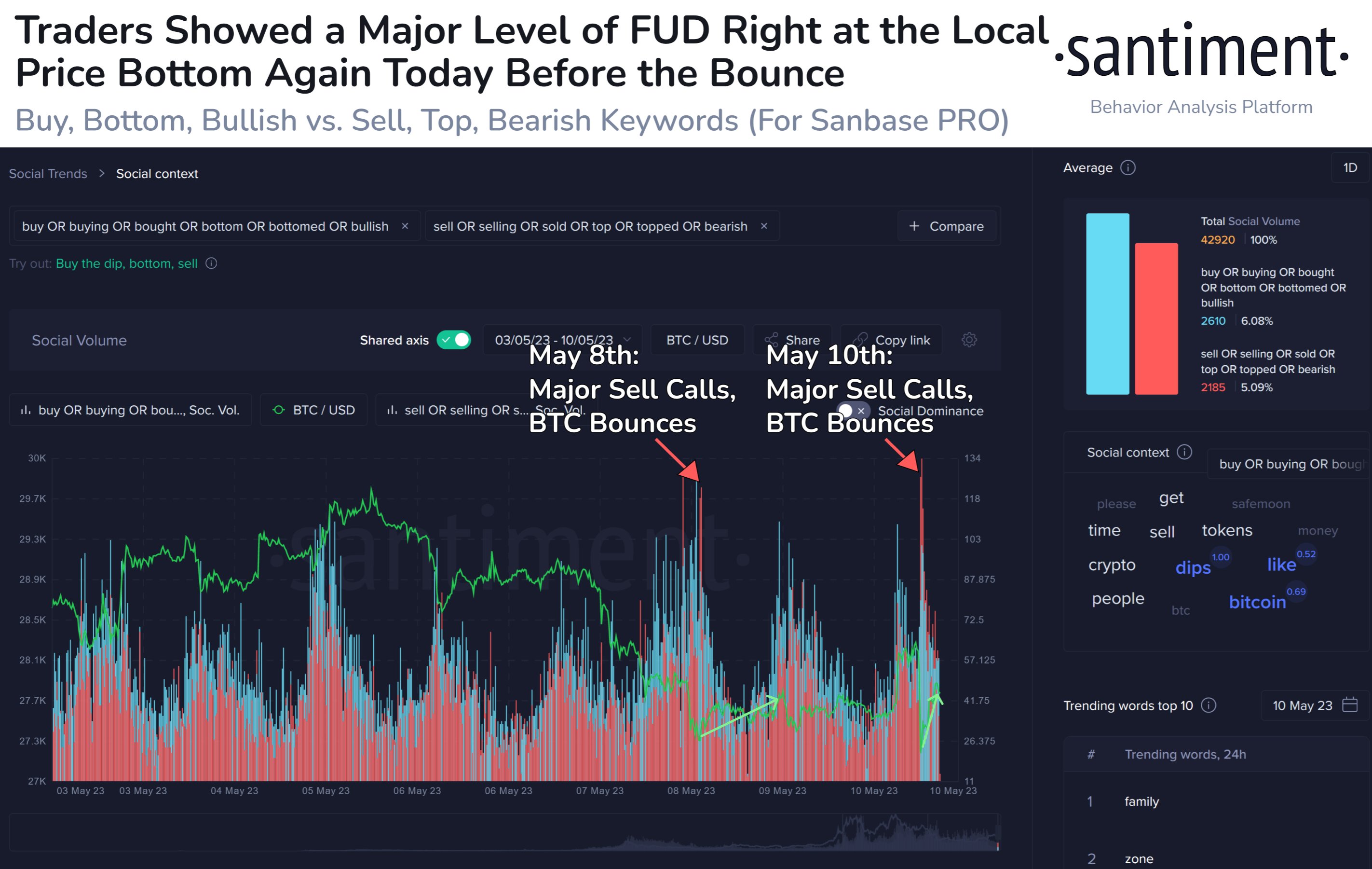

Twitter user ‘Byzantine General’ wrote on the social platform that the market was showing inconsistent and clashing signals. He went on to explain that short and long squeezes were both possibilities as short and long investors were being aggressive.

The post On-chain data reveals whales are accruing even more bitcoin appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|