2023-6-17 17:50 |

Documents provided to the New York Attorney General’s office as part of Tether’s settlement in 2021 reveal that the company held Chinese securities in the reserves backing its stablecoin USDT at the time, Bloomberg News reported.

The NYAG released the documents on June 15 under a Freedom of Information Law (FOIL) request made by CoinDesk after Tether dropped its opposition to the requests.

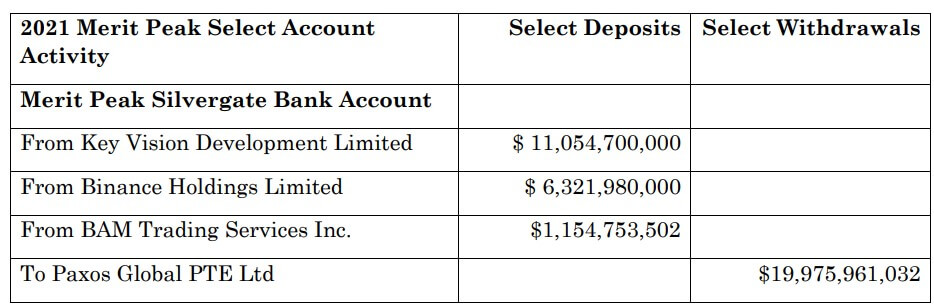

The documents include letters, bank accounts, reserve holdings and wallet addresses, as well as the methods employed by Tether to detect money laundering.

They also detail the state of its assets as of March 31, 2021.

As part of Tether’s settlement with the NYAG in 2021, the company was mandated to report its reserves every quarter for two years — this obligation concluded on June 15.

As of June 15, Tether has officially completed its two-year-long obligation.

Tether said it initially blocked the FOIL requests due to concerns around private customer data but withdrew the appeal in an effort to be more transparent with the crypto community.

However, it urged the media to employ caution and avoid releasing sensitive information like client details. The company also posted an in-depth blog addressing many of the points raised in media and why it made certain decisions in the past.

Chinese exposureAccording to the documents, Tether held securities issued by major Chinese state-owned entities including the Industrial & Commercial Bank of China Ltd., China Construction Bank Corp. and Agricultural Bank of China Ltd.

Tether also held securities issued by major European lenders like Deutsche Bank and Barclays, among others.

Most of the Chinese securities matured in 2020 and 2021, according to the documents.

Tether said in its blog post that the Chinese commercial paper it held was primarily issued by banks, which the documents confirm. The firm also said that holding such securities is common practice even among some of the largest investment managers in the world.

Tether said it has steadily reduced its overall exposure to commercial papers to zero since then and no longer holds any Chinese securities in the USDT reserves.

The post NYAG releases documents detailing Tether’s exposure to Chinese securities in 2021 appeared first on CryptoSlate.

Similar to Notcoin - Blum - Airdrops In 2024

Tether (USDT) на Currencies.ru

|

|