2020-12-23 15:00 |

Bitcoin has begun to show signs of weaknesses after a crazy rally from $11,000 to $24,000. The drop has made some suggest that a strong move lower is on its way. But on a near-term basis, not everyone is convinced that Bitcoin is done rallying just yet. Bitcoin Isn’t Poised to Crash, Say Some Analysts

Bitcoin has begun to show signs of weaknesses after a crazy rally from $11,000 to $24,000. The leading cryptocurrency currently trades for $22,600, down a handful of percent since the aforementioned highs.

This drop has made some fear that a bigger move lower is on its way. As reported by Bitcoinist previously, one trader, referencing the chart below, recently said:

“BTC – Weekly RSI and Stoch RSI significantly overbought. It has been a trending market and oscillators can remain overbought – but I’m just being cautious here…. Local top?”

As the chart shows, BTC’s Stochastic relative strength index (RSI) has begun to peak after a strong move higher. This may suggest that Bitcoin’s uptrend momentum is losing steam and may thus revert to the downside.

Analysts are not all convinced that a drop is likely, though.

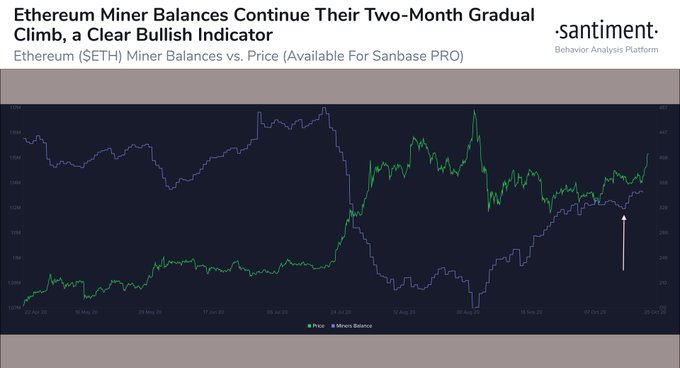

Image Courtesy of TraderXO. Source: BTCUSD on TradingView.The chart below was shared by a leading trader during Bitcoin’s price drop. It shows that BTC may catch a bid in the $22,300 region, at which point it would bounce even higher back toward $24,000.

As the chart shows, that level has been crucial for bulls over recent days. Bitcoin managing to hold the $22,300 support level could suggest that a reversion to the upside is highly likely.

Historical supports are likely to act as supports once again, as can be seen in the chart below.

Image Courtesy of crypto asset trader Crypto ISO. Source: BTCUSD on TradingView. Fundamentals of BTC Still StrongBitcoin still has room to move to the upside as its fundamentals remain strong.

As reported by Bitcoinist previously, the passing of the recent U.S. stimulus may push this market higher.

On Monday night, the U.S. Senate voted in favor of a bill that will see $900 billion worth of stimulus injected into the economy as a result of the pandemic. Many expect this to have positive effects on the stock market and on businesses, which should help BTC move higher as a risk asset:

“Looking at the increase of USD supply in the last 12 months and it’s the trajectory for the next 12, it’s easy to see that Bitcoin’s 2020 price increase isn’t as substantial as it looks, and the continued entry of institutions and sovereigns will dwarf anything to date.” — wrote Brendan Blumer, the co-founder/CEO of Block.One.

Institutional capital is also poised to drive this market higher, as Brendan Blumer of Block.one said.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Macro Analysis Predicts Bitcoin Has Begun Rally Toward $100k origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|