2023-3-4 21:40 |

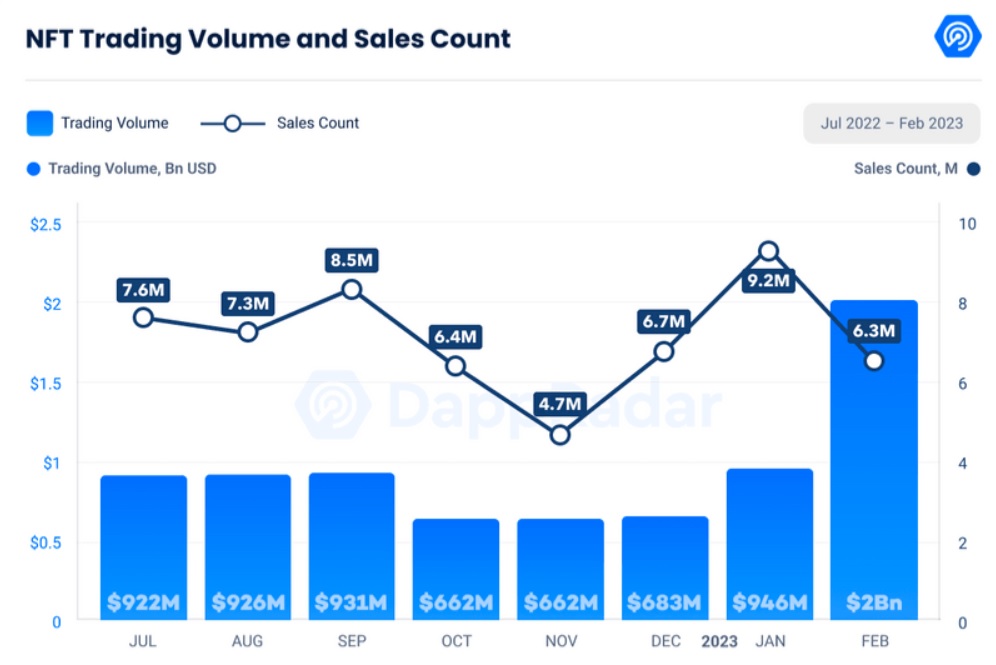

Non-fungible token (NFT) market’s trading volume increased to $2 billion in February, reaching its pre-LUNA crash levels, according to DappRadar’s Industry Report.

The NFT trading volume recorded a 117% spike from January’s $956 million, as the DappRadar data shows.

NFT trading volume and sales count (Source: DappRadar)Despite the significant surge in the NFT trading volume, the sales count recorded a 31.46% decrease, falling to 6.3 million from January’s 9.2 million.

In February, Ethereum (ETH) remained the top blockchain by NFT trading volume. The chain recorded $1.8 billion in trading volume, which marks a 174% increase from the $659 million in January. Based on these numbers, ETH represents 83.36% of the entire NFT market.

Top blockchains by NFT trading volume (Source: DappRadar)Solana (SOL) and Polygon (MATIC) followed ETH as the second and third chain, with the highest NFT trading volume in February. Even though SOL ranked second by facilitating $75 million in trading volume, it still recorded a 12% decrease from January’s $86 million. MATIC, on the other hand, marked a 147% increase in February, reaching $39 million from the $16 million of the previous month.

Blur vs. OpenSeaIn February, Blur triumphed over OpenSea in terms of trading volume. Blur facilitated over $1.3 billion in trading volume throughout the month, while OpenSea came second with $587 million. These numbers indicate that Blur accounted for 64.8% of the whole NFT market trading volume, while OpenSea represented 28.7% of it.

X2Y2 and LooksRare followed OpenSea as third and fourth in the ranking by recording $39 million and $29 million in trading volume, representing 1.9% and 1.4% of the whole market, respectively.

Profit chasers vs. art loversEven though the difference in trading volumes points to Blur as the busiest NFT marketplace, OpenSea still holds the most significant number of users. Currently, Blur has 96,856 users as opposed to OpenSea’s 316,199. To catch up with OpenSea on that front, Blur has also been trying to grow its user count by issuing airdrops to loyal users.

Referring to this contrast in user counts and trading volume, DappRadar stated:

“This [the contrast in numbers] confirms that the trading patterns on Blur are largely driven by NFT whales farming on the platform rather than typical trading activity.”

In support of this perception of Blur, a whale recently sold 139 NFTs and earned $9.6 million.

A specific part of the community also criticizes Blur for stripping the art from NFTs and luring people by promoting great returns. A representative of this crowd, Aaron Sage, recently wrote:

“I just wish the NFT space could switch it’s lens to how we used to be – about the art and culture (i.e. ape noises in clubhouse and even the lazy lion twitter raids), but not what it is today with Blur.“

The post NFT trading volume returns to pre-LUNA crash levels in February appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|