2022-1-11 15:56 |

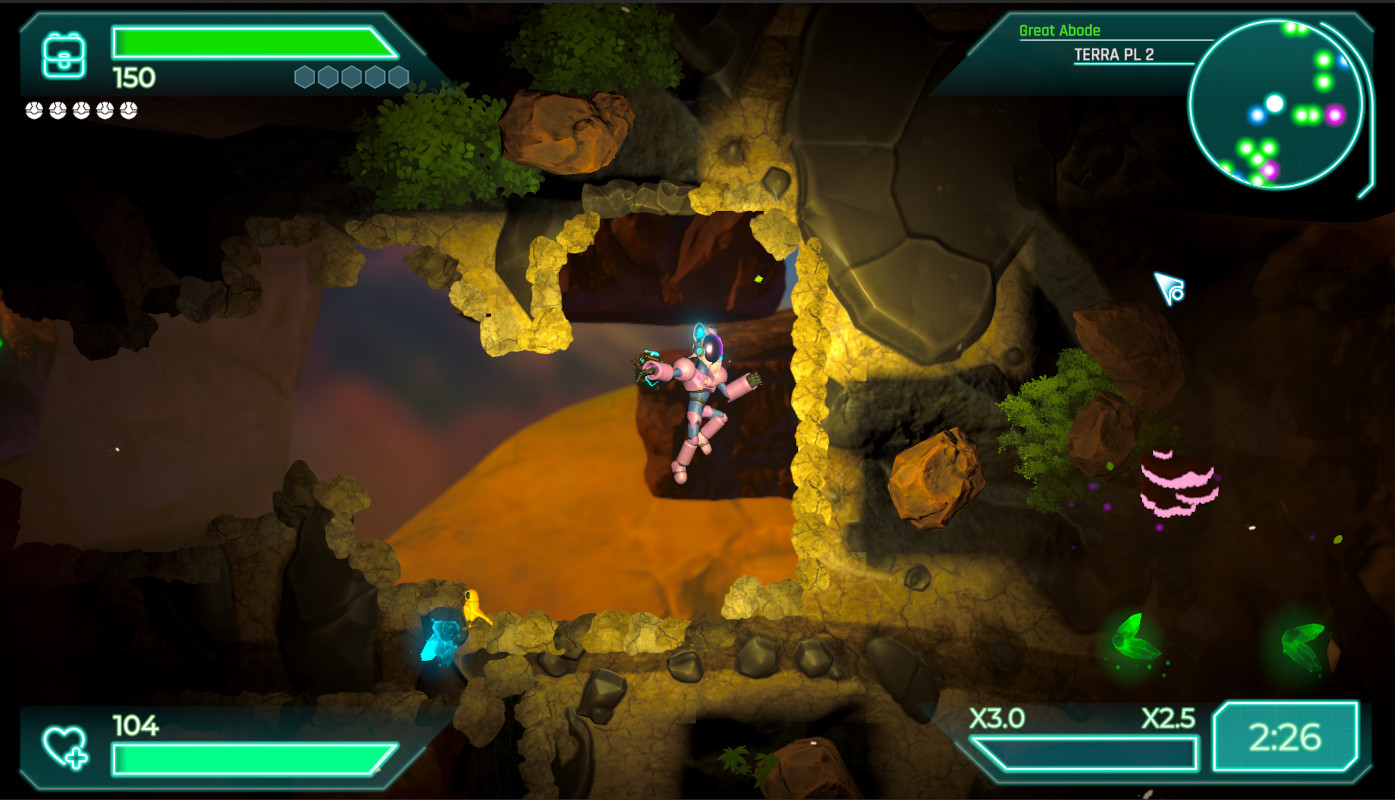

If NFTs were the hottest story of 2021, play-to-earn games certainly weren’t far behind. As games like Axie Infinity charged their way onto the crypto scene, gamers, investors, and even legacy gaming institutions began to take notice.

Play-to-Earn games have seen phenomenal growth in the past twelve months – rising from relative to obscurity to putting established gaming powerhouses “on notice.” Axie has no doubt been leading the way, working its way up to 2.5 million active monthly users at the time of this writing. Unsurprisingly, the growth of this industry is only expected to climb higher – as more mainstream audiences discover such platforms, as people begin to understand the financial empowerment gained through playing such games, and as the ability to rent NFTs further breaks down barriers to joining and succeeding within decentralized games.

Why Has Play-to-Earn Been So Successful?Prior to the introduction of the play-to-earn gaming model, one could confidently state that most games and gaming platforms were a “closed system.” That is, anything and everything that a player accomplished and/or earned in the game would be trapped on that gaming platform forever. This was understandable, as the infrastructure did not yet exist to seamlessly transfer information between one platform to another, or to even allow an intermediary to easily broker transactions between two parties.

Blockchain – and more specifically, decentralized gaming, changes all of this. For the first time ever, players can not only play, earn, and win in a game – but they can take those earnings and winnings off of the gaming platform, and transact with others in the “real world.”

From in-game tokens (similar to those coins collected by Mario in Super Mario Bros) to in-game assets (think swords, armor, other accessories), everything a player earns within a play-to-earn game is able to be taken off-platform and into a marketplace.

With in-game tokens (e.g. Smooth Love Potion (SLP) from Axie) regularly traded on exchanges, and in-game assets available for sale on marketplaces like OpenSea, players who are willing to learn and dedicate their time to a play-to-earn platform have the potential to turn their in-game earnings to real-world currencies.

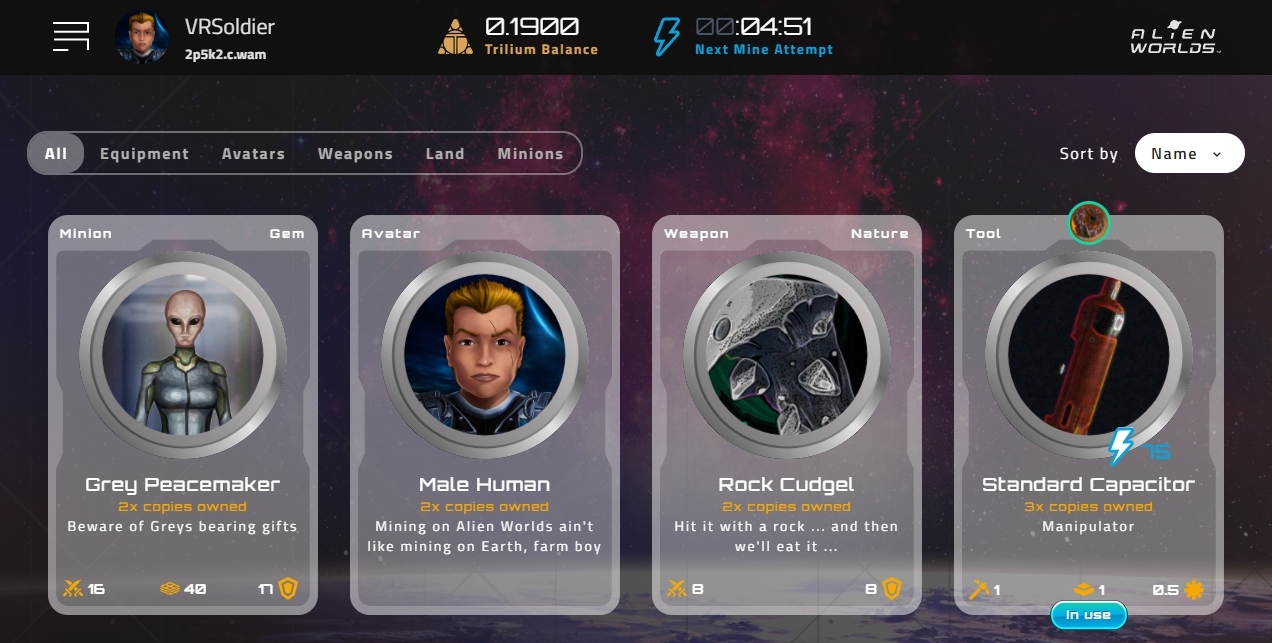

What NFT Renting Enables and Why Solid NFT Rental Infrastructure is KeyWhile Axie Infinity has been enormously successful over the past year, its success has not been without challenges, especially when enticing and onboarding new users. New entrants to the Axie universe must first acquire three Axie characters before they can even start playing the game.

These cute little Axies, resembling miniature pufferfish of various colors, often cost a minimum of almost 0.02 ETH, and up to 300 ETH. While 0.02 ETH can be affordable depending on where the player resides – in many parts of the world, paying such an amount would not be feasible based on the average monthly salary of the average citizen. Assuming a conversion rate of $4,000 USD/ETH, 0.02 ETH equates to $80 USD. In the Philippines, where Axie is extremely popular, the average monthly salary currently stands at around $880 USD. Asking a Filipino to purchase an Axie would require them to put up almost 10% of their monthly earnings. For three Axies (the minimum to begin playing), they would need to contribute up to 30% of their monthly income – an unmanageable amount by all accounts for most people.

So how do Filipinos, or residents from other lower-wage countries begin playing on Axie?

Players who are interested in Axie but who lack the financial resources to acquire the initial set of characters can essentially participate in an NFT lending and borrowing process from others who are able to acquire them. While this model of NFT renting comes in many forms, one of the most popular ways of getting access to Axie NFTs is through Yield Guild Games (YGG), one of the most successful play-to-earn gaming guilds to date. Through YGG, players essentially rent NFT Axie characters, and the earnings that are acquired during the time that the individual plays with those Axies is then divided between the guild and the players themselves.

While this model of NFT borrowing has been great to start with, they completely rely on a solution outside of the gaming platform for the NFT lending process. Fortunately, in-game solutions are not far on the horizon, and NFT rental infrastructure providers are starting to emerge – with companies like IQ Labs leading the way with the IQ Protocol.

How IQ Protocol WorksAt a high level, IQ Protocol is a blockchain agnostic solution that allows any blockchain project to enable NFT renting for their users. Projects do not need to rely on other third parties to coordinate these services, but rather, the end-to-end NFT rental process can be managed completely within a project (or decentralized game) itself.

Further, unlike traditional crypto renting where a user needs to put up collateral before being able to rent the asset, IQ Protocol provides NFT rental infrastructure that has never been seen before. In short, IQ Protocol enables collateral-less NFT renting, wherein the user only needs to pay the rental fee before being issued a wrapped version of the rented asset.

On the lender side, asset holders need not worry – as their original asset remains protected in the smart contract established between lender and borrower. The asset is locked safely while the borrower is using a wrapped version of the asset – which derives all of its value from the original asset itself.

The Need for Solid NFT Rental InfrastructureIn typical NFT lending and borrowing scenarios, there is always a concern from both parties that what has been deposited in the transaction will be lost. For the lender, this would be the asset that has been put up for rental. For the borrower, this would be the collateral that has been deposited to ensure the return of the asset.

IQ Protocol enables a world where both of these doubts have been resolved, while still providing the benefits of a rental transaction. On the NFT lending side, this means passive rental income on a safely protected asset – and for the borrower, this means renting the asset without worrying about the loss of upfront collateral.

Solid NFT rental infrastructure like those provided by IQ Labs will enable all games and projects to be able to provide such an offering to its users. Without another third party governing and coordinating the transaction, each project can easily manage their own NFT rental marketplace – built on the strong foundations provided by the IQ Protocol.

Play-to-Earn and the Future of NFT RentingThe play-to-earn industry is exploding – and while first movers like Axie are clearly ahead of their competitors, other games are quickly catching up. Splinterland, Gods Unchained, and more, are quickly making their mark as challengers to the play-to-earn throne currently occupied by Axie.

As more decentralized games make their way to the surface and to the mainstream – projects and games will want to consider how to continue to grow their user base, and to maximize the playing experience.

For games that require the player to acquire game assets up-front, IQ Protocol will allow the project to coordinate the NFT lending and borrowing of such assets to its future players. Removing the need for third parties to coordinate the transaction themselves, each project will be able to create a seamless end-to-end experience for its players in on-boarding them with the necessary tools.

Other platforms where users can simply begin playing can also greatly benefit from having their own NFT rental infrastructure. In the end, play-to-earn means that players are in the game to not only have fun, but to make money. As players level up in-game, earn tokens or other NFT assets, being able to empower the game community with an NFT rental marketplace will further strengthen the playing experience and create an environment which is even more lucrative for its participants.

In the end, NFT renting will push play-to-earn games to the next level. Further breaking down barriers to access, upgrading the playing experience, and introducing new streams of income and capabilities for all of its participants – the possibilities enabled by NFT renting are something that every project and game should consider to maximize the experience of its users.

IQ Labs and its IQ Protocol are ready to provide the underlying infrastructure to power such NFT rental economies. With its revolutionary approach to NFT renting and its knowledge of how such things can be applied to the play-to-earn world, IQ is ready to meet all of the needs related to NFT lending and borrowing on the blockchain.

Disclaimer: This is a sponsored post brought to you by IQ Protocol.

The post NFT renting poised to supercharge growth in Play-to-Earn games appeared first on CryptoSlate.

Similar to Notcoin - Blum - Airdrops In 2024

ITAM Games (ITAM) на Currencies.ru

|

|