2024-4-25 02:52 |

According to the latest report by NonFungible.com, the NFT lending market has reached a significant milestone. In the first quarter of 2024, it surpassed $2 billion in volume, marking a growth rate of 44% compared to the fourth quarter of 2023. This rapid growth is attracting attention from both investors and NFT holders.

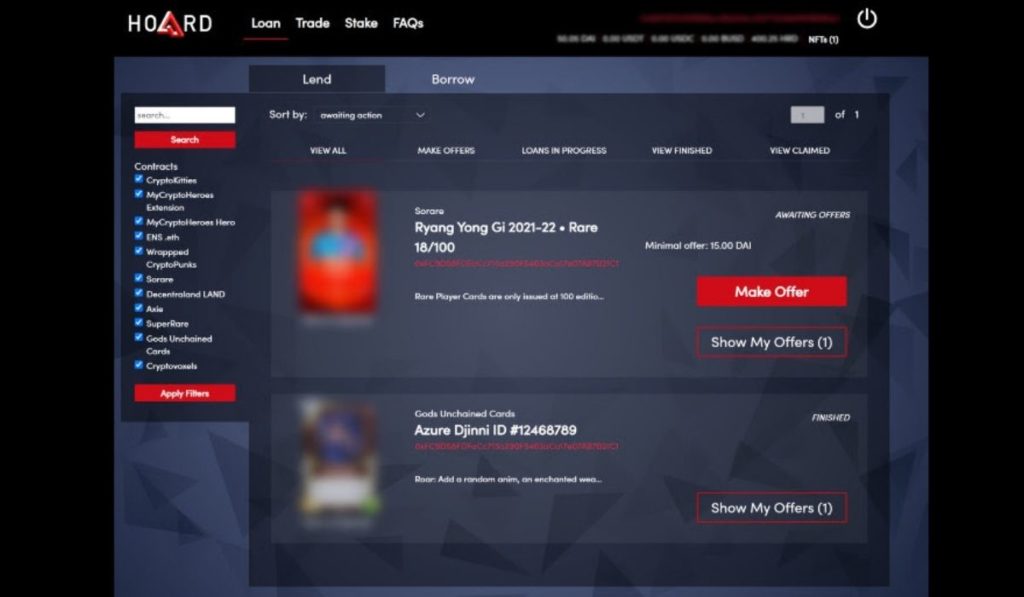

But what exactly is NFT lending? Simply put, it is the process of using your NFTs as collateral for a loan. Lending platforms allow users to lock in their NFTs and receive a loan in return, giving them access to liquidity without having to sell their valuable assets.

Leading the NFT lending market is Blend, a platform launched by popular NFT marketplace Blur in May 2023. As of March 2024, it holds an impressive 93% market share, with its lending volume for the first quarter of 2024 reaching over $2.02 billion. This dominance is not surprising, considering the synergy between Blend and Blur, both owned by the same parent company.

The Role of NFT HoldersBut what is driving this trend? The answer lies in long-standing NFT holders. These individuals or organizations have been holding onto their unique digital assets for a while now, watching as their value skyrockets. However, they may not be able to access that value, especially if they do not want to sell their NFTs.

That’s where NFT lending comes in. By using their NFTs as collateral, holders can unlock liquidity and make moves in the market without sacrificing their valuable assets. This trend is expected to continue as more and more NFT holders look for ways to leverage their assets.

The Players in the MarketApart from Blend, there are other players in the NFT lending market, albeit with smaller market shares. Arcade and NFTfi hold 2.8% and 2.2% respectively, with both platforms seeing significant quarter-on-quarter increases in lending volumes. Smaller platforms like X2Y2 and BendDAO each hold a 0.8% market share, with Parallel Finance accounting for 0.5%.

However, the introduction of new tokens by Arcade and an anticipated release by NFTfi are being closely monitored for their potential impact on the market. As the industry continues to grow and evolve, it is expected that more players will enter the market, providing more options for NFT holders.

At present, Ethereum NFT collections remain the primary collateral type in the NFT lending market. This is not surprising, considering that Ethereum is currently the leading blockchain platform for NFTs. However, with different blockchains emerging and gaining popularity for hosting NFTs, we may see a shift in this trend in the future.

ConclusionThe NFT lending market has surpassed $2 billion in volume and is expected to continue its growth as more players enter the market. With Blend dominating the industry, other platforms are also seeing significant increases in lending volumes. This trend is driven by long-standing NFT holders who want to access liquidity without selling their valuable assets. As new tokens and collateral types are introduced, the NFT lending market is set to become more diverse and competitive. It’s an exciting time for this emerging trend in the world of NFTs.

Featured Image: DepositPhotos

The post NFT Lending Volume Tops $2 Billion In Q1 2024 appeared first on NFT News Today.

origin »Bitcoin price in Telegram @btc_price_every_hour

NFT (NFT) на Currencies.ru

|

|