Quantitative - Свежие новости [ Фото в новостях ] | |

The 'cent-millionaire' portfolio: 5 crypto coins under $0.10 to watch

Over the past 24 hours, Bitcoin [BTC] has rallied 7.27% to retest the $94k resistance level. The end of quantitative tightening from the Federal Reserve and the Vanguard Bitcoin exchange-traded funThe post The 'cent-millionaire' portfolio: 5 crypto coins under $0.10 to watch appeared first on AMBCrypto. дальше »

2025-12-9 16:00 | |

|

|

Tomorrow the Fed Ends QT — Crypto Thinks the Melt-Up Starts Now

On December 1, 2025, the Federal Reserve (Fed) will officially end Quantitative Tightening (QT), freezing its balance sheet at $6. 57 trillion after draining $2. 39 trillion from the system. Analysts point to parallels with 2019, when the last QT pause coincided with a major bottom in altcoins and a surge in Bitcoin. дальше »

2025-12-1 22:52 | |

|

|

Learn How to Earn $5,952 Through AI Quantitative Trading on CenionAI

As the global crypto market continues to heat up, AI-based quantitative trading has become increasingly popular due to its low entry barrier, high efficiency, and full automation. Unlike manual tradinThe post Learn How to Earn $5,952 Through AI Quantitative Trading on CenionAI appeared first on AMBCrypto. дальше »

2025-11-4 12:15 | |

|

|

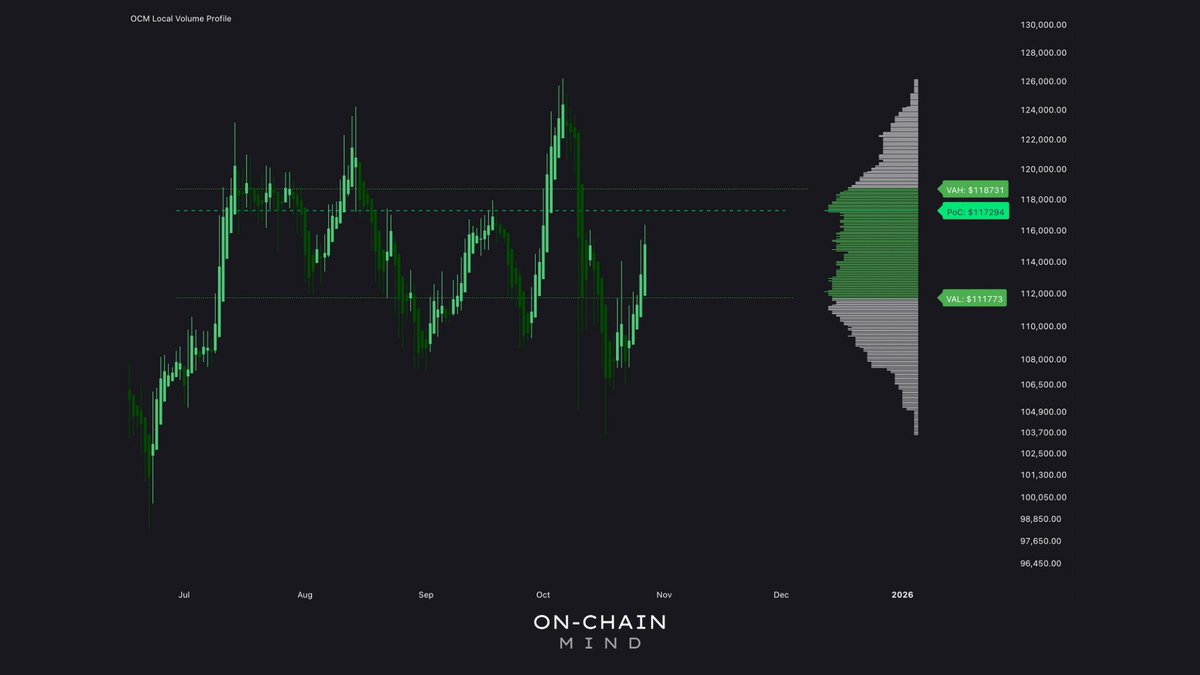

Bitcoin Point Of Control Sits At $117K – Key Battle Zone For Bulls

Bitcoin (BTC) tumbled below the $110,000 level in a sharp move that rattled markets and triggered a wave of short-term panic selling. The sudden decline followed an initial post-Fed volatility spike, as traders reacted to the US Federal Reserve’s 25bps rate cut and announcement of an impending end to quantitative tightening. дальше »

2025-11-1 02:00 | |

|

|

Ted Pillows on Altcoins: Fed’s End to QT Could Keep Crypto Under Pressure

Crypto analyst Ted Pillows has highlighted the future of altcoins with the US Fed ending its balance sheet drawdown, otherwise known as Quantitative Tightening. The post Ted Pillows on Altcoins: Fed’s End to QT Could Keep Crypto Under Pressure appeared first on Coinspeaker. дальше »

2025-10-30 16:44 | |

|

|

Fed Cuts Rates 0.25%, Halts QT as Crypto Market Faces $795M Liquidations

The Federal Reserve reduced interest rates by 25 basis points while announcing an end to quantitative tightening starting December 1st, causing immediate turbulence in cryptocurrency markets. The post Fed Cuts Rates 0. дальше »

2025-10-29 23:20 | |

|

|

Bitcoin, altcoins slip as the Fed lowers interest rates by 25 basis points

The US Fed has cut rates by 25 bps, signaling a softer monetary stance. Bitcoin price is down 3% to $111,400 as traders digest the policy move. Fed to end the quantitative tightening on December 1. дальше »

2025-10-29 22:07 | |

|

|

Fed cuts 25 bps, but there is another hidden macro challenge looming

The Federal Reserve cut rates by 25 basis points today and hinted that its balance-sheet runoff may soon end, arguably the bigger story for Bitcoin. With the overnight reverse repo facility nearly empty at roughly $14 billion, any further quantitative tightening now drains bank reserves directly. дальше »

2025-10-30 21:55 | |

|

|

Jerome Powell warns of employment risks as Fed cuts rates again

The Federal Reserve is continuing with rate cuts, with another 25bps reduction and an end to quantitative easing. Slow job growth is an increasing concern for the Federal Reserve. On Wednesday, October 29, the U.S. Federal Reserve delivered a widely… дальше »

2025-10-29 21:39 | |

|

|

Federal Reserve Cuts Interest Rates by 25 Basis Points, Ends Quantitative Tightening

Bitcoin Magazine Federal Reserve Cuts Interest Rates by 25 Basis Points, Ends Quantitative Tightening The Federal Reserve cuts its benchmark interest rate by 0. 25% today to 3. дальше »

2025-10-30 21:16 | |

|

|

Polygon taps into Manifold for institutional liquidity to DeFi ecosystem

Polygon is integrating Manifold Trading, an institutional-grade quant firm to tap into data-driven liquidity and institutional-grade execution features for its decentralized finance ecosystem. Polygon Labs announced its move to join forces with the quantitative investment firm Manifold via a press… дальше »

2025-10-28 19:43 | |

|

|

MasterQuant Integrates AI Bots for Streamlined Crypto Trading

MasterQuant, a pioneer in AI-powered quantitative investment solutions, has added AI bots to boost AI investing and algorithmic trading for cryptocurrency markets. This timely launch brings new features to equip investors with automated, data-driven strategies to match the 2025 crypto landscape. дальше »

2025-9-22 11:54 | |

|

|

Jump Crypto takes leap into tokenization with Securitize stake

Jump Crypto has acquired a significant equity stake in Securitize for an undisclosed price. Jump Crypto, the digital asset arm of Chicago quantitative trading firm Jump Trading, has acquired a significant equity stake in Securitize, which specializes in real-world asset… дальше »

2025-5-11 20:00 | |

|

|

BitMEX co-founder sees Bitcoin reaching $110k before plunging below $77k

As the Federal Reserve shifts to quantitative easing, BitMEX’s co-founder Arthur Hayes appears to be confident to bet on Bitcoin hitting $110,000 before dipping to $76,500. Arthur Hayes, BitMEX‘s co-founder, is back with another prediction, this time saying Bitcoin (BTC)… дальше »

2025-3-24 11:58 | |

|

|

Bitcoin reclaims $85K as Fed 'scales back QT' - What’s next?

BTC relief bounce was linked to the Fed’s dovish tilt on quantitative tightening (QT). Some technical price indicators were yet to flip bullish for sustained BTC price recovery at the time The post Bitcoin reclaims $85K as Fed 'scales back QT' - What’s next? appeared first on AMBCrypto. дальше »

2025-3-20 22:00 | |

|

|

Arthur Hayes predicts Bitcoin rally: what does it mean for PepeX?

Hayes believes that Bitcoin’s recent dip to $77,000 might have marked the bottom. He points to the likely end of quantitative tightening (QT) by April 1 PepeX emerges as a fairer investment alternative with its upcoming presale and AI-powered meme coin launchpad. дальше »

2025-3-20 10:15 | |

|

|

Will Bitcoin bounce back? - Analysts weigh in ahead of FOMC meeting

BTC could recover if the Fed signals a policy shift from quantitative tightening. Bitfinex and CryptoQuant analysts warned of weak demand and a likely ‘bear market.’ Bitcoin [BTC] has The post Will Bitcoin bounce back? - Analysts weigh in ahead of FOMC meeting appeared first on AMBCrypto. дальше »

2025-3-19 01:00 | |

|

|

InsightQuantAi (IQAI) Winter Charity Event: "700 Gifts for 700 Smiles"

During the warm winter holiday season, Santiago, Chile, hosted a heartwarming celebration—"700 Gifts for 700 Smiles." Organized by the leading quantitative trading platform, InsightQuantAi (IQAI), tThe post InsightQuantAi (IQAI) Winter Charity Event: "700 Gifts for 700 Smiles" appeared first on AMBCrypto. дальше »

2025-1-22 17:25 | |

|

|

BitMEX’s Hayes predicts Bitcoin to peak soon as Fed’s tools near exhaustion

The Federal Reserve’s quantitative tightening and liquidity measures could drive Bitcoin to a late Q1 peak, BitMEX co-founder Arthur Hayes says. In his latest essay on Jan. 7, BitMEX co-founder Arthur Hayes predicts Bitcoin (BTC) will hit its peak by… дальше »

2025-1-7 10:59 | |

|

|

US Congressman Mike Collins buys ETH worth $80k

Republican Mike Collins, re-elected to the U. S. House of Representatives in Georgia’s 10th Congressional District, holds Ethereum. Collins disclosed an investment in Ethereum (ETH) worth nearly $80,000, according to the platform Quiver Quantitative. дальше »

2024-11-9 21:52 | |

|

|

Xapo Bank teams up with trading firm Hilbert Group to launch $200m Bitcoin fund

Hilbert Group partners with Xapo Bank to launch a Bitcoin-denominated hedge fund with over $200 million in expected capital. Quantitative investment company Hilbert Group has announced a strategic partnership with crypto-friendly Xapo Bank to manage a new Bitcoin-denominated hedge fund.… дальше »

2024-8-27 13:54 | |

|

|

SUNDOG and POPCAT Prices Surge: Is PandaWorld (PADW) the Next Meme Coin to Explode?

Last Friday, Jerome Powell, the Chair of the Federal Reserve, delivered a pivotal speech at Jackson Hole, hinting at potential shifts in monetary policy. As the Fed gears up to implement quantitative easing starting in September, there’s a growing expectation that a flood of new capital could flow into the cryptocurrency market. дальше »

2024-8-26 16:00 | |

|

|

Algoz taps Zodia Custody to trade collateral without direct asset control

Standard Chartered-backed crypto custodian Zodia Custody has collaborated with trading firm Algoz to mitigate counterparty risks that caused market turbulence in 2022. Zodia Custody, a crypto custodian backed by Standard Chartered, has announced a partnership agreement with Algoz, a quantitative… дальше »

2024-8-9 16:31 | |

|

|

Promontory Technologies Launched its Alpha Fund, a multi-strategy approach to trade liquid-listed digital assets

Promontory Technologies is thrilled to introduce the Promontory Alpha Fund, a cutting-edge investment vehicle that employs a quantitative, systematic, multi-strategy approach to trading liquid-listed digital assets. дальше »

2024-6-25 16:35 | |

|

|

Promontory Technologies Goes Live for External/LP Investors

Promontory Technologies is excited to announce the launch of its Promontory Alpha Fund, a quantitative, systematic, multi-strategy approach to trade liquid listed digital (“crypto”) assets. The fund is designed to be market-neutral and avoid deep drawdowns, offering both a BVI vehicle for non-US investors and a Delaware LP for US investors. дальше »

2024-6-25 11:46 | |

|

|

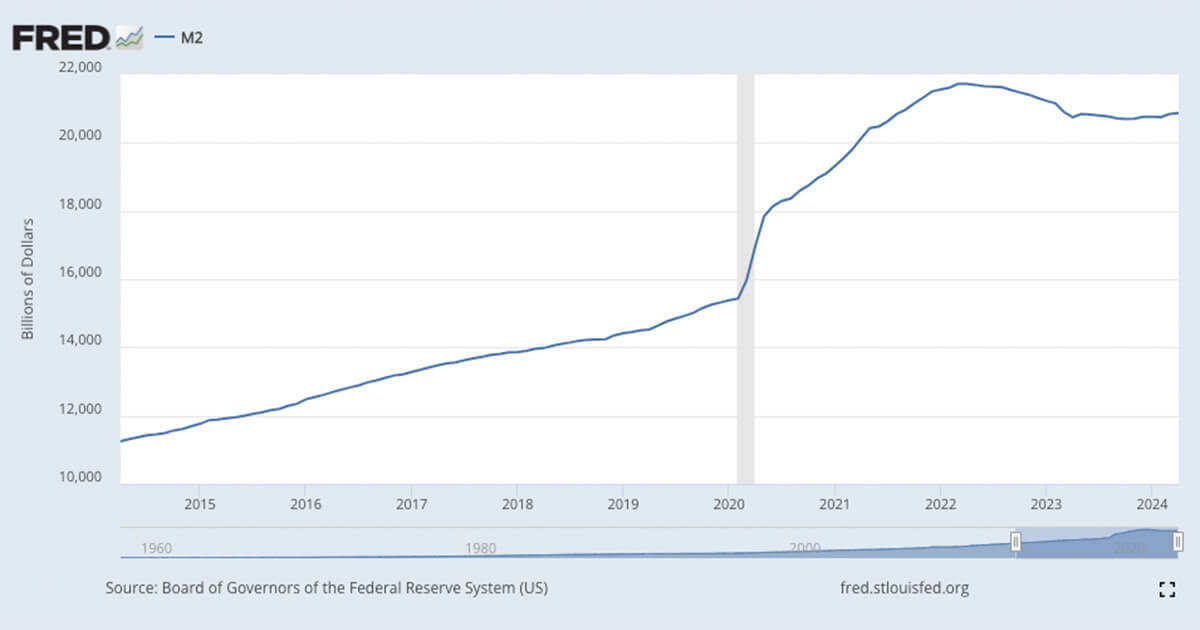

Rising M2 money supply signal potential tailwinds for Bitcoin

Quick Take Analyzing recent data from the Federal Reserve Economic Data (FRED), we observe significant trends in the Federal Reserve’s balance sheet and the M2 money supply. The Federal Reserve’s balance sheet has been gradually declining (quantitative tightening), now standing at $7. дальше »

2024-6-1 18:50 | |

|

|

Crypto Principal Trader Arbelos Markets Raises $28M Led by Dragonfly Capital

Before starting Arbelos Markets last year, Tang served as chief investment officer at quantitative digital asset investment firm LedgerPrime while Lim was head of trading strategy at Galaxy and head of derivatives at now-defunct crypto lender Genesis. дальше »

2024-5-8 15:25 | |

|

|

Institutional Bold Bet: Susquehanna Pours $1.1 Billion Into Spot Bitcoin ETFs

Quantitative trading giant Susquehanna invests $1.1 billion in various Bitcoin ETFs. The post Institutional Bold Bet: Susquehanna Pours $1.1 Billion Into Spot Bitcoin ETFs appeared first on BeInCrypto. дальше »

2024-5-8 07:27 | |

|

|

Почему решения ФРС влияют на курс биткоина?

Что такое QE и QT? Количественное смягчение (Quantitative easing, QE) — политика центрального банка страны, предполагающая покупку финансовых активов на открытом рынке. Регулятор вливает ликвидность в экономику для стимулирования межбанковских операций с целью снижения процентных ставок. дальше »

2024-5-7 14:00 | |

|

|

Borderless Capital Acquires Asset Manager CTF Capital in Miami and LatAm to Expand Global Presence

Borderless Capital expands for better value generation in the digital asset industry by combining AI and quant skills under one roof. For an unknown sum, Borderless Capital, a cutting-edge Web3 investment management company, has announced the acquisition of CTF Capital, a renowned asset management and quantitative trading organization with headquarters in Miami and Latin America. […] дальше »

2024-3-26 21:38 | |

|

|

NAV Bridging the Gap Between TradFi and DeFi with Compliant Asset Products

NAV, a pioneering quantitative hedge fund, is making significant strides in bridging the gap between traditional finance and the decentralized finance (DeFi) ecosystem through its suite of regulatory-compliant Structured Investment Products (SIPs). дальше »

2024-3-18 16:41 | |

|

|

Stock-to-flow mastermind PlanB outlines key Bitcoin price levels before halving

Dutch creator of the Stock-to-Flow model says the largest by market cap crypto has entered a pre-bull market. An anonymous Dutch investor and quantitative analyst, PlanB, best known for his stock-to-flow (S2F) model for Bitcoin (BTC), says the cryptocurrency is… дальше »

2023-11-20 16:23 | |

|

|

Fed’s balance sheet signals cautious but consistent quantitative tightening

Quick Take The Federal Reserve’s balance sheet has undergone a recent update, revealing a quantifiable decrease in its total. As of Nov. 8th, the balance sheet reveals a total of $7. 861T, indicating the continuation of the Federal Reserve’s quantitative tightening strategy. дальше »

2023-11-10 19:40 | |

|

|

ATPBot Introduces Advanced AI-Driven Trading Solutions for Binance and Kraken Users

Singapore, Singapore, October 3rd, 2023, Chainwire Recently, ATPBot announced its support for Binance and Kraken users to implement AI-automated trading through API. As an advanced intelligent AI quantitative trading strategy development and service platform, ATPBot has launched one of the most powerful AI-automatic trading bots on the market. дальше »

2023-10-3 12:37 | |

|

|

Central banks globally roll back balance sheets – quantitative tightening pace heightened

Quick Take Global central banks are decidedly rolling back on their respective balance sheets, indicating an aggressive stride in quantitative tightening for 2023. The Bank of England’s (BOE) balance sheet downsized by 3%, while the Federal Reserve reported a 4% reduction. дальше »

2023-8-24 19:00 | |

|

|

Federal reserve drains a quarter of USD liquidity: economic consequences await

Quick Take Recently, the Federal Reserve (Fed) has initiated a policy shift that sees a decrease in United States Dollar (USD) liquidity by 25%, according to analyst Joe Consorti. This strategy contrasts markedly with the earlier Quantitative Easing (QE) policies. дальше »

2023-7-23 16:00 | |

|

|

Major repricing event underway in TradFi markets

Quick Take Since the Global Financial Crisis (GFC) in 2008, a zero-interest rate policy and quantitative easing as the norm for the past 15 years. This policy has contributed to asset inflation, which is anticipated to reverse. дальше »

2023-6-20 17:27 | |

|

|

OFX Exchange: Redefining Cryptocurrency Trading with Intelligent Quantitative System

OFX Exchange provides a platform for individuals looking to optimize their earnings and achieve long-term financial growth in the cryptocurrency market. They offer VIP quantifying plans tailored to different levels of trading expertise and investment capacity, making it accessible to traders with varying levels of experience and resources. дальше »

2023-6-19 05:38 | |

|

|

TraderDAO’s AI Tool TradeGDT Is Revolutionizing The Trading Space, Recording 10% Bybit Derivatives Trading Volume In 4 Hours

TradeGDT, an AI-powered trading tool by TraderDAO, is making waves, hitting 10% of Bybit Derivatives Trading volume in 4 hours. TradeGDT (Trading Generated Data Transformer) is an improved quantitative trading bot for extensive data created to help traders easily navigate the crypto market. дальше »

2023-5-25 01:20 | |

|

|