Derivatives - Свежие новости [ Фото в новостях ] | |

Crypto futures legitimized by CME with Cardano, Chainlink, and Stellar addition, but retail traders face a massive catch

The era of the crypto industry being seen as a two-asset town is officially over at the world’s largest derivatives marketplace. On Jan. 15, CME Group announced plans to launch futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar (XLM) on Feb. дальше »

2026-1-17 22:50 | |

|

|

CME expands regulated crypto futures with Cardano, Chainlink and Stellar contracts

CME Group has announced plans to expand its regulated cryptocurrency derivatives offering with the launch of Cardano [ADA], Chainlink [LINK], and Stellar [XLM] futures, marking another step in the insThe post CME expands regulated crypto futures with Cardano, Chainlink and Stellar contracts appeared first on AMBCrypto. дальше »

2026-1-17 20:06 | |

|

|

CME bets on altcoins as Cardano, Chainlink and Stellar futures go live Feb. 9

CME will list Cardano, Chainlink and Stellar futures on Feb. 9, adding micro and standard contracts as institutions seek regulated altcoin exposure and hedging tools. CME Group, the world’s largest derivatives exchange, announced plans to launch futures contracts tied to… дальше »

2026-1-17 13:49 | |

|

|

BitMEX Report Finds Crypto Perpetuals Enter Post-Yield Era

BitMEX, one of the safest exchanges, today released its end-of-year research report, “State of Crypto Perpetual Swaps 2025,” outlining five core insights that defined a turbulent year for the global crypto derivatives market. дальше »

2026-1-16 13:45 | |

|

|

CME Group to Launch Cardano, Chainlink, and Stellar Crypto Futures on February 9

CME Group, the world’s largest derivatives marketplace, plans to list futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar (XLM). Trading is scheduled to begin on February 9, pending regulatory approval. дальше »

2026-1-16 08:27 | |

|

|

Nearly $3 Billion in Bitcoin and Ethereum Options Expire as Markets Test Breakout Conviction

Nearly $3 billion worth of Bitcoin and Ethereum options are set to expire on January 16. This puts derivatives markets in focus just as crypto prices test the strength of a recent rally. While Bitcoin has pushed decisively above a key technical resistance level, options positioning and volatility metrics suggest traders remain cautious about declaring The post Nearly $3 Billion in Bitcoin and Ethereum Options Expire as Markets Test Breakout Conviction appeared first on BeInCrypto. дальше »

2026-1-16 08:12 | |

|

|

Stellar Enters A New Institutional Era With CME Futures Listing

Stellar has crossed a major institutional threshold. CME Group, the world’s largest derivatives exchange, confirmed it will launch regulated futures contracts for Stellar’s $XLM, alongside Cardano ($ADA) and Chainlink ($LINK). дальше »

2026-1-17 21:41 | |

|

|

Bitcoin Rally to Two-Month High Signals Shift in Crypto Derivatives Sentiment, Bybit and Block Scholes Find

PRNewswire, PRNewswire, 15th January 2026, Chainwire The post Bitcoin Rally to Two-Month High Signals Shift in Crypto Derivatives Sentiment, Bybit and Block Scholes Find appeared first on CaptainAltcoin. дальше »

2026-1-15 18:31 | |

|

|

Glassnode: Bitcoin Is Back At $96K, Hitting The Same Sell Ceiling Again

Bitcoin’s early-2026 bounce has pushed back into a familiar problem area: a dense pocket of overhead supply that Glassnode says has repeatedly capped rallies since November. In its latest Week On-chain report, the analytics firm frames the move above $96,000 as constructive on the surface, but still largely dependent on derivatives positioning and liquidity conditions rather than persistent spot accumulation. дальше »

2026-1-15 16:30 | |

|

|

Binance bulls face make-or-break test as spot dominance hits 25% low

Binance’s spot share has slid from ~60% to 25% and derivatives from ~70% to ~35% as offshore CEXs and on-chain platforms like Hyperliquid steadily erode its once-dominant position. Binance, the world’s largest cryptocurrency exchange, has experienced a significant decline in… дальше »

2026-1-15 14:14 | |

|

|

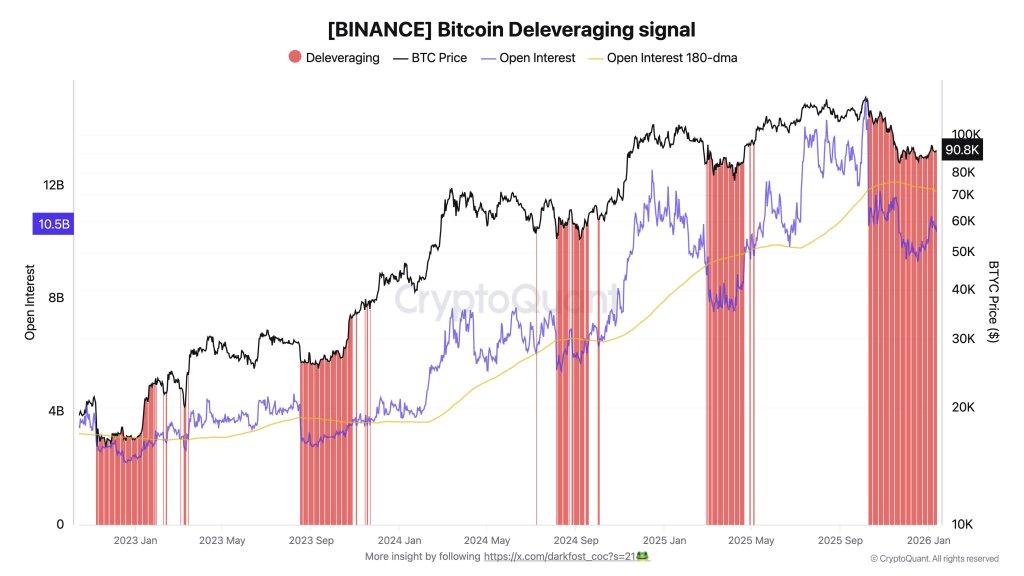

Bitcoin Futures Flush 31% Of Open Interest As Bottom Thesis Takes Shape

Bitcoin’s derivatives market is showing signs of a reset after a speculative 2025, with Binance open interest falling more than 31% from an October peak as futures-led selling pressure cools, a combination CryptoQuant contributor Darkfost argues often coincides with meaningful cycle lows. дальше »

2026-1-15 03:00 | |

|

|

Futures Frenzy Pushed Crypto Exchange Volume To Nearly $80 Trillion In 2025

According to reports, global crypto exchange trading volume jumped to over $79 trillion in 2025, driven largely by futures and perpetual contracts. That surge pushed derivatives to claim most of the market’s activity, while spot trading grew at a much slower pace. дальше »

2026-1-14 04:00 | |

|

|

Ethereum stuck between staking strength and derivatives risk - What's next?

Risk assets are stuck in a tug-of-war between supply and demand. Consequently, breaking out of the ongoing market chop requires spotting a bid–ask imbalance. According to AMBCrypto, how top caps The post Ethereum stuck between staking strength and derivatives risk - What's next? appeared first on AMBCrypto. дальше »

2026-1-14 01:00 | |

|

|

Bitcoin options flash warning as traders brace for sharp move

Bitcoin is trading quietly near $91,000, but derivatives markets are sending a very different message. While spot prices remain trapped inside a narrow range, options traders are rapidly pricing inThe post Bitcoin options flash warning as traders brace for sharp move appeared first on AMBCrypto. дальше »

2026-1-13 01:34 | |

|

|

$460M Crypto Longs Squeezed As Bitcoin Slips Below $90,000

Data shows the crypto derivatives market has faced a fresh wave of liquidations as Bitcoin and other assets have gone through a retrace. Crypto Market Has Seen Liquidations Of More Than $462 Million According to data from CoinGlass, a notable amount of liquidations have occurred in the crypto derivatives market over the past day. дальше »

2026-1-9 07:00 | |

|

|

Aave eyes breakout to $200 amid strong on-chain and derivatives data

The recent cryptocurrency market rally has stalled, with prices of most coins and tokens currently down by less than 1%. AAVE, the native coin of the Aave blockchain, is hovering around $173 on Wednesday, up by less than 1% in the last 24 hours. дальше »

2026-1-7 14:06 | |

|

|

Dogecoin’s Rebound Gains Traction Amid DOGE ETF Activity and Renewed Memecoin Demand

Dogecoin (DOGE) has extended its rally into early 2026, showing signs of sustained momentum as the memecoin space experiences renewed interest. Related Reading: Here’s Why The Shiba Inu Price Jumped Over 13% After a nearly 30% rise over four days, DOGE is consolidating above key technical levels, supported by rising trading volumes, derivatives data, and the growing popularity of leveraged Dogecoin ETFs. дальше »

2026-1-7 00:00 | |

|

|

Onyxcoin price soars as derivatives surge, funding rate signals reversal

Onyxcoin price continued its strong recovery, reaching its highest point since Oct. 2. It has soared by nearly 200% from its lowest point this year, bringing its market cap to over $422 million. дальше »

2026-1-7 18:30 | |

|

|

BitMEX launches Equity Perps for 24/7 trading of US stocks using crypto collateral

BitMEX has expanded its derivatives offering with the launch of Equity Perps, a new product that allows traders to gain exposure to major US stocks and equity indices using cryptocurrency as collateral. дальше »

2026-1-7 15:00 | |

|

|

BitMEX Launches Equity Perps for 24/7 Stock Trading

[Mahe, Seychelles – Jan. 6, 2025] BitMEX, one of the safest exchanges, today announced the launch of Equity Perps, a new derivatives product that allows traders to gain exposure to major U. дальше »

2026-1-7 15:00 | |

|

|

Phemex launches $650k trading contests for 2026 New Year futures push

Phemex launches Apex Season 3 and New Year Futures Boost, offering $650k in prizes and risk support to attract both pro and emerging crypto derivatives traders. Cryptocurrency exchange Phemex has launched two trading programs in early 2026, offering a combined… дальше »

2026-1-7 14:15 | |

|

|

Bitcoin breaks $94,000 for the first time in a month: Why is crypto up today?

Bitcoin (BTC) pierced $94,000 on Jan. 5, reaching its highest level since Dec. 10 and capping a rally that added nearly $100 billion to the total crypto market capitalization in 24 hours. The move came as spot Bitcoin ETFs recorded their strongest inflows in three months, derivatives positioning turned aggressively bullish, and macro conditions created […] The post Bitcoin breaks $94,000 for the first time in a month: Why is crypto up today? appeared first on CryptoSlate. дальше »

2026-1-7 12:29 | |

|

|

BingX Review 2026: Is it Safe & Legit to Trade Crypto?

BingX is a leading cryptocurrency exchange that offers spot, futures, and derivatives trading services. The platform is popular for its easy-to-use interface and social trading features that allow users to The post BingX Review 2026: Is it Safe & Legit to Trade Crypto? appeared first on CryptoNinjas. дальше »

2026-1-6 08:30 | |

|

|

CME Group Hits All-Time Highs: Crypto And Rates Fuel Record 2025 Trading

CME Group posted a record level of trading activity across its markets in 2025, hitting an average daily volume of 28 million contracts, up 6% from the prior year. Based on reports, the gains came from a mix of rate products, equity indexes, commodities and a sharp rise in crypto derivatives. Related Reading: Crypto Money […] дальше »

2026-1-6 08:00 | |

|

|

ADA eyes $0.43 despite the geopolitical risks: check forecast

Cardano (ADA) has slightly dipped below $0. 40 on Monday after a rally that allowed it to close above the falling wedge pattern in the previous week. The positive performance is supported by increased participation in the derivatives market, with retail traders optimistic about ADA’s price in the near term. дальше »

2026-1-6 16:10 | |

|

|

Gate Releases 2025 Annual Report: “All in Web3” Gains Momentum, Comprehensive Strength Remains Industry-Leading

In 2025, Gate, a leading global digital asset trading platform, released its 2025 annual report. The report shows that the platform’s global user base has reached nearly 50 million. Both spot and derivatives trading activity increased, with overall market share maintaining a top-tier global position. дальше »

2026-1-5 15:30 | |

|

|

Crypto Derivatives Shakeout: Market Records Lowest Trading Volume In December 2025

The crypto market produced one of its most disappointing performances in the final quarter of 2025, with most large-cap assets ending the year in the red. While prices struggled to make any mark in the last few months of the year, liquidity also continued to seep out of the market. According to the latest on-chain […] дальше »

2026-1-4 22:00 | |

|

|

Binance ETH Open Interest Surges Above $7.1B Amid Heavy Market Repositioning – Details

Amid the cheers of the new year, Ethereum achieved a decisive breakout above the long-standing price resistance around $3,000. According to market analyst Amr Taha, this price gain has been accompanied by significant changes in the derivatives market, which suggest an aggressive shift in investors’ positioning. дальше »

2026-1-4 02:30 | |

|

|

Here’s Exactly Why PEPE Price Exploded 30%

PEPE price surged more than 30% today, pushing its market capitalization above $2. 4 billion and placing the meme coin back at the center of market attention. The move came fast, caught many traders off guard, and was driven by a mix of social momentum, derivatives pressure, and a clean technical breakout. дальше »

2026-1-3 02:25 | |

|

|

Stablecoins, Base and ‘everything exchange’: a look inside Coinbase’s strategy to expand in 2026

Stablecoins and the Base network sit at the core of its plans through 2026. The strategy places Coinbase closer to retail brokerages and derivatives platforms. Security and support concerns remain a constraint as the platform broadens. дальше »

2026-1-2 16:53 | |

|

|

Bitcoin price holds $87K–$89K range as today’s $1.85B options expiry limits breakout

Bitcoin price is hovering in a narrow range as traders stay cautious ahead of a large options expiry, with both spot and derivatives data pointing to lack of a clear directional bet. At press time, Bitcoin was trading at $88,326,… дальше »

2026-1-2 09:01 | |

|

|

Over $2.2 Billion in Bitcoin and Ethereum Options Expire as 2026 Begins

More than $2. 2 billion worth of Bitcoin and Ethereum options are set to conclude today, marking the first broad-based derivatives settlement of 2026. With both assets trading near key strike levels, the event is drawing close attention from traders watching for post-settlement volatility and early signals for the year ahead. дальше »

2026-1-2 08:26 | |

|

|

XRP derivatives open interest surges 80% in four hours as bulls re

XRP derivatives open interest jumped 80% in four hours as traders added leverage, setting up sharper price swings if resistance breaks or gains fade. XRP (XRP) recorded an 80% increase in derivative open interest within a four-hour trading window, according… дальше »

2026-1-1 16:54 | |

|

|

3 Altcoins That Could Trigger Major Liquidations in Early January

Short-term derivatives traders have maintained long positions in several altcoins as of late December. However, without strict stop-loss plans, these positions could face liquidation risks as early as January. дальше »

2025-12-30 00:00 | |

|

|

Bitcoin price discovery shifts to derivatives as spot demand fades

A large crypto trader expanded existing shorts by opening new positions worth approximately $119m in Bitcoin, and other major digital assets on 29 December. The trader placed more than $250 milliThe post Bitcoin price discovery shifts to derivatives as spot demand fades appeared first on AMBCrypto. дальше »

2025-12-29 19:16 | |

|

|

Top 5 Picks: Best Crypto Presale to Invest: DeepSnitch AI, Remittix & More as $86T Derivatives Boom Signals Institutional Wave

Best crypto presale projects positioned for 2026 breakout. DeepSnitch AI crushes presale gains as $86T derivatives volume proves institutions are loading up. дальше »

2025-12-28 01:20 | |

|

|

Ethereum Sees Record-High Activity In 2025 Derivatives Market — Here’s How Much Was Traded

According to the latest market data, Ethereum has seen an annual record of speculative trading activity in 2025. Below is how much was traded in the ETH derivatives market in the past year. Ethereum Futures Trading Hits New Yearly Record In a December 26 post on social media platform X, pseudonymous analyst Darkfost revealed that […] дальше »

2025-12-28 22:30 | |

|

|