Bottoms - Свежие новости [ Фото в новостях ] | |

ICP price triple bottoms as BOB, MSQ push transactions higher

Internet Computer price retreated for the fourth consecutive day as network activity surged following the launch of fair minting protocols in its ecosystem. Internet Computer (ICP) dropped to $7.70, its lowest level since Sept. 9, and 16% below its highest… дальше »

2024-9-18 15:50 | |

|

|

Bitcoin transaction fees hit four-year low amid miner capitulation concerns

Lower Bitcoin transaction fees may signal reduced network activity, posing challenges for miners and potentially indicating market bottoms. The post Bitcoin transaction fees hit four-year low amid miner capitulation concerns appeared first on Crypto Briefing. дальше »

2024-7-10 12:19 | |

|

|

Biden campaign adviser Keisha Lance Bottoms calls crypto bipartisan issue

Keisha Lance Bottoms, soon to be Joe Biden’s senior campaign adviser, told the media that crypto is a nonpartisan issue. On June 27, Bottoms told The Hill that crypto is “a nonpolitical and unifying issue that has received bipartisan support,” adding that crypto has attracted attention from voters across the US. дальше »

2024-6-28 05:00 | |

|

|

Bitcoin miner capitulation: 14 days in, compared to 41-day average over the past 5 years

Quick Take The Hash Ribbon chart by Glassnode is a market indicator that identifies potential bottoms in Bitcoin’s price by analyzing miners’ behavior. Specifically, it suggests that Bitcoin reaches a bottom when miners capitulate, meaning mining becomes unprofitable relative to the costs. дальше »

2024-5-30 19:50 | |

|

|

Hash Ribbon metric signals miner capitulation, possibly marking Bitcoin’s price bottom at roughly $56,500

Quick Take The Hash Ribbon metric by Glassnode, which has marked most of the bottoms in Bitcoin in the past five years, is finally signaling miner capitulation. This technical indicator assumes Bitcoin tends to bottom when miners are forced to capitulate due to mining becoming too costly relative to revenues. дальше »

2024-5-15 16:20 | |

|

|

Surge in Bitcoin to OTC desks potentially marks a local peak

Quick Take The recent stagnation in Bitcoin’s price has been accompanied by a significant influx of Bitcoin (BTC) into the over-the-counter (OTC) trading desks, a trend that has historically signaled the approach of local tops and bottoms. дальше »

2024-5-9 16:38 | |

|

|

Crypto Pundit Lists 4 Altcoins To Buy Once The Bitcoin Price Bottoms

Crypto analyst DonAlt has listed four altcoins he will buy once he believes that Bitcoin’s price has bottomed. The analyst further provided insights into why he is particularly bullish on these altcoins. дальше »

2024-5-4 21:00 | |

|

|

Crypto analysts predict major price gains for Cardano (ADA), VeChain (VET), and Rebel Satoshi Arcade (RECQ)

Despite the bear market bottoms in the crypto industry, analysts have given bullish predictions for three altcoins – Cardano, VeChain, and Rebel Satoshi Arcade to see massive gains this period. Read on to find out why analysts are bullish about these altcoins and their current price movements. дальше »

2024-4-22 16:00 | |

|

|

Bitcoin Correction Is Not Over Yet, Analyst Says BTC Could Hit $120,000 If This Happens

Bitcoin recently rallied as high as $49,000, closely matching the 6. 618 Fibonacci extension level from its 2022 correction lows. This key Fib ratio, based on golden ratio mathematics, often defines upside targets off of significant market bottoms. дальше »

2024-1-23 21:30 | |

|

|

Solana Forms Sell Signal, Decline To $30 Ahead?

Solana is forming a TD Sequential sell signal on the weekly chart right now and this analyst believes a decline to as low as $30 could happen for SOL. Solana Weekly Chart Is In Process Of Forming A TD Sequential Sell Signal The “Tom Demark (TD) Sequential” refers to a popular tool in technical analysis that’s used to pinpoint probable tops or bottoms in the price of any given asset or commodity. дальше »

2023-11-21 18:00 | |

|

|

Pizzino Dismisses Institutions Collapsing Bitcoin Market: “They Need a Buy-Up Low” – Here’s His BTC Outlook

Prominent crypto analyst Jason Pizzino is calling the recent low of BTC the official bottom of the current Bitcoin market cycle. In a recent video update, Pizzino stated, “I’m claiming that as the market cycle bottoms, and I know that there are a lot of people that still don’t believe that the low is in […] The post Pizzino Dismisses Institutions Collapsing Bitcoin Market: “They Need a Buy-Up Low” – Here’s His BTC Outlook appeared first on CaptainAltcoin. дальше »

2023-10-31 19:30 | |

|

|

Chiliz: This update could set the pace for more demand as CHZ bottoms out

CHZ might experience more demand as Chiliz expands to more exchanges. CHZ is ripe for a rally but there is one major factor holding it back. The Chiliz [CHZ] network is currently in its expaThe post Chiliz: This update could set the pace for more demand as CHZ bottoms out appeared first on AMBCrypto. дальше »

2023-8-31 23:30 | |

|

|

Bitcoin Bottom: BTC Not Fulfilling This Historical Pattern Yet

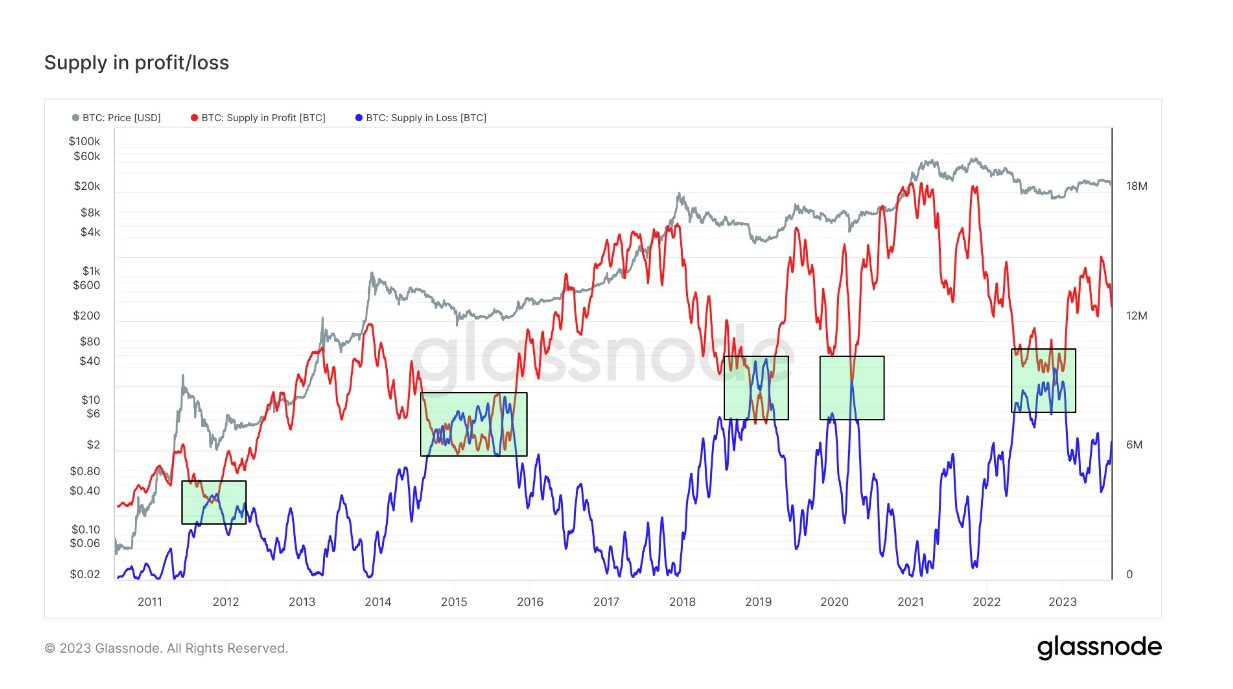

On-chain data shows Bitcoin is currently not satisfying a condition that has historically occurred alongside major bottoms in the price. Bitcoin Supply In Profit Is Still Greater Than Supply In Loss In a new post on X, James V. дальше »

2023-8-25 23:00 | |

|

|

The 5 Best Tools for Fundamentals Based Bitcoin Price Analysis

What is Bitcoin really worth? While the day-to-day BTC price is notoriously volatile, big gains and losses are often driven by speculation and macro events. But what can BTC's fundamentals tell us? In this article, we profile several ‘fundamental’ indicators which have proven useful over the years at signalling tops, bottoms and the start of price trends. дальше »

2023-6-13 16:00 | |

|

|

Bitcoin Retests Moving Average That Marked All Major Market Bottoms

Bitcoin price is falling, crypto is crumbling, and the United States SEC appears to be out for blood. But before a bloodbath occurs across the digital asset market, the top cryptocurrency by market cap is making a stand at a key level. дальше »

2023-6-8 03:03 | |

|

|

Helium bottoms out in oversold territory- here's what investors can expect next

Assessing the prospects of an HNT recovery as sell pressure runs out. A strong bounce-back may not be on the cards following Binance's delisting. Helium’s native token HNT had a rough starThe post Helium bottoms out in oversold territory- here's what investors can expect next appeared first on AMBCrypto. дальше »

2023-3-26 12:30 | |

|

|

Bitcoin Bull Run - 5 Tools for a Fundamentals Based BTC Price Analysis

What is Bitcoin really worth? While the BTC price is up 38% in the last week, gains are being driven by speculation and macro events. So what can BTC's fundamentals tell us? In this article, we profile several ‘fundamental’ indicators which have proven useful over the years at signalling tops, bottoms and the start of price trends. дальше »

2023-3-20 17:00 | |

|

|

KAVA Token Ignores Market Downtrends With Over 10% Daily Gains

Amid the bearish crypto market, the KAVA token emerged as the top daily gainer with a 10. 29% over the past 24 hours. The crypto market is currently dancing to tunes played by the bears as depressing sentiments push coin prices toward bottoms. дальше »

2023-3-10 22:00 | |

|

|

Research: BTC price surge increases miner profitability, indicating market bottom

Glassnode data analyzed by CryptoSlate analysts suggests that rising Bitcoin (BTC) price also increases miner profitability and revenue, which have been historical pointers for market bottoms. The post Research: BTC price surge increases miner profitability, indicating market bottom appeared first on CryptoSlate. дальше »

2023-2-4 22:03 | |

|

|

Bitcoin Ends 2022 With 55% Of Supply In Loss, But Is It Enough For Bottom?

On-chain data shows Bitcoin is about to end 2022 with a peak supply in loss of 55%. Here’s how this value compares with previous bottoms. Around 55% Of Total Bitcoin Supply Has Been Underwater Recently As per CryptoQuant’s year-end dashboard release, this metric reached a value of 60% during previous bottoms. The “supply in loss” […] дальше »

2022-12-29 18:20 | |

|

|

Why Bitcoin Drawdown May Still Not Be Painful Enough For Bottom

The Bitcoin supply in profit metric could hint that the current bear market hasn’t been painful enough yet for the cyclical bottom to be formed. Bitcoin Supply In Profit Has Plummeted To 45% Following Crash As pointed out by an analyst in a CryptoQuant post, all the historical bottoms took place when the profit in […] дальше »

2022-11-18 22:00 | |

|

|

Bitcoin Cash invalidates a potential bullish reversal zone. Should buyers be optimistic?

If you have been eyeing Bitcoin Cash at $110, you may have to wait a little longer. A contagion of risks brewing in the market forced a sharp selloff, pushing Bitcoin Cash to below $110. The level was crucial support, with the token forming multiple bottoms. дальше »

2022-11-12 23:37 | |

|

|

Binance BNB steady above $266 – A quick technical outlook

Binance (BNB/USD) buyers continue to defend $266. The level has become a crucial zone, as the cryptocurrency has formed multiple bottoms. That gives buyers a real chance to thwart bear interest and move the cryptocurrency higher. дальше »

2022-10-21 22:04 | |

|

|

Bitcoin Supply In Profit Continues Decline, But Still Not At Historical Bottom Zone

Data shows the Bitcoin supply in profit has continued its decline, but the metric has still not reached levels as low as the previous bear market bottoms. Around 50% Of The Bitcoin Supply Is In Profit At The Moment According to the latest weekly report from Glassnode, the current profitability levels in the BTC market are still above the 40%-42% values that were observed during historical bottoms. дальше »

2022-10-12 22:00 | |

|

|

Bitcoin Shows Resilience In Dollar-Driven Bloodbath | BTCUSD September 26, 2022

In this episode of NewsBTC’s daily technical analysis videos, we examine the recent resilience in Bitcoin compared to traditional assets like gold, oil, and the S&P 500. We also compare BTC to the DXY Dollar Currency Index and past crypto bear market bottoms. дальше »

2022-9-27 22:54 | |

|

|

Arbitrum: Here's what could be the key to Ethereum L2's organic growth

Ethereum L2s have experienced a resurgence after overcoming past bottoms. Arbitrum is heading this charge after the launch of the Nitro upgrade in September despite a hacking scare. Fixing the last pThe post Arbitrum: Here's what could be the key to Ethereum L2's organic growth appeared first on AMBCrypto. дальше »

2022-9-27 21:00 | |

|

|

5 Tools for a Fundamentals Based Bitcoin Price Analysis

What is Bitcoin really worth? While the BTC price these days appears to be mostly driven by speculation and macro events, this article profiles several ‘fundamental’ indicators which have proven useful over the years at signalling tops, bottoms and the start of price trends. дальше »

2022-9-21 17:00 | |

|

|

WATCH: Bitcoin Bottoms As Easy As Pi? | BTCUSD September 9, 2022

In this episode of NewsBTC’s daily technical analysis videos, we compare past Bitcoin bottoms and tops using the Pi Cycle Bottom and Pi Cycle Top indicator. We also dive into recent comments from John Bollinger, creator of the Bollinger Bands. дальше »

2022-9-10 21:27 | |

|

|

Arbitrum's latest milestone has a lot to do with this upgrade

Ethereum [ETH] L2s are experiencing a resurgence after overcoming June's bottoms. Arbitrum is heading this charge after accomplishing its latest milestone. Daily transactions on the Arbitrum networThe post Arbitrum's latest milestone has a lot to do with this upgrade appeared first on AMBCrypto. дальше »

2022-9-7 18:30 | |

|

|

A bullish Bitcoin trend reversal is a far-fetched idea, but this metric is screaming 'buy'

Non crypto-related factors continue to weigh on BTC price, but a key on-chain metric that called previous market bottoms suggests Bitcoin is severely undervalued. дальше »

2022-8-24 23:38 | |

|

|

Hash Ribbons Give Buy Signal – Has Bitcoin Already Bottomed?

One of the most reliable signals to buy BTC has flashed. Hash Ribbon is an indicator based on the health of the Bitcoin network, which has historically indicated large increases. What's more, in most cases, it has also served to mark macro bottoms in the BTC price. дальше »

2022-8-23 20:00 | |

|

|

STEPN: Should you invest in GMT before 'sneaker season' ends

Many crypto projects have recovered from the crypto winter. STEPN is another project that has shown extensive growth since June's bottoms. The move-to-earn gaming phenomenon has come back to life aThe post STEPN: Should you invest in GMT before 'sneaker season' ends appeared first on AMBCrypto. дальше »

2022-8-9 11:33 | |

|

|

Bitcoin Bounces Off Historic “Mayer Multiple” Bottom Zone

Data shows the price of Bitcoin has broken above the 0. 55 Mayer Multiple level, below which the crypto has historically formed bottoms. Bitcoin Has Now Left The Zone Below 0. 55 Mayer Multiple As per the latest weekly report from Glassnode, the BTC price has escaped above the Mayer Multiple bottom zone. дальше »

2022-7-26 22:00 | |

|

|

Research: Long-term holders possess 80% of all Bitcoins

Numerous metrics could be used to determine cycle tops and bottoms but realized cap HOLD waves are rarely mentioned in the bunch. The post Research: Long-term holders possess 80% of all Bitcoins appeared first on CryptoSlate. дальше »

2022-7-23 14:00 | |

|

|

Аналитики Glassnode указали на признаки формирования дна котировками биткоина

После волн капитуляций в мае-июне 2022 года котировки биткоина уже месяц находятся ниже реализованной цены. Появились и другие сигналы формирования дна, пишут аналитики Glassnode. #Bitcoin is testing the underside of the Realized Price, which has historically been associated with bear market bottoms. дальше »

2022-7-19 12:15 | |

|

|

Bitcoin (BTC) Weekly RSI Shows Signals That Historically Preceded Bottoms

Bitcoin is in the process of breaking out from an important resistance area. This is a movement that's supported by both the weekly and daily RSI. The post Bitcoin (BTC) Weekly RSI Shows Signals That Historically Preceded Bottoms appeared first on BeInCrypto. дальше »

2022-7-18 11:15 | |

|

|

Bitcoin Supply Still Not Underwater Enough For Historical Bear Bottom Zone

On-chain data shows the Bitcoin supply in loss is still around 48%, which is lesser than the values observed during past bear market bottoms. About 52% Of The Total Bitcoin Supply Is In Profit At The Moment As pointed out by an analyst in a CryptoQuant post, BTC may see further decline before a bottom […] дальше »

2022-7-13 22:00 | |

|

|