2024-6-25 04:00 |

South Korea appears to have found itself at a crossroads, engaging with the potential impacts of introducing spot crypto exchange-traded funds (ETFs) into its financial ecosystem.

The Korea Institute of Finance (KIF) recently released a report voicing significant concerns over these financial products. What did they say about ETFs?

Crypto ETFs Could Create Side Effects For South KoreaAccording to the report, while spot crypto ETFs are gaining traction internationally, their integration into South Korea’s economy might result in adverse effects rather than benefits.

The primary apprehensions center around the potential for these funds to siphon off significant capital from local financial markets to the volatile digital currency sector, potentially undermining investment in critical local industries. KIF particularly noted:

Allowing [ETF] products can lead to side effects such as increased inefficiency in resource allocation, increased exposure to crypto-related risks in the financial market, and weakened financial stability

The institute’s report further emphasizes the risk of increased market vulnerability, which could escalate to a crisis within the digital currency sector, leading to broader economic repercussions and eroding investor trust in both the market and regulatory frameworks.

However, despite the gloomy remarks, the KIF concedes that digital currencies could evolve into a viable store of value if they mature into more “defined and regulated” financial assets, thus potentially justifying the future introduction of these ETFs.

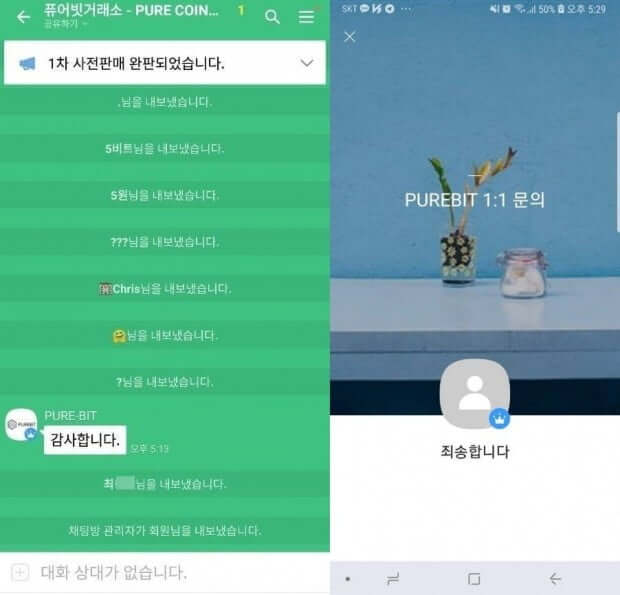

Where Does Crypto Stand In The Country?In related developments, South Korea has taken definitive steps to tighten its oversight of the digital currency market. The enactment of the country’s first crypto-specific user protection law on July 19 marked a significant move towards “safeguarding investors.”

Following this, the Financial Intelligence Unit (FIU) reported a slight decline in the number of digital currencies listed on local exchanges, from over 600 in the first half of 2023 to a slightly reduced count in the latter half.

This regulation mandates that exchanges conduct rigorous reviews of their listed cryptocurrencies every six months, with additional “maintenance reviews” every three months, ensuring compliance with financial regulations and enhancing market stability.

Furthermore, the Financial Supervisory Service (FSS) has directed all registered exchanges to verify whether their listed digital currencies meet strict regulatory standards.

Exchanges like Upbit, Bithumb, Coinone, and Korbit must critically assess the viability of supporting each digital currency asset on their platforms.

In addition to tightening cryptocurrency regulations, South Korean authorities have expanded their oversight to include non-fungible tokens (NFTs), classifying them alongside digital currency as virtual assets.

Featured image created with DALL-E, Chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|