2021-1-15 16:35 |

In another record quarter, the world's largest asset manager saw “unprecedented” demand with $3.3 billion of inflows, which is four times the cumulative inflows seen by Grayscale Investments from 2013-2019.

In 2020, the year was described as a hallmark by Grayscale; the company had $5.7 billion of total investment in its products. Last year, GBTC grew from $1.8 billion to $17.5 billion AUM; this fast growth is an “incredible testament to the maturation of the digital currency ecosystem,” says the company in its 4Q20 report.

Source: Grayscale

GBTC demand actually outstripped the supply as Bitcoin inflows were about 194% of mined Bitcoin in Q4, up from 77% in Q3 and a mere 27% in Q1 of 2020.

Grayscale saw an increase of 128% in the percentage of Bitcoin’s circulating supply that it holds in just a year.

93% of this heightened demand actually came from institutional investors, dominated by asset managers. Their average commitment is also growing “at a significant pace,” up from $2.9 million in the previous quarter to $6.8 mln now.

But it’s not just institutions; Grayscale is now seeing “surging” demand from RIAs, those who advise high-net-worth individuals (HNWI) on investments and manage their portfolios, as well, which is noted as an emerging trend in the last 6 months.

“2020 was the year institutional investors recognized that Bitcoin is a viable option for offsetting the abundance of paper money and the cumbersome nature of gold. In a world with over $17 trillion of negative-yielding debt, we believe Bitcoin will continue to become a cornerstone of investors’ portfolios in 2021,” concluded the asset manager.

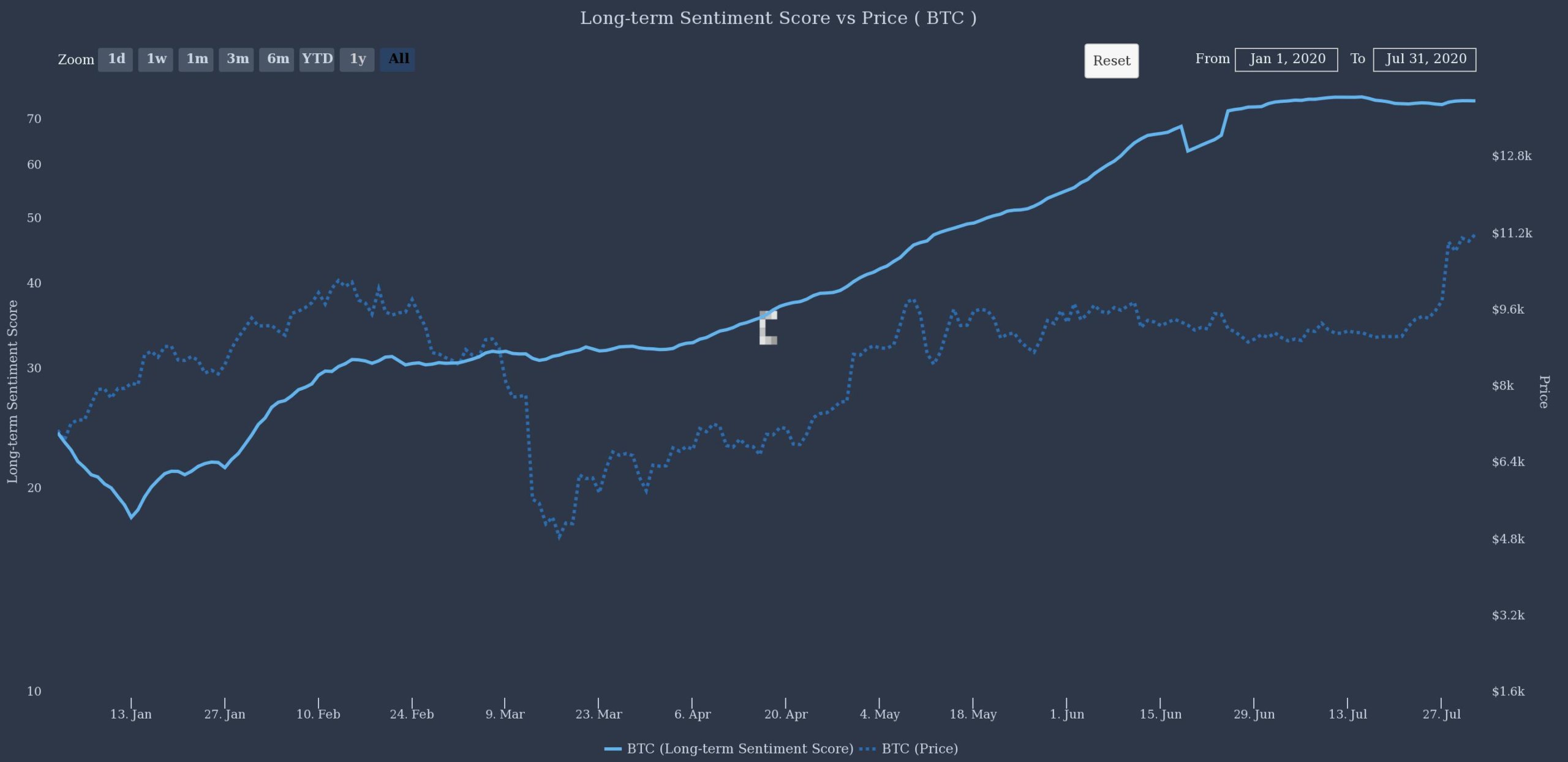

Source: Grayscale – Bitcoin: 2020 Year In Review

As for the company's 2021 outlook, Grayscale sees nation-states following institutions just as RIA because not allowing Bitcoin is now turning into a career risk. Wealth managers advise on approx. $80 trillion in assets, and most have not yet recommended digital assets, it further says.

According to the digital asset manager, Bitcoin rewards could become a significant source of demand for Bitcoin, and major credit card companies will follow in the footsteps of Fold, Lolli, CashApp, and BlockFi.

Besides Bitcoin, Grayscale mentions the emerging Decentralized Finance (DeFi) — “as the search for yield intensifies in traditional markets, we expect major financial firms to consider integrating with decentralized protocols” this year.

Grayscale Investments Buys 2,170 BTC, No ETH Yet While Dissolving XRP Trust Altogether AnTy January 14, 2021 Churchill Management Corp Increases its Ownership in Grayscale's GBTC by 32.9% AnTy January 14, 2021 Grayscale Reopens Deposits for New Investors In Its Crypto Trusts; Excludes Ethereum & XRP Jimmy Aki January 12, 2021 GBTC Added $1.6B in December But Grayscale Hasn’t Purchased Any BTC in Over a Week AnTy January 3, 2021 The post Nation-States to Adopt Bitcoin & Digital Currencies says Grayscale in its ‘Hallmark’ Year Report first appeared on BitcoinExchangeGuide. origin »New Year Bull (NYB) на Currencies.ru

|

|