2018-11-28 19:29 |

Securities exchange operator NASDAQ is looking ahead for a Bitcoin futures listing, as revealed by two people familiar with the matter. NASDAQ believes that the cryptocurrency has sustained market interest, despite the prolonged bearish market this year. The exchange operator has been looking into the Bitcoin futures market since last year but hasn’t provided a formal offering yet.

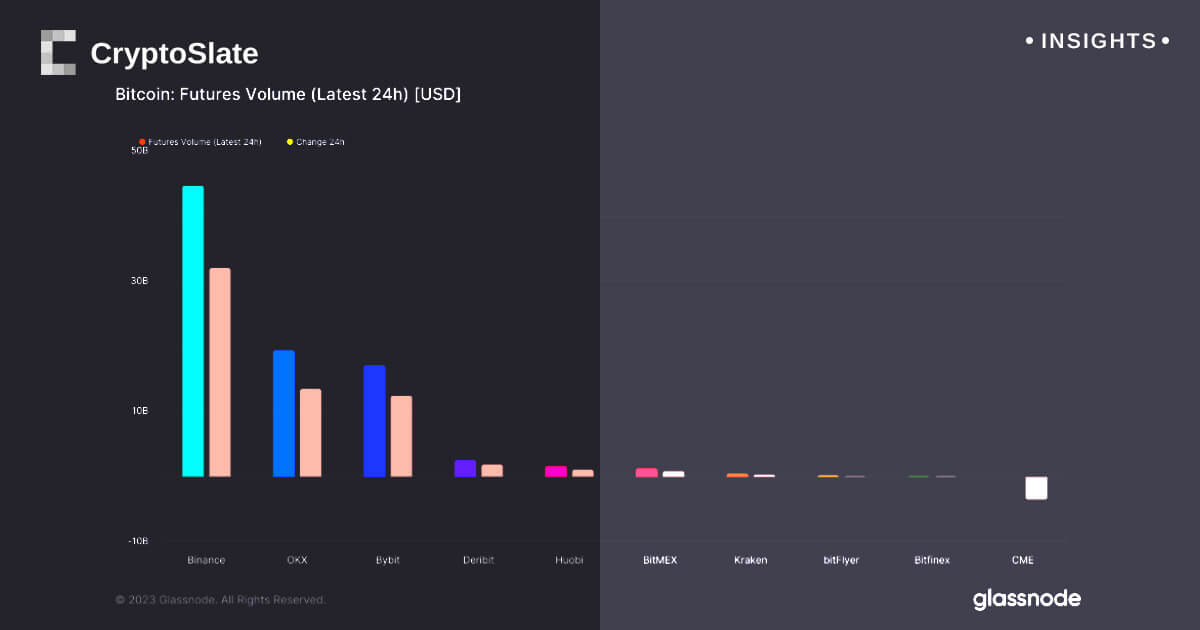

A Bitcoin Futures Listing in 2019?According to sources, NASDAQ doesn’t intend to wait any longer. It could release its Bitcoin futures listing as soon as the first quarter of 2019. The CME Group and Cboe Global Markets have already launched their Bitcoin futures. However, the two futures offerings were introduced around the global crypto craze of December 2017 to January 2018. If NASDAQ investigates a first-quarter 2019 offering, it will be launching its product in the midst of an extremely bearish market where Bitcoin has lost over 75% since its highs.

Not only this, but Bitcoin futures have also failed to drive up institutional investments in the crypto space. Some cryptocurrency exchanges are trying hard to bring institutional investors into the market, but there has been no significant growth in this space.

Will the NASDAQ Offering Be Any Different?NASDAQ CEO Adena Friedman said in January this year that the exchange will try to distinguish its offering from its competitors. The futures listing on NASDAQ will be based on Bitcoin’s price in numerous spot exchanges. Cboe only focuses on only one market.

On the other hand, CME takes prices from four markets into account. The price data will be compiled by VanEck Associates. Note that VanEck is also looking into a Bitcoin futures offering and the SEC is yet to decide the fate of the proposal. It has already declined several of these proposals and SEC chair Jay Clayton recently noted that he wants to see more key developments in the space before being “comfortable” with an ETF.

NASDAQ is not the only big-ticket securities exchange looking into cryptocurrency derivatives. The New York Stock Exchange is also lining up its Bitcoin futures offering. Intercontinental Exchange, the NYSE owner, said last week that it would launch its own contracts on January 24, 2019.

Neither NASDAQ nor VanEck representatives have commented on the development yet.

NASDAQ Will Continue With Its Plan to Launch Bitcoin Futures Despite Drop in Prices was originally found on [blokt] - Blockchain, Bitcoin & Cryptocurrency News.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|