2020-9-2 16:01 |

Bitcoin Press Release: Following a successful audit, Multiplier protocol announces its beta release, as it looks to roll out simplified stable bonds.

1st September 2020, Hong Kong – Multiplier DeFi protocol has successfully completed a full audit by leading blockchain-based form verifier, and cyber security expert Certik. Following approval for its advanced blockchain protocol, Multiplier will commence its DeFi beta release on 2nd September 2020, with the MainNet to follow immediately after. A total of 1 billion MXX tokens will be allocated for minting during the Beta Release.

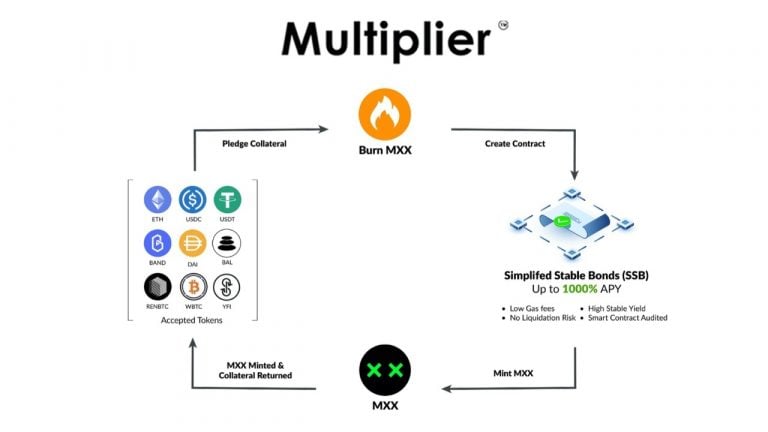

Multipliers DeFi protocol will offer a number of advancements of the technology, including its Simplified Stable Bonds, low gas fees, a high and stable yield, and no risk of liquidation.

Simplified Stable Bonds

Multiplier is now ready to roll out its asset tokenization concept called Simplified Stable Bonds (SSB), resembling a hybrid of traditional bond characteristics blended with digitized assets.

SSB Contracts mint MXX tokens, offering users stable yield for their underlying assets over a period of time. Users can create their own SSB contracts, determining the tenor and interest rates paid on their underlying assets. Deposited assets are not locked and contracts can be redeemed at any time.

Low Gas Fees

Multiplier focused on optimizing coding lines while maintaining protocol integrity, effectively reducing gas fees spent executing smart contracts on their DeFi MainNet.

Surging network use and transaction fees could constitute to a future of which gas fees play an increasingly crucial factor in farming yield.

High Stable Yield

Unlike most platforms with daily fluctuating APY, Multiplier’s yield is fixed for the duration of the SSB contract. This encourages farmers to stay on one platform, instead of fluttering from one platform to another in search of better yield.

No Liquidation Risk

Another key difference between Multiplier and other DeFi platforms, is that there is no risk of liquidation of collateral assets, simply due to the nature of the Bonds market as opposed to lending and borrowing markets.

Audited DeFi Protocol

Multiplier’s DeFi protocol is open-sourced, verifiable and has been audited by leading blockchain cybersecurity and smart contract auditor, CertiK. Multiplier MXX governance tokens are currently listed on Uniswap, Balancer and Bilaxy Exchange.

Learn more about Multipliers advanced DeFi protocol – https://multiplier.finance

Join the community discord server at – https://discord.gg/2fatBM7

Join the official Multiplier Telegram channel – https://t.me/themultiplierio

Follow on Twitter – https://mobile.twitter.com/MultiplierMXX

Media Contact Info

Contact Name: D.R Dudley

Contact Email: [email protected]

About Bitcoin PR Buzz: Bitcoin PR Buzz has been proudly serving the crypto press release distribution needs of blockchain start-ups for over 8 years. Get your Bitcoin Press Release Distribution today.

Multiplier is the sole source of this information. Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. This press release is for informational purposes only. The information does not constitute investment advice or an offer to invest.

The post Multiplier DeFi (Beta Release) Targets Tokenized Bonds appeared first on Bitcoin PR Buzz.

Bitcoin PR Buzz - Massive Exposure For Bitcoin Services, Projects, and Merchants

Similar to Notcoin - Blum - Airdrops In 2024

RELEASE COIN (REL) на Currencies.ru

|

|