2023-6-29 16:15 |

On Wednesday, 28 June, MicroStrategy founder Michael Saylor revealed that the renowned firm purchased 12,333 Bitcoin between 29 April and 27 June, spending $347 million. The latest buy saw the company strengthening its crypto holding. MicroStrategy acquired its BTC assets at $28,136 average price.

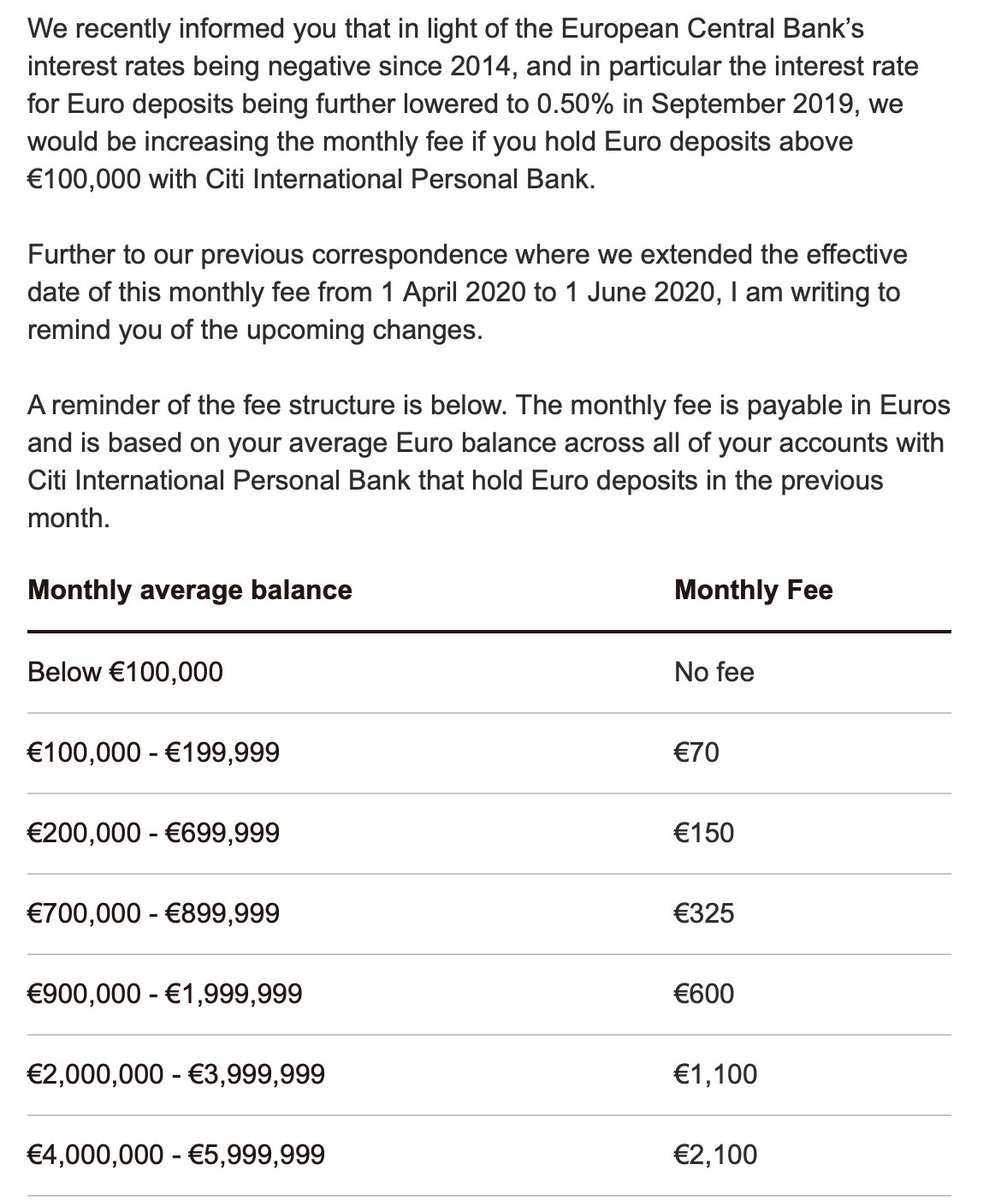

MicroStrategy has acquired an additional 12,333 BTC for ~$347.0 million at an average price of $28,136 per #bitcoin. As of 6/27/23 @MicroStrategy hodls 152,333 $BTC acquired for ~$4.52 billion at an average price of $29,668 per bitcoin. $MSTR https://t.co/joHo1gEnR0

— Michael Saylor⚡️ (@saylor) June 28, 2023MicroStrategy now has 152,333 Bitcoins, worth more than $4.6B at prevailing prices. The firm is among the largest BTC hodlers. Moreover, MicroStrategy has remained resilient despite challenges plaguing the crypto space.

While Michael Saylor has been supporting the leading crypto, even backing BTC’s layer2 platform Lightning Network, the latest Bitcoin buy shows the company’s trust in the asset.

Bitcoin sees increased institutional interestBitcoin has witnessed increased attention ever since BlackRock filed for a Spot Bitcoin ETF. The leading crypto asset gained an upside momentum as more financial giants followed BlackRock’s move. BTC surged more than 20% within one month.

The latest stats show Bitcoin recorded surged institutional participation. For instance, ProShare’s futures inflows hit a seven-day high of $65M last week (invezz.com news). MicroStrategy’s latest announcement further cements institutional inflows into the asset.

Bitcoin priceCryptocurrency prices remained relatively calm on Wednesday, with leading assets by market cap flashing minor declines. Bitcoin traded at $30,189 at press time, losing 1.34% in its 24-hour chart. The bellwether crypto remained stable over the past week, gaining over 4%.

While the top cryptocurrency battles to stabilize beyond $30K, analysts remain optimistic, forecasting explosive moves for Bitcoin. Analyst expects a breakout anytime soon, forecasting $33K. Increased attention from institutional investors signals potential surges in Bitcoin price. Nonetheless, time will tell.

or you can say it already has and it i coming back down to retest the Pennant.

If we do retest it and break to the upside we could easily see a 33k #bitcoin ..

But, we know the tricks of bitcoin, break out of the bullish pennant but fake out to come down to close below, only… pic.twitter.com/8Rfq63Umrs

The post MicroStrategy buys Bitcoin worth $347M to strengthen its crypto holding appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|