2018-6-17 05:20 |

Cryptocurrency markets are steadily coasting along after suffering from some volatile low swings last week. Over the past 24 hours, most cryptocurrencies are still in the red nurturing losses between 1-3 percent, and a few are in the green by a few percentages. At the time of publication, the price of bitcoin cash (BCH) is hovering around $850 per coin. Meanwhile, bitcoin core values are meandering just above the $6,500 region.

Also read: William Shatner Joins Bitcoin Mining Project, Admits He Doesn’t Quite Get It

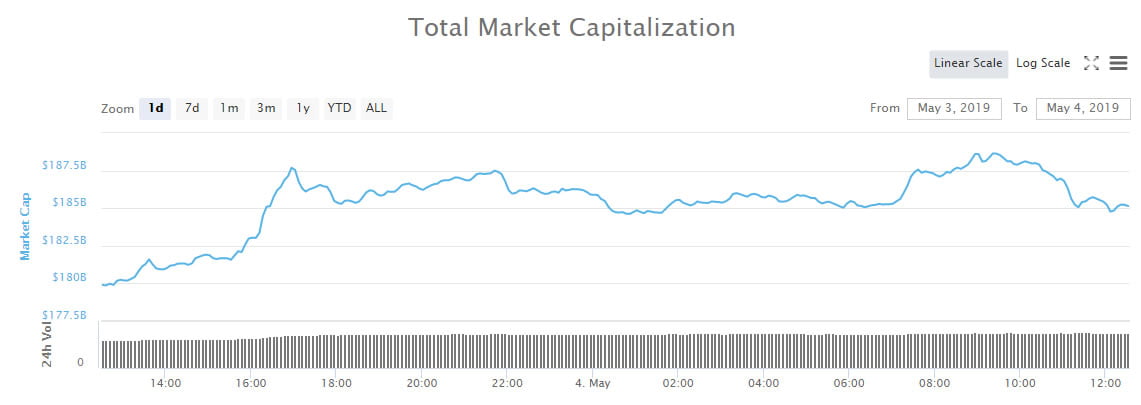

SEC Announcement Adds Second Wind Into the Cryptocurrency Market SailsSince last week’s ‘Bloody Sunday’ cryptocurrency market have seen some slight recovery but not by much. Markets were dropping pretty low up until the U.S. Securities and Exchange Commission (SEC) revealed cryptocurrencies that are decentralized are not securities. After the SEC’s head of the Division of Corporate Finance, William Hinman, made these statements digital asset markets saw a small rally and this push has kept markets from drawing lower, at least for a short period of time. The overall market valuation for all 1600+ cryptocurrencies is currently worth around $280Bn USD and 24-hour trade volume for the entire lot of digital currencies is $10.8Bn.

BCH Market ActionBitcoin cash markets have steadily held above the $840 – $855 region over the past few hours with around $303Mn in 24-hour trade volume. Just like before last week’s dump, trade volume is pretty flat and action has simmered down over the past day. The top exchanges swapping the most BCH today are Okex, Exx, Hitbtc, and Bitz. Bitcoin core (BTC) currently represents 48.8 percent of the trades swapped with BCH today. This is followed by tether (USDT 28.8%), USD (13%), KRW (4%) and ETH (2%). As of this writing, one BCH is equivalent to 0.1309 BTC, and bitcoin cash is the fifth highest trade volume.

BCH/USD Technical IndicatorsThe daily and 4-hour charts on Bitfinex show that BCH bulls have some resistance ahead in order for the markets to progress upwards. The two Simple Moving Averages (SMA) on the 4-hour BCH/USD chart show the short-term 100 SMA is above the long-term 200 trendline.

The two SMAs recently crossed hairs and this indicates a move to the upside could be in the cards. Both the Relative Strength Index (RSI) oscillator (54) and the MACd show deep consolidation and a touch of uncertainty. Looking at order books shows BCH bulls have some solid resistance past the $870 mark and some more between $900 – $950. On the backside, stronger foundations have been built up over the past few days and BCH bears will see some pit stops around $825 and $775.

BTC Market ActionAs mentioned above, bitcoin core markets have been hovering just above the $6,500 territory for most of today’s trading sessions. Trade volume over the past 24 hours for BTC is around $3.1Bn and the overall market capitalization today is $111Bn. The top five exchanges by BTC trade volume on June 16 are Bitfinex, Coinbase, Bitstamp, Kraken, and Neraex. The Japanese yen today is dominating BTC trades today by over 71 percent. This is followed by tether (USDT 14.3%), USD (9.1%), KRW (1.6%), and the EUR (1.3%). Currently, BTC dominance amongst all the other markets is 39.9 percent.

BTC/USD Technical Indicators4-hour and daily charts for GDAX and Bitstamp’s BTC/USD markets show quite a bit of consolidation as well. We can see from this chart that the two SMAs have also crossed paths with the 100 SMA just above the 200 SMA trendline. This indicates the path of least resistance will be towards the upside, but much like the BCH/USD 4-hour chart the gap is small, and the two could easily cross again.

RSI levels are the same as well (52) and the MACd looks to be heading southbound soon. The current resistance zone for BTC bulls is between $6650 and $6775 (20 and 50 MA) at press time. On the back side, bears will meet resistance between 6400 and 6200 and significant foundational buy support beyond that. If things were to go into the sub-$6K region, the $5K region will likely hold for a very long time. However, at any time between this vantage point and that theoretical region, we could see a strong impulse leg upward.

The Top Cryptocurrency MarketsOn Saturday, June 16 the second highest valued market held by ethereum (ETH) is up 1.7 percent and one ETH is averaging around $500. Ethereum values over the last seven days are down 14 percent. Ripple XRP markets are down 0.4 percent over the last 24-hours and down 18 percent during the course of the week. One XRP is trading for $0.53 cents per token. The fifth largest market, EOS, is up 0.12 percent and down 23 percent over the last seven days. The EOS token is trading for $10.67 and the currency holds the fourth highest trade volumes today.

The Verdict: Skepticism Remains StrongThe verdict this weekend still leans towards the bearish side taking into consideration the current charts, but mostly, market volumes have been considerably low. The SEC news helped add some positivity to an otherwise extremely gloomy week as far as markets were concerned. Traders are likely to remain skeptical for the time being until some bullish signals appear. The good news is markets have found support once again but where it will take us from here is hard to say.

Where do you see the price of BCH, BTC, and other coins headed from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Crypto Compare, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: SEC Adds a Brief Market Spike — But Will It Last? appeared first on Bitcoin News.

origin »Bitcoin (BTC) на Currencies.ru

|

|