2023-5-25 20:32 |

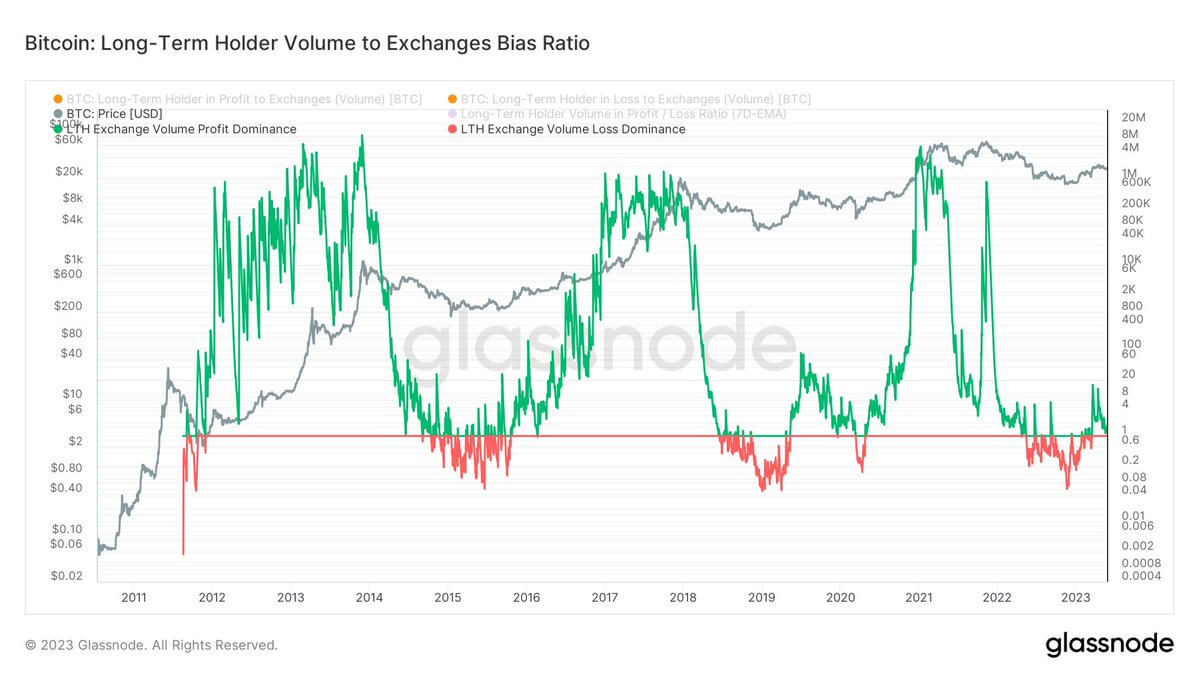

Quick Take The Bitcoin Long-Term Holder (LTH) volume-to-exchanges bias ratio shows LTHs are sending greater volumes of coins in profit to exchanges relative to coins in loss, denoted by the green. LTH volume-to-exchanges bias ratio is currently at 1.73, according to Glassnode data as of May 25, which shows a slight dominance in terms of long-term holders sending coins to exchanges at a profit. Long-term holder supply recently hit an all-time high of 14.463M, as reported by CryptoSlate on May 19. When the ratio is red, usually during bear markets, it shows that LTHs are sending greater volumes of coins in loss to exchanges relative to coins in profit. The bear market bottom occurred in November 2022 in this cycle, and a similar pattern emerged in 2016 and 2019 when the ratio of one was tested and it could be re-tested multiple times. For the current cycle to be deemed a new bull market, the dominance ratio has to stay positive. LTH Vol to exchange: (Source: Glassnode)

The post Long-term holders’ bias ratio hints at Bitcoin’s potential return to bull market appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ratio (RATIO) на Currencies.ru

|

|