2019-10-16 18:50 |

Layer1, a cryptocurrency infrastructure platform, has secured $50 million in series A funding in a bid to revolutionize the bitcoin mining space in the U.S.

According to a Layer1 blog post published on October 15, 2019, the funding (which values the company at $200 million) came from legendary investor Peter Thiel, among others.

This isn’t the first time that Layer1 has accessed external funds to bankroll its operations. In December 2018, the company successfully raised $2.1 million in seed funding from Thiel, venture capital firm Digital Currency Group and others. At the time, the company was looking to use the funds to enhance the development of programmable money and store-of-value applications.

But Layer1’s objectives have shifted somewhat since 2018. According to the blog post, the money raised from this latest funding round will go to the development of full-stack mining infrastructure, including the development of proprietary liquid-cooled mining containers and ASIC chips.

Bitcoin Mining in TexasLayer1 would be incorporating its mining venture in West Texas, pointing out that the state has a combination of friendly regulations, competitive electricity prices and sufficient renewable energy.

“The future of Bitcoin mining lies in the heart of the United States: Texas,” the blog post reads. “This is where world-class electricity prices, friendly regulation, and an abundance of renewable energy sources meet. It is here that we are rapidly scaling our mining operations to bring as much hash rate as possible back to the United States.”

With the funding, Layer1 plans to own the production line, from design to production, and operation of the mining gear, as well as power procurement.

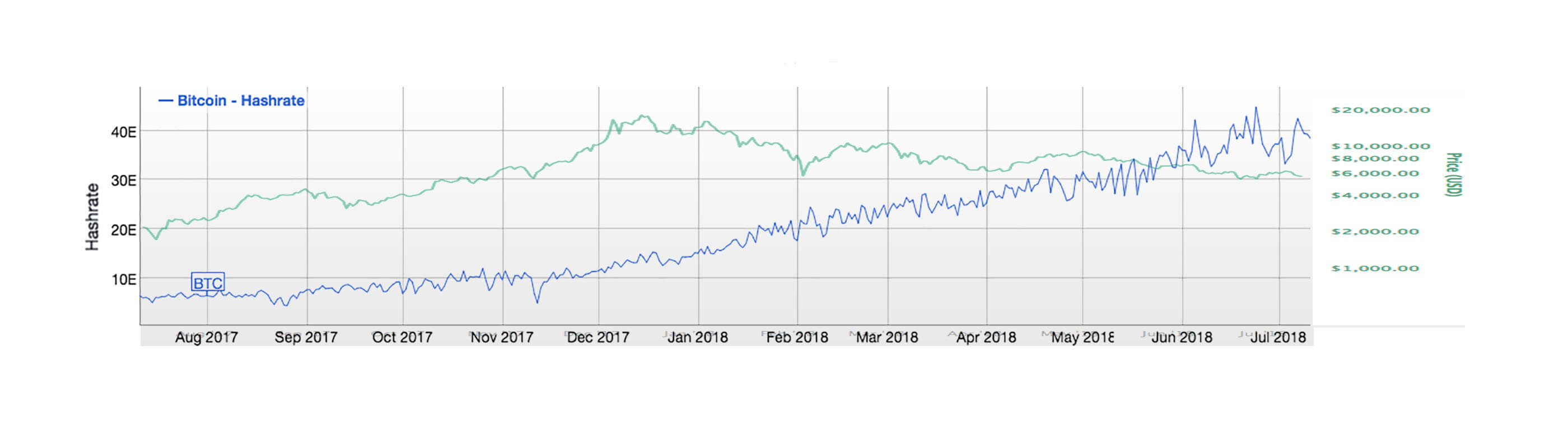

Reclaiming the Bitcoin Hash RateBesides effectively leveraging renewable energy, Layer1’s ultimate goal is to rebalance the global Bitcoin network hash power. As the company pointed out in its blog post, China dominates when it comes to bitcoin mining and the production of mining gear. Layer1 believes it can change the narrative.

So far, China seems to have a firm hold on the bitcoin mining scene. In October 2018, a report by Princeton University and Florida International University revealed that up to 74 percent of the global bitcoin mining power resides in China. The dominance of China can be largely attributed to the influence of local mining rig manufacturer Bitmain.

The mining giant has thrived in the space for years, benefiting from the cheap electricity available in its home country. However, the company has also endured some hard times of late, with the “crypto winter” of 2018 eroding a large chunk of its profitability.

Mining in North AmericaThe bitcoin mining landscape is changing, however, especially in North America. In August 2019, Blockstream opened flagship mining facilities in Quebec and the state of Georgia. To use the facilities, clients send in their miners and Blockstream manages the operation for a fee.

Hut8 has also been expanding its operations into Canada, with two mining sites in the province of Alberta, which leverage 85 BlockBox AC centers — 56 in Medicine Hat and 29 in Drumheller.

As for advances in renewable energy, Pluton Mining recently raised major investment capital to produce mining farms driven by solar power in Western Mojave, California. The 50-acre project will use photovoltaic panels, with 200 to 400-plus watts capacity per panel, that the company hopes to install for less than $1 per watt to initially produce 10 to 12 megawatts of energy. At full capacity, using all 50 acres, the company is hoping to generate up to 45 megawatts.

The post Layer1 Secures $50M in Funding to Rebalance the Global Bitcoin Hash Power appeared first on Bitcoin Magazine.

origin »Bitcoin (BTC) на Currencies.ru

|

|