2020-6-9 20:00 |

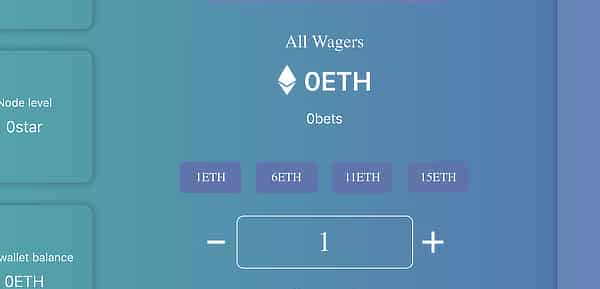

To some people, it would appear as if Ethereum’s smart contract and dApp industry is thriving. Others see the space being dominated by transparent Ponzi Schemes and a stablecoin, hinting at little innovation.

The actual use cases for smart contracts remain somewhat limited.

Smart Contracts Remain a Niche IndustryMore specifically, smart contracts have tremendous potential, assuming someone can develop a project that will gain traction.

So far, that has proven much easier said than done.

Looking over Ethereum’s dApp and smart contract statistics, things are not looking overly convincing.

The top 4 projects ranked by value and volume are Tether’, a Scam, and two Ponzi Schemes.

Not necessarily a list that will get speculators and onlookers excited by any means.

One also has to wonder why this situation is in place

It is not an issue native to Ethereum either.

Any blockchain with smart contract functionality will attract these types of dApps and projects.

Building real applications that serve a purpose in everyday life is an ongoing challenge.

Whoever can break this code first may help elevate the cryptocurrency and blockchain industry to a whole new level.

For now, it seems unlikely that anything major will change, yet one never knows what the future may hold.

Image(s): Shutterstock.com

The post Lack of Real-world Use Cases Prevents Smart Contracts From Moving Beyond Stablecoins and Ponzi Schemes appeared first on NullTX.

origin »Bitcoin price in Telegram @btc_price_every_hour

SmartCash (SMART) íà Currencies.ru

|

|