2022-8-2 04:01 |

Uppsala, a blockchain security service provider for crypto AML/CTF, transaction risk management, regulatory compliance, and transaction tracking, has announced today that it has signed a contract to supply digital asset AML solutions to KODA (Korea Digital Asset), a South Korean crypto exchange.

Through the contract with Uppsala Security, KODA will receive full access to Uppsala Security’s Threat Intelligence Database (TRDB), Crypto Analysis Transaction Visualization (CATV), and Crypto Analysis Risk Assessment (CARA) tools.

KODA is a digital asset custody service company established by Kookmin Bank (KB), South Korea’s largest bank, based on technology provided by blockchain developer Haechi Labs and in association with Hashed. The company provides a one-stop digital asset custody service specialized in corporations and institutions and has signed Wemade as its first customer.

By becoming an active user of Uppsala Security’s Threat Intelligence data hub (TRDB), KODA can strengthen its Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) fund monitoring functions by checking and reviewing in advance whether the wallet addresses of the deposited funds are blacklisted wallets related to the Dark Web or hacking/financial crimes.

In addition, Uppsala Security’s CARA tool, which uses Artificial Intelligence (AI) and Machine Learning (ML) mechanisms to detect various on-chain transaction patterns based on blacklisted wallet addresses behavior, helps with associating a risk level to wallet addresses that are not labeled yet in Uppsala Security’s Threat Intelligence data hub (TRDB), so that the risk of interacting with suspicious wallets can be mitigated and categorized in advance by grading them.

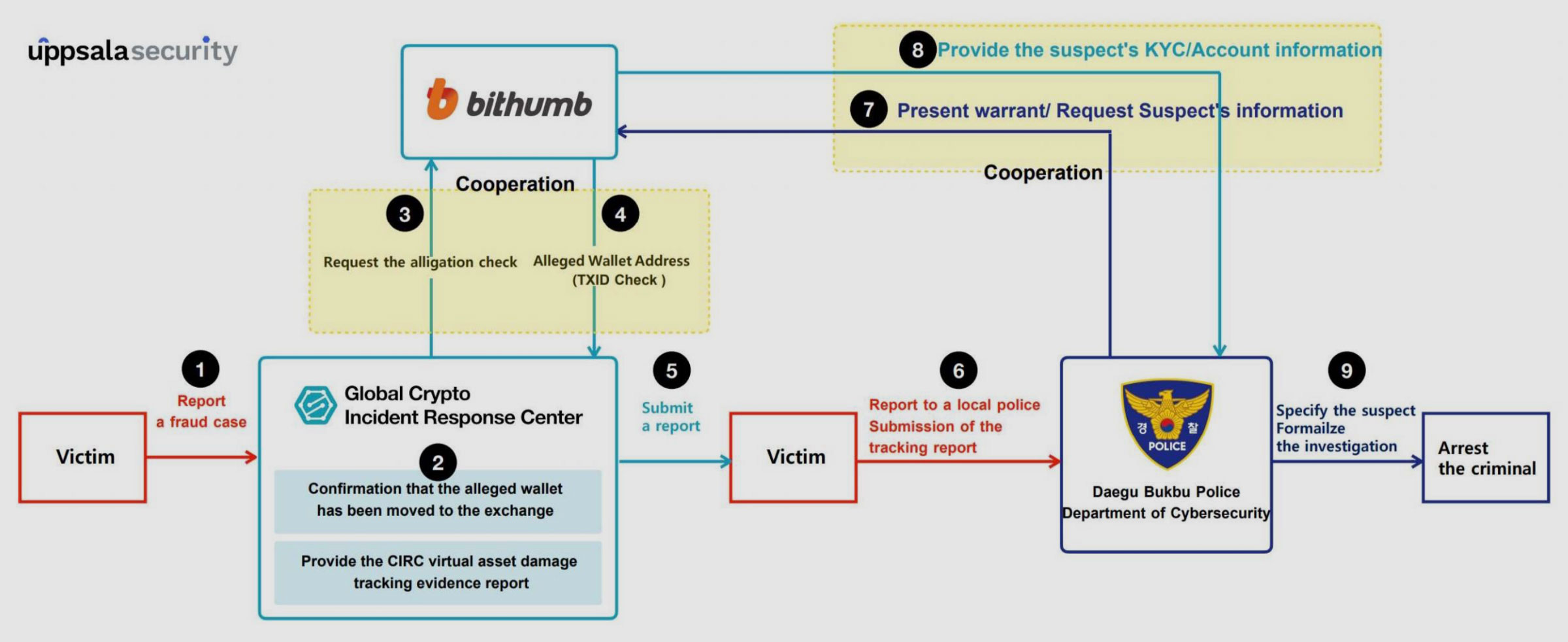

Uppsala Security also explained that if virtual asset transactions involved in crimes such as fraud are discovered at a later time, wallet transaction flows can be tracked and monitored in real-time through the Virtual Asset Tracking Security Solution (CATV) to further strengthen Regulatory Compliance and prevent virtual asset Money Laundering.

According to Uppsala Security, the company is currently working full steam ahead on developing a completely new leading-edge digital asset Fraud Detection System (FDS) solution that can block high-risk transactions in advance by pre-checking the risk of a large number of wallet addresses with just one click.

“KODA’s AML and internal control security system are already operating at the level of the existing financial sector and industry’s requirements, but we expect to be able to handle digital assets above the Government’s regulatory standards by additionally introducing Uppsala Security’s Anti-Money Laundering and Transaction Tracking solutions. We are also reviewing the introduction of a digital asset-specialized FDS solution that Uppsala Security will soon launch.”

– Ko Young-joo, Chief Information Security Officer (CISO) at KODA

The post Korean crypto exchange KODA to use Uppsala to boost AML and threat detection appeared first on CryptoNinjas.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|