2023-6-1 21:44 |

Bitcoin’s volatility persisted on the final day of May as prices continued to drop amidst a broader pullback in the crypto market.

Last Sunday, Bitcoin showed signs of recovery with a 4% surge, reaching $28,400. However, the gains were short-lived, and over the past three days, the price retraced, wiping out more than half of the previous gains and potentially setting the trend for June.

Nevertheless, despite the sharp price drop, several key metrics within the Bitcoin market indicate the potential for a bullish trend. On Tuesday, pseudonymous analyst “Cryptohell” from onchain analytics firm Cryptoquant highlighted the declining supply of BTC circulating on exchanges, a key indicator of a potential bull run.

In a post on the firm’s website, the pundit noted that since May 1, 2023, the exchange reserve metric had experienced a substantial decline, indicating a reduction in the amount of Bitcoin held on exchanges.

“At least the amount of Bitcoin circulating on exchanges has decreased in the past month. Specifically, if we calculate based on the Exchange Reserve USD metric, it indicates that exchanges have lost approximately $7 billion worth of Bitcoin,” he wrote.

Furthermore, the pundit highlighted the deposit trend, which also exhibited a decline throughout the past month. He also analyzed historical transaction data from July 2019, concluding that it revealed a similar decrease in deposit transactions preceding a BTC price increase that preceded the May 2020 halving event. Based on these findings and considering the upcoming halving, Cryptohell concluded that these findings suggest a potentially positive market trend.

Another analyst from the same company, known as “onchain”, pointed out the UTXO Value Bands indicator, a tool to measure how much Bitcoin large investors are accumulating. This indicator looks at the different values of Bitcoin being held and helps identify trends in the overall Bitcoin supply. When there is an increase in the percentage of Bitcoin held in the +10K BTC band, it means that significant investors are accumulating more Bitcoin. The pundit shared a chart showing that the number of Bitcoins held in this band has increased from 1,742,300 BTC to 1,774,200 BTC, suggesting a potential increase in demand and a subsequent price rise.

Echoing the sentiment of cautious accumulation, onchain analytics firm Santiment tweeted on May 30 that addresses holding between 10 and 10,000 Bitcoins have accumulated a combined total of 93,000 BTC during the price fluctuations witnessed between $26,000 and $30,000 over the past month.

That said, despite the decline in price and the numerous fluctuations in the market, these crucial metrics indicate the possibility of a bullish trend for Bitcoin. Investors are thus likely to consider these indicators alongside their other price analysis tools to gain valuable insights into the cryptocurrency’s price trajectory.

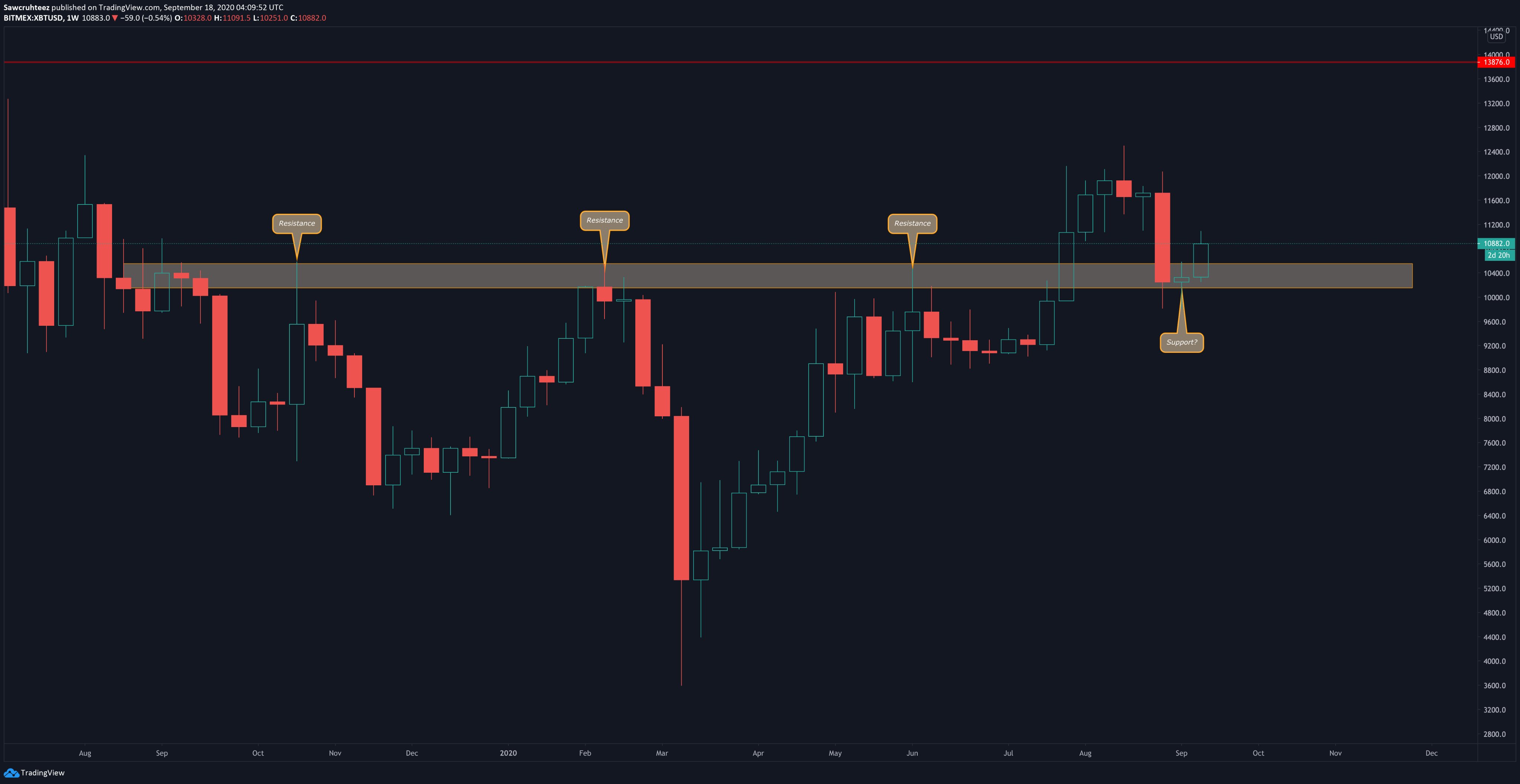

BTCUSD Chart by TradingViewAt press time, Bitcoin was trading at $27,068, down 3% over the past 24 hours, according to data from CoinMarketCap.

Similar to Notcoin - Blum - Airdrops In 2024

Dropil (DROP) на Currencies.ru

|

|