2020-12-10 00:10 |

In JPMorgan’s usual predictions on gold and crypto markets’ shift, the famous American Wall Street bank said the rise of cryptocurrencies in mainstream finance would keep coming at the expense of gold.

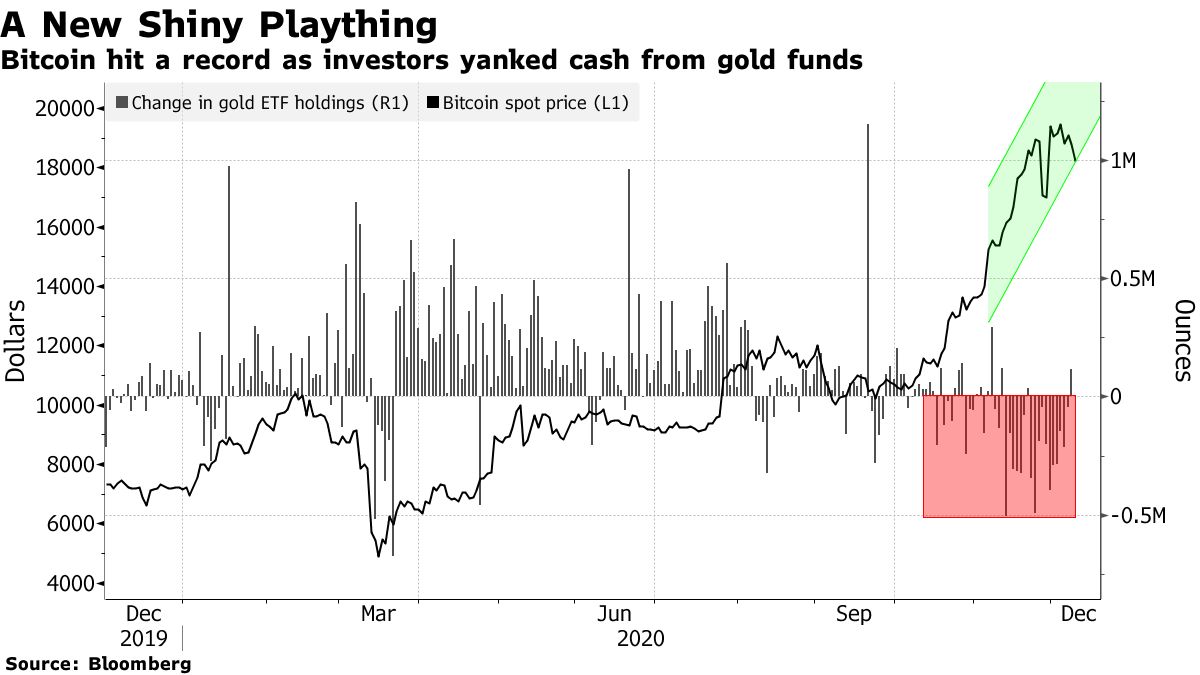

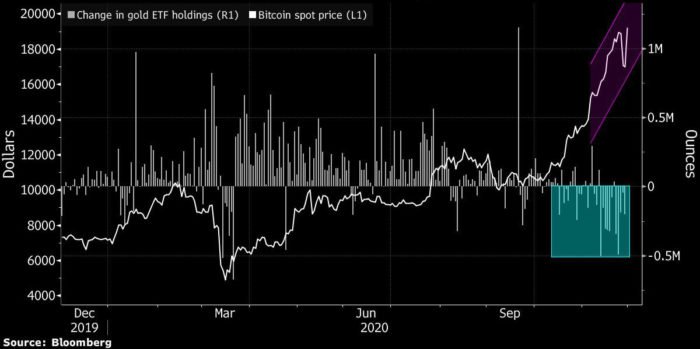

Following a review from the bank’s quantitative strategists, it cited that there has been an increasing outpour of funds into Bitcoin since October. Still, the case has been the opposite for gold. This trend would continue to reign as more institutional investors continue to adopt cryptocurrencies, the bank stated.

JPMorgan’s strategists’ statement on the subject reads, “The adoption of bitcoin by institutional investors has only begun, while for gold its adoption by institutional investors is very advanced.”

Gold’s Future at StakeThe bank’s quest on what lies ahead for gold has geared it in making further analysis from Grayscale Bitcoin Trust, a listed fund popular with institutions.

Grayscale Bitcoin Trust unveiled inflows of almost $2 billion since October; meanwhile, exchange-traded funds backed by gold have seen outflows of $7 billion since the stated date. This suggests a bad future for gold.

The bank suggested that a thin means of survival for Gold holders is to buy one Grayscale unit and sell three units of the SPDR Gold Trust. This is because shifting gold’s allocations to Bitcoin would only mean the transfer of Billions in cash.

JPMorgan says, “If this medium to longer term thesis proves right, the price of gold would suffer from a structural flow headwind over the coming years.”

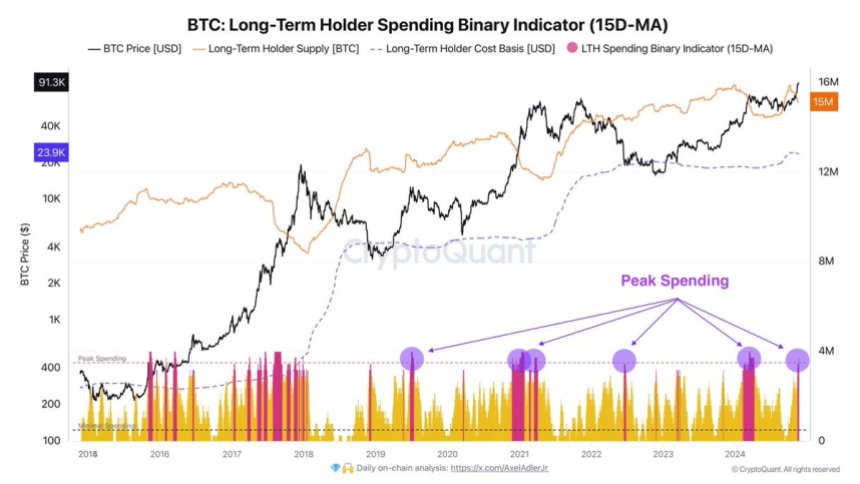

Gold Could Get a Chance to RecoverAccording to JPMorgan, investors that trade on price trends could sell their Bitcoin in the short run.

There is a tendency that Bitcoin prices have overshot as momentum signals have depreciated. This could mean a fair recovery for gold within the short space.

Similar to Notcoin - Blum - Airdrops In 2024

Golos Gold (GBG) íà Currencies.ru

|

|