2022-11-24 01:03 |

The crypto industry has a well-deserved reputation for changing in the blink of an eye. This month, in the space of just a couple of weeks, we’ve witnessed the centralized crypto empire unravel before our very eyes.

It began with the stunning collapse of FTX, and the shockwaves created a ripple effect that led to several other major players, notably BlockFi and perhaps Genesis and Gemini, all imploding as the crypto community rushed to get its funds out of centralized exchanges into somewhere safe.

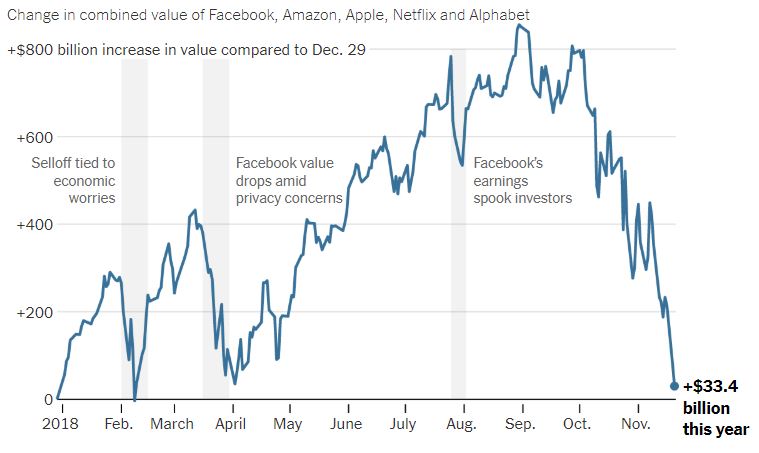

The turmoil resulted in the prices of Bitcoin and virtually every other crypto asset declining by more than 10%. But though it may feel like doomsday within the crypto industry right now, if we take a step back, we can see that it might play out differently from what the early panic seemed to have suggested.

The one commonality of all these major crypto players is centralization. So-called centralized finance (CeFi) might look similar in appearance to decentralized finance (DeFi) but it’s actually a very different beast. Whereas DeFi is all about self-sovereignty, CeFi refers to projects – or really profit-making businesses – in the crypto space that holds authority over their user’s assets.

When you leave funds in a CeFi platform, you don’t actually control them. Instead, you’re leaving them in the hands of the people who own that platform, and they’re free to use them in any way they see fit.

The liquidity issues that caused FTX to file for bankruptcy can be attributed to its control, power and governance of its user’s assets. Centralization means users are subject to manipulation. In the alternative world of DeFi, that can’t happen because there’s no central authority running the show from behind the curtains. Asset ownership remains firmly in the hands of the users. DeFi alternatives are, therefore trustless and immune to the greed and recklessness of centralized institutions.

This key difference between CeFi and DeFi has become only too apparent in the last few days. While major tokens fell to new yearly lows as a result of the turmoil caused by FTX, there has been a surge of interest in tokens tied to DeFi platforms. According to Delphi Digital, DEX tokens have strongly outperformed CEX tokens – its DEX basket of tokens was up by +24% vs. the equivalent CEX basket, which was down by -2% since November 11th.

With centralized exchanges once again showing that they just cannot be trusted, decentralized exchanges have benefited from a strong influx of crypto users looking for safety.

Evidence of this trend can also be seen in Polkadot, a blockchain project that has long advocated the benefits of decentralization. New data from Dot Insights, an initiative that tracks the Polkadot and Kusama blockchain ecosystems, shows that Polkadot has witnessed a sharp spike in user activity recently.

For instance, the number of new Polkadot accounts has risen by more than 900% in November. At the same time, the number of active accounts has jumped by more than 300%, from around 1,100 to 4,516 at the last count. Crypto users are clearly looking for a safe haven for their funds, and there’s nothing safer than self-custody, hence the growing interest in decentralized platforms.

Polkadot is a natural destination, as its creator Gavin Wood has long been one of the most vocal proponents of decentralization and self-sovereignty of funds. While Binance’s founder Changpeng ‘CZ’ Zhao has been attacking FTX’s Sam Bankman-Fried on Twitter, calling him a psychopath and a bad player, Wood simply observed that it’s not the individual in question that is the problem, but rather the whole concept of centralization that enables such individuals to prosper.

CZ on SBF:“No one can protect [from] a bad player, to be very frank, if a guy is very good at lying, and very good at just pretending to be what he’s not.” Not been paying attention? Protection comes thru decentralisation. That’s the point of web3 and trustless tech. @cz_binance

— Gavin Wood (@gavofyork) November 15, 2022It’s too early to tell if this episode spells the end for centralized platforms in crypto, but recent trends over the last few days suggest that we’re seeing a clear and conscious shift. A lot of people needed a lot of prodding to be convinced about the merits of crypto in the first place, and now those same people are just beginning to understand the true purpose of what they’ve gotten into. With that, a much-needed departure from CeFi to the world of DeFi and true self-sovereignty is finally picking up steam.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Emerald Crypto (EMD) íà Currencies.ru

|

|