2021-3-27 20:35 |

Over the past few months, there’s been a boom in demand for non-fungible tokens (NFTs) in tandem with the growing cryptocurrency market. However, this rise in demand has not gone unnoticed as venture capital firms have poured over $90 million in NFT projects so far this year representing a sharp 150% increase from NFT projects’ investment last year, a CNBC report states.

According to Pitchfork, Sorare, a blockchain-based football digital collectibles game, has raised the most from VCs this year, $48.8 million, including Accel, Benchmark, and former Manchester United F.C. defender, Rio Ferdinand.

Andrei Brasoveanu, a general partner at Accel, labeled the expansive growth of NFTs as “one of the most exciting tech developments” shortly after the “record-breaking” investment became public. Brasoveanu further stated,

“It’s one of those developments that have mass-market appeal and could potentially impact a world outside the crypto niche.”

Notwithstanding, reports have linked popular NFT marketplace, OpenSea, which has previously sold some of the top-selling NFTs, with a possible $250 million raised at $2 billion valuations. The DApp creator, Dapper Labs, raised $23 million in a seed funding round for OpenSea led by Andreessen Horowitz in 2020.

Dapper Labs is well-known for its NBA Top Shot application that creates and sells to users NBA players’ NFT collectible cards. However, the funding rumors were quashed by Roham Gharegozlou, CEO and founder of Dapper Labs, who said the rumors were “baseless.”

A Critical Stand Against the Booming NFT MarketDespite VCs opening up their checkbooks to invest in NFT-related firms, some critics believe the NFT market is a fad in the crypto world. CEO of L'Atelier BNP Paribas, John Egan, compares buying NFT collectibles to gambling in a casino. “I think it's probably akin at this stage to going into the casino,” he said.

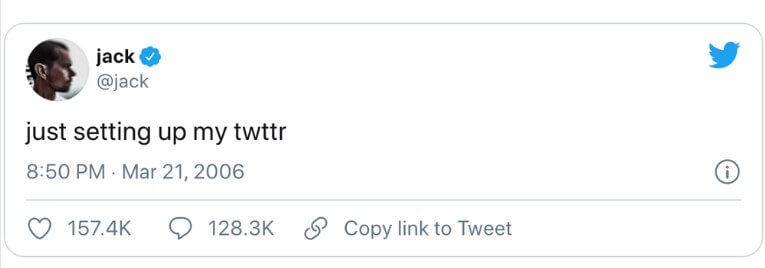

In the past week, Beeple, a digital artist, made huge waves in the crypto world as his collection of NFTs sold for $69 million, making this art the third most expensive art from a living artist. Elon Musk, Jack Dorsey, and athletes such as Ron Gronkowski have all offered their unique NFTs to the public amidst the surging demand.

Despite his skepticism, Egan stated the NFT world possesses highly risky assets, but he believes the ecosystem will play a key role in the future. He stated the unique and cryptographic secure nature of NFT provides “the bedrock economic infrastructure within the virtual economy.”

The Path to Darkness – Money Laundering?Apart from an ensuing “bubble” that most critics have prophesied, others claim NFTs are headed to a regulation path, similar to the cryptocurrency assets preceding them. One of the most practical dangers lingering above NFTs is money-laundering, which is also a grave issue in the crypto field.

According to Jesse Spiro, the chief of government affairs at the blockchain analysis firm Chainalysis, NFTs present a harder challenge to single out money laundering. Spiro said,

“One of the ways to identify trade-based money laundering with [traditional] art is that [an appraiser] comes up with a fair market value for something, and you’re able to measure that fair market value against the pricing that’s involved [and flag] over-invoicing or under-invoicing.”

“This is either selling that asset for less than it’s worth or for more than it’s worth.”

While noticing money laundering patterns in well-established markets such as the NBA Top Shot is easy, random or one-off NFT sales is much more complicated, he explained.

“All that’s needed is two parties that are involved to execute that [transaction] successfully effectively.”

However, a former Deutsche Bank and Credit Suisse fund manager argued that money laundering using NFTs “does not make sense.” The fund manager stated,

“I certainly see the potential for money laundering here, but given that there are lots of assets out there on the blockchain that people can use for that, [NFTs] may not be best-suited.”

The post Investors Pump Millions into The NFT Market, Analysts Debate – Good Or Bad Investment? first appeared on BitcoinExchangeGuide.Similar to Notcoin - Blum - Airdrops In 2024

NFT (NFT) на Currencies.ru

|

|