2020-2-4 20:58 |

Coinspeaker

Investment Insights from a Self-Made Billionaire

Can anyone be a billionaire? Maybe. I sat down with Dr. Morgan Shi – who is one of China’s most well-regarded experts in domestic and international investment as well as risk management – and asked about his philosophy, which investments brought him the most return, and what investment vehicles have the most upside. The following transcript has been edited for clarity.

Are billionaires, or even millionaires, different in how they approach money and investment?

Everyone has the opportunity to make money. I believe fully that opportunity is everywhere but you must balance being discerning and taking risks. How I personally balance that is embracing the philosophy of my favorite American writer Salinger and becoming a”keeper of the wheat field” in the world of investment. To me this means I reallocate my primary investments about once every ten years to let things grow to harvest and to see where others have died off.

What investment do you think has the most potential for growth in the next ten years to use your timeframe?

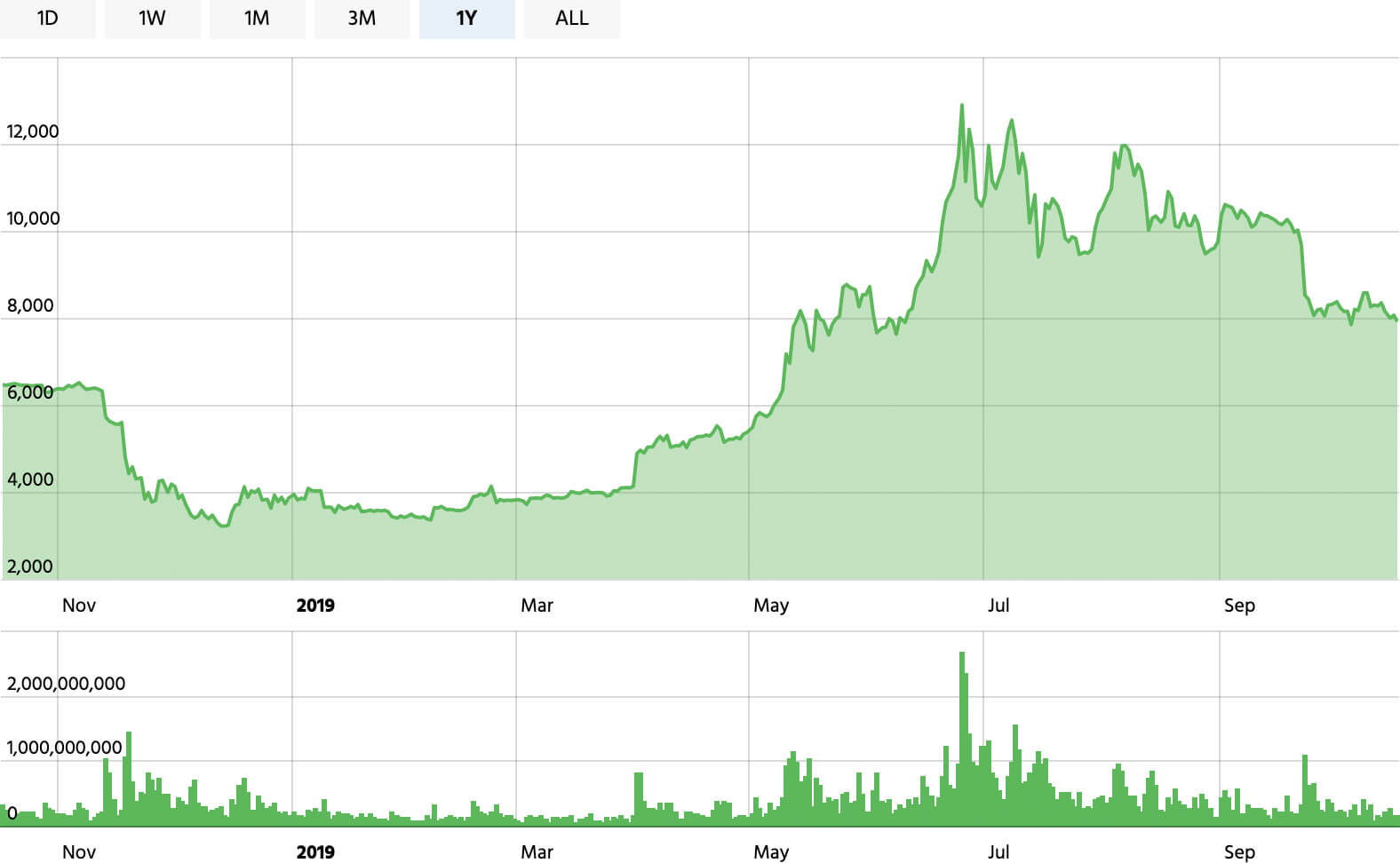

Bitcoin and cryptocurrencies have the most upside, especially looking at the long term. If you had invested $1,000 in 2009 when coin prices were $ 0.0008, you would have had $ 28 billion at the peak. The rate of growth is completely unbeatable, making Bitcoin the most profitable investment project in the last 100 years. Many people were skeptical and still are, but today, many countries and regions around the world use cryptocurrencies. Of course, some countries do not support it and explicitly ban it, but this will change over time since legal regulations in any one country have no effect on its value. This is the attraction of cryptocurrencies from a long-term investment perspective.

So, only invest in Bitcoin?

No-no. Capital markets are also important, and one good example of this are the shares of Li Ka-shing. Investing in Li Ka-shing’s Yangtze River Industrial Co., Ltd., listed in 1972, increased 5,000 times in 48 years. In short, an investment of $1,000 is now worth $5 million, 48 years later. Not as good as Bitcoin, but not bad at all.

What about stocks or companies most people in the U.S. will know about. Any good picks?

Technology stocks remain a favorite for many investors, especially those who are able to get in early and see the vision for these companies. $1,000 in Microsoft in 1986 would be around $1.6 million today. E-commerce giants Amazon and Alibaba also have proven kind to investors but I’ll let you do the math there yourself. The earlier you can see the trend the better off you are, and of course, many people lose money as well. Not all the companies take off but the ones that do are worth the risk.

Where would you advise millionaire-hopefuls to look for growth? What’s the future?

Everyone asks about the future, and I always say that industry experts in several countries and some senior institutional investor groups have already published this. Over and over I see and know that the most profitable projects in the future are still in the cryptocurrency arena. However, in the future, cryptocurrencies may compete with Bitcoin, either in terms of time to return on investment or in space to create value, including profit models and application scenarios. I think projects that are innovative in this space will win long term, similar to Amazon who completely revolutionized multiple verticals and will continue to. My favorite pick in this area going into 2020 is FF Token. The BMS Action Star Reality Show has its own blockchain + movie + sports revenue model that has a lot going on and a built-in audience of boxing and entertainment fans.

Investment Insights from a Self-Made Billionaire

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Intelligent Investment Chain (IIC) на Currencies.ru

|

|